Market Data

November 15, 2024

November energy market update

Written by Brett Linton

In this Premium analysis we cover North American oil and natural gas prices, drilling rig activity, and crude oil stock levels. Trends in energy prices and rig counts are an advance indicator of demand for oil country tubular goods (OCTG), line pipe, and other steel products.

The Energy Information Administration (EIA) released their November Short-Term Energy Outlook (STEO) earlier this week. The report forecasts that both crude oil and natural gas prices will increase through the first quarter of 2025, though not as high as previous estimates. Explore the full STEO report covering energy spot prices, production, inventories, and more.

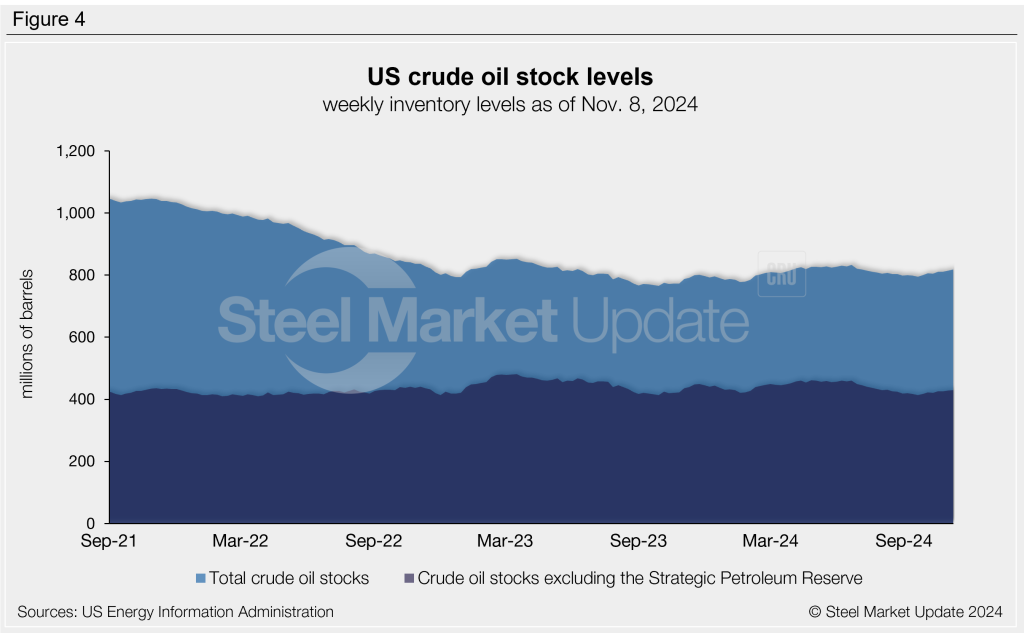

Oil and gas spot prices

The weekly West Texas Intermediate oil spot market price has generally fluctuated in the $70-90 per-barrel (b) range for the past two years. The latest spot price inched up to $71.89 as of Nov. 8 (Figure 1). One week prior the spot price fell to a near three-year low of $68.69/b, the lowest weekly price seen since December 2021.

In their latest forecast, the EIA expects oil spot prices to experience upwards pressure in the coming months, averaging $78/b across the first quarter of 2025. Due to increasing global oil production and growing inventories in the second quarter, their Q2’25 forecast was adjusted downward to an average of $74/b.

Following multi-decade lows seen earlier this year, natural gas spot prices have fluctuated in recent months but remain historically low. Recall that in March prices fell to a 25-year low of $1.40 per metric million British thermal units (mmBtu). The EIA attributed these low prices to historically high inventory levels due to reduced winter consumption. Natural gas prices picked up some steam across the summer months, peaking at $2.73/mmBtu in June, but have since declined again. The latest spot price is down to a six-month low of $1.50/mmBtu as of Nov. 8.

The November STEO forecasts natural gas to climb in the coming months following regular seasonal patterns, though not as high as previous estimates. They forecast prices to average $2.80/mmBtu in the first quarter of 2025. The average price for all of 2025 is currently estimated to be $2.90/MMBtu.

