Prices

November 21, 2024

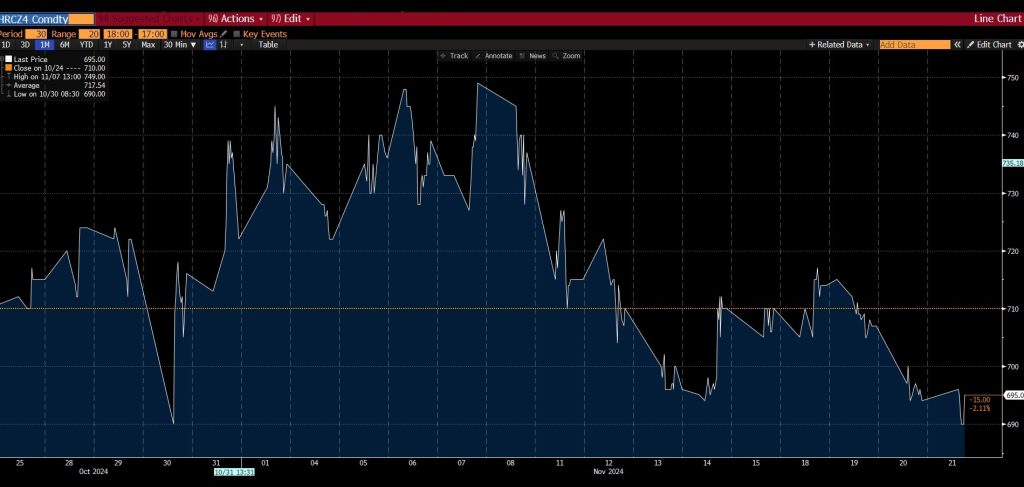

Nearby HR futures pull back as 2024 nears end

Written by Mark Novakovich

After experiencing a rally ahead of the 2024 election, the nearby part of CME HRC futures complex has softened as we approach year-end. Meanwhile, the forward positions (second half of 2025) have remained supported and largely unchanged.

The December ’24 HRC futures contract hit a 30-day high on Nov. 7 at $749 per short ton (st), but has since slid down to close today at $695/st. Enthusiasm in the marketplace about the longer-term potential benefits to steel demand under a second Trump administration, combined with uncertainty about additional tariff impacts, has since given way to the near-term reality on the ground among steel consumers and producers alike.

Weakness in the prompt part of futures curve has been driven by the underlying weakness in the physical market. The convergence between physical and CME HRC futures prices is evident as we make our way through the November pricing period for the CRU assessment, with November ’24 HRC futures settling at $680/st on Nov. 21 against the CRU month-to-date average thus far of $678/st.

Meanwhile, the forward part of the curve remains little changed, with July ’25 HRC futures settling $800/st on the day, down just $2/st from its price at this time last month.

In the past several days, the market has been driven by strategic selling in the June ’25 position, with additional financial interests spilling over into the first and second quarters of 2025. On the other hand, overall commercial participation has been somewhat muted as physical traders remain unconvinced the levels trading in the forward months are justified. Cash-and-carry traders remain reluctant to collapse the ongoing contango structure, which maintains its relentless march forward.

The CME’s MW Busheling contract (BUS) has seen a resurgence over the past month, going from less than 10,000 gross tons (gt) of open interest in mid-October, to ~80,000 gt open as of several days ago. While the CME has formally announced the initial listing of a Chicago-indexed busheling future (BCH), hedgers were said to have urgent needs mitigate some 2025 price risk ahead of the Dec. 16 launch of the new contract.