Prices

November 14, 2024

HRC Futures: Here comes Trump bump 2.0?

Written by Dave Feldstein

No more excuses! The election is over. Donald Trump will be inaugurated on Monday, Jan. 20, with the Republican party in control of Congress. Now, it is time to get back to work!

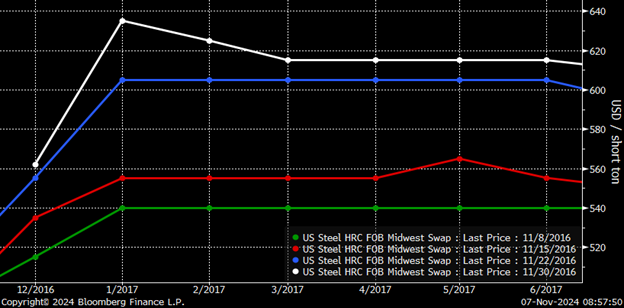

This graph shows the Midwest hot-rolled coil (HRC) futures curve from 2016 on Election Day (Nov. 8), Nov. 15, Nov. 22, and Nov. 30. The futures saw little change in the days after the election. But they then gained around $15 per short ton (st) on Friday, Nov. 11. The futures curve then started to move higher each subsequent week, thereafter gaining roughly $80/st by the end of November.

CME HRC futures curve $/st – 2016

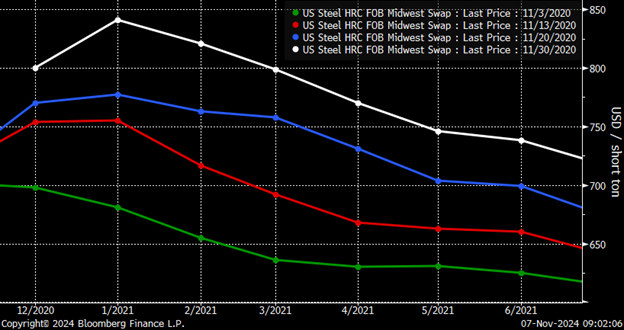

The graph below shows the Midwest HRC futures curve in 2020 on election day (Nov. 3), Nov. 13, Nov. 20, and Nov. 30. While the 2020 election had a very different outcome than in 2016 with the election of Democrat Joe Biden, the Midwest HRC futures curve again marched higher week after week. It ended November up roughly $160-$170/st from election day. Of course, 2020 was very different from 2016 not only because Joe Biden won but also because the of the COVID pandemic, supply swings from idled furnaces, mill outages due to COVID, Cliffs’ acquisition of ArcelorMittal USA, etc. Nevertheless, the HRC futures curve moved higher following both elections.

CME HRC futures curve $/st – 2020

There is no doubt that simply getting past the election unleashes some amount of pent-up demand. Moreover, certain industries benefit significantly depending on which party wins. For instance, the oil-and-gas industry is likely to perform significantly better than it would have if Kamala Harris had won.

Imagine a boardroom of an oil-and-gas production firm with forecast R and forecast D. Clearly, this hypothetical firm’s forecast will be materially higher under an oil-and-gas friendly Republican administration versus an alternative-energy friendly Democrat administration. Now that Trump has been elected with a Republican Congress, the firm is looking at a much more optimistic forecast R and is now ready to start making decisions. Some of those decisions will result in purchase orders for steel in the weeks and months ahead.

The chart below of the NFIB Small Business Optimism Index surged in 2016 following Trump’s upset of Hillary Clinton. And it declined after Biden won in 2020. Moreover, it steadily declined in the first half of 2022 as inflation caused the Fed to move interest rates sharply higher. For two years, small business optimism has remained at lows not seen since the early 2010s.

Will Trump’s election and lower interest rates boost small business optimism in the months ahead? The steel and manufacturing industries are comprised of thousands of small businesses. Will increased optimism unleash the animal spirits back into the steel industry? Thus will these factors help to lift sentiment?

NFIB small business optimism index

Both the Midwest HRC futures and physical price indices have been stuck in a tight range for months. It has been a slow year generally. But business seemed to grind to a halt in the month before the election. Now that the election is over, will that unleash pent-up demand? Will we see another “feast” out of the buying community as was seen at the end of last year and in the winter of 2023?

So far, the Midwest HRC futures curve is not following the same pattern as was experienced in 2016 and 2020. Is this a bad sign? Is this telling us things are really bad out there? Or do we need to be patient?

CME HRC futures curve $/st

HRC lead times reportedly pushed out 0.7 weeks WoW to 5.4 weeks, according to BMO. Does that mean the mills saw a wave of orders last week following the election, now that the uncertainty has passed? Was yesterday’s $12/st WoW decline in the CRU Midwest HRC monitor revealing a hobbled and weak market? Or was that decline indicative of large, discounted purchase orders being placed with the mills – and that is why lead times expanded? The latter seems more logical. But it was John LaScola who warned me back in 2013 about the risks of trying to apply logic to forecasting the price of steel. What does not add up is how the Midwest HRC futures have seen declines of roughly $20-$30/st in the December and January future with little change in other months. Where’s the beef?

While we look for it, let’s turn to scrap. Just when the CME busheling future looked like it was about to be put to pasture – falling to just below 18,000 gross tons (gt) of open interest – 50,000/gt traded in the last two days of October. It was a revival! Open interest surged back above 80,000/gt before this week’s expiration of the November future. November’s settlement was basically unchanged MoM – down $0.35/gt to $411.98/gt. This was considered a win by one scrapyard source.

Rolling 2nd month CME BUS future ($/gt), open interest (red), and 22-day moving average (yellow)

Also this week, the CME announced a new busheling contract that will settle off AMM’s Chicago No. 1 Busheling Index with December 16 marked as its opening day.