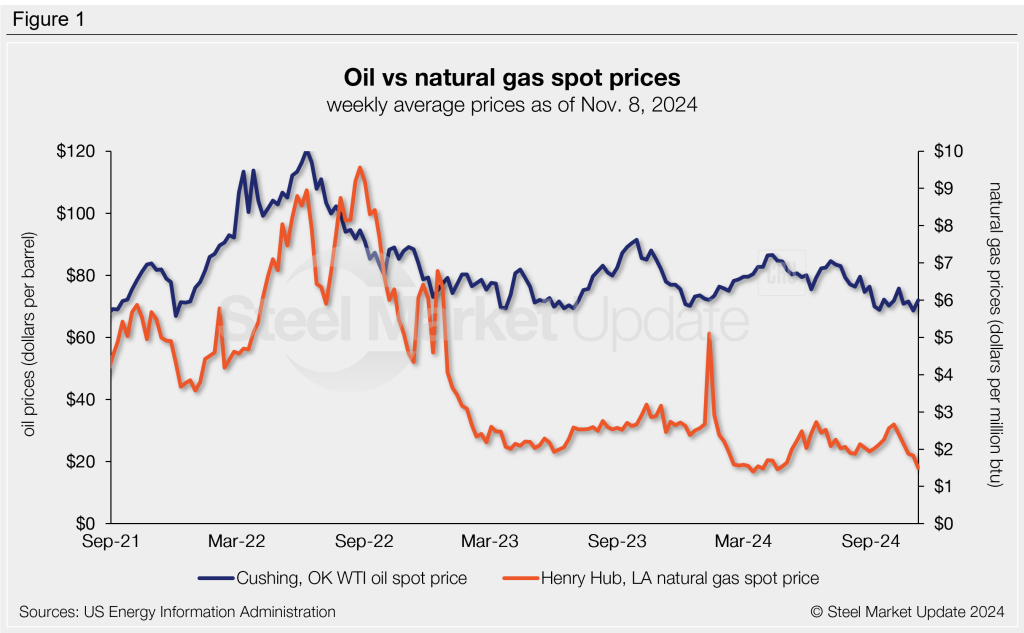

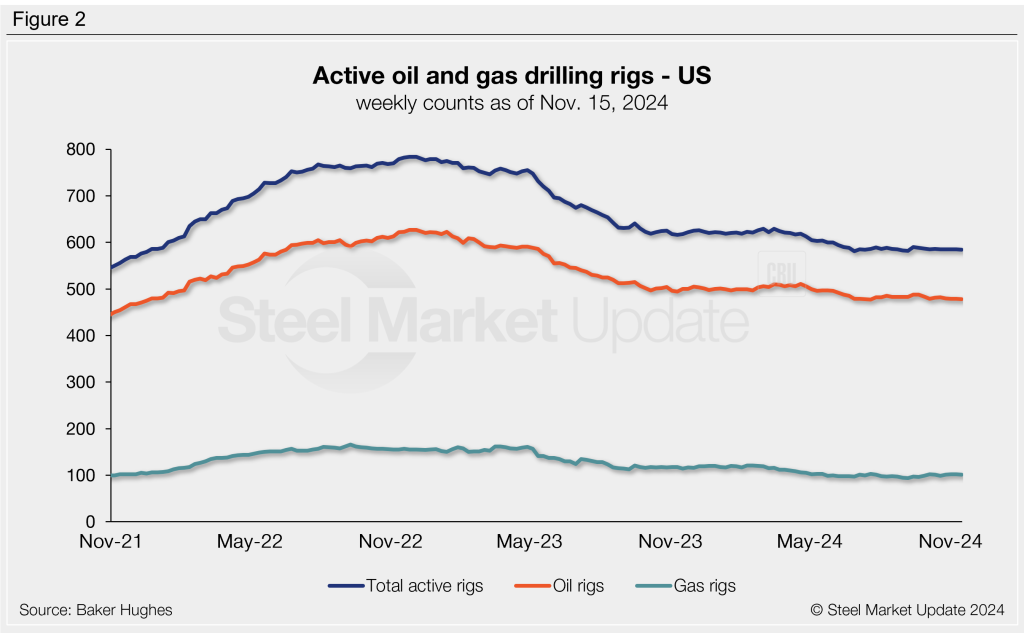

Rig counts

The number of active drilling rigs operating in the US remains near multi-year lows, territory in which they have been in since June (Figure 2). The latest US rig count is 584 as of Nov. 15, according to Baker Hughes. Active US rig counts are 6% lower than rates seen this time last year.

Canadian drilling activity has trickled lower since October but remains historically strong. The active rig count was 200 rigs last week (Figure 3). Canadian rig activity is up 2% compared to levels recorded one year prior.

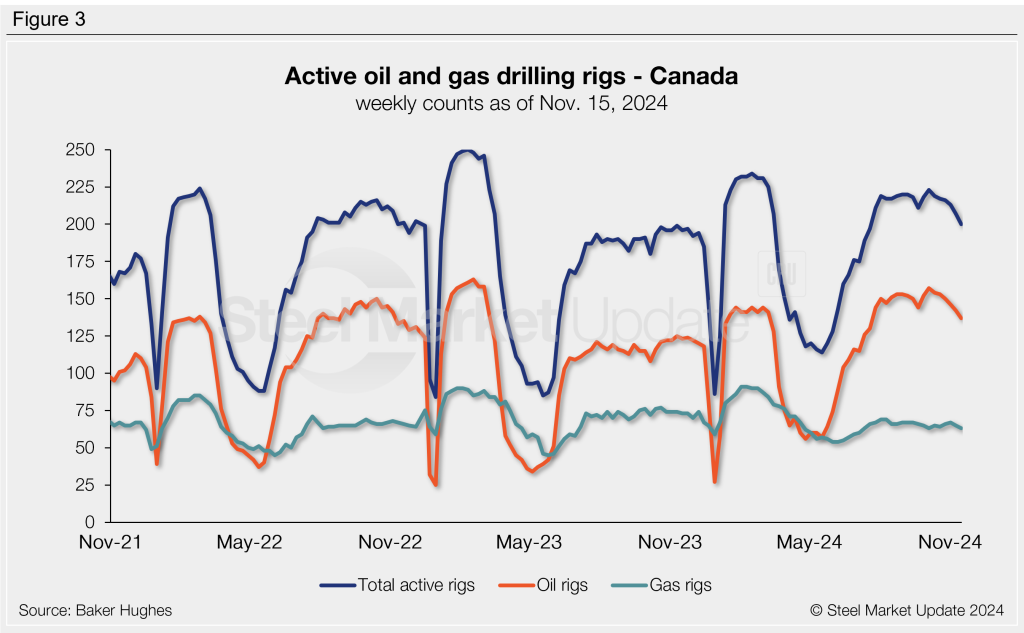

Stock levels

Following the seven-month low of 795 million barrels recorded in September, US crude oil stocks have increased over the past two months. The latest US stock level has risen to a four-month high of 818 million barrels as of Nov. 8. November stocks are 3% higher than levels recorded this time last year (Figure 4).