Analysis

November 10, 2024

Final Thoughts

Written by David Schollaert

Another presidential election cycle has come to an end. If you’re anything like me, part of you is just happy you no longer need to unsubscribe or “Text STOP to opt-out” from the onslaught of political text messages this cycle produced.

And while Trump’s emphatic win was a bit of a shock, what was even more of a surprise was that our survey results – 58% of you expected Trump to be next president – were closer to an exact representation of the outcome across America than we initially thought.

And as intriguing at that is, here are some other notable results from this week’s survey.

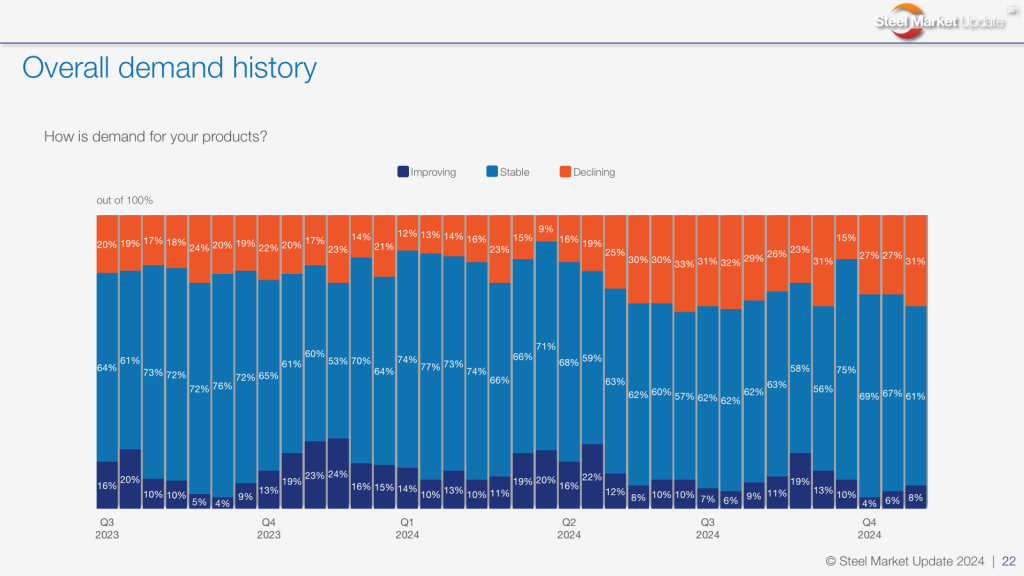

Demand still hanging back

From our latest survey results, 31% of respondents still note that demand is declining, though 61% continue to say that demand is stable, and just 8% are seeing demand on the rise. But could a shift be on the horizon now that election uncertainty is no longer a sticking point?

Here’s what some of you had to say:

“Seasonal slowdown.”

“We’re seeing a little pick-up in activity over the last 1-2 weeks.”

“Demand is weak.”

“Seasonality and election uncertainty are not a great combination.”

“Better than a few months ago but just steady.”

“Status quo is prevailing.”

“Looking for a second-half bounce.”

“Stable to flat to down until post-election results.”

But there are still some sticking points.

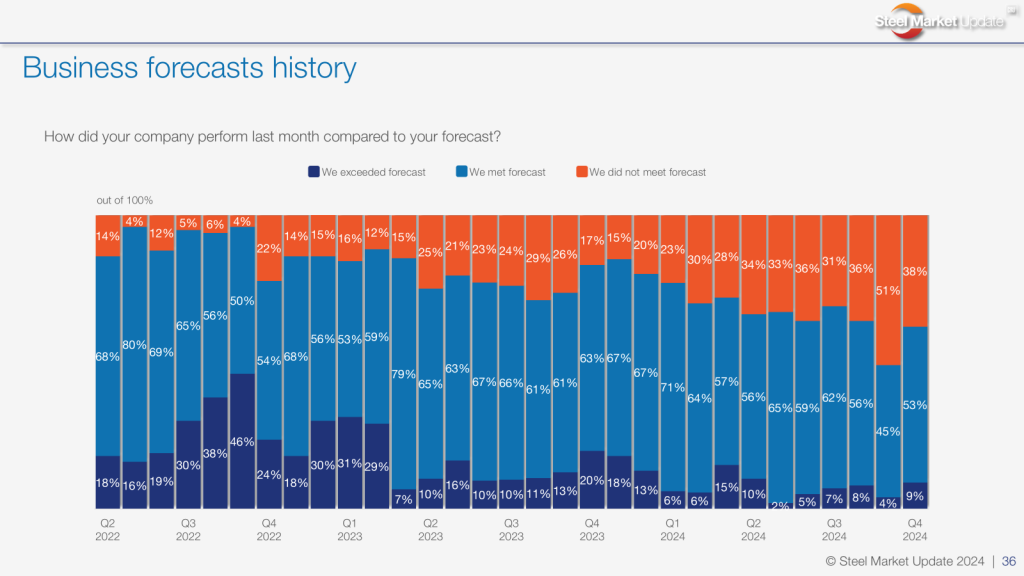

Forecasts are still problematic to many

More than one-third of respondents didn’t meet forecast in October, a trend we’ve seen since the beginning of Q2.

“It sure seems we were down in October, but not too far down.”

“Demand has been weak so bookings and shipments are down.”

“Demand was softer than a typical October.”

“Close but not quite.”

“Forecast was very conservative and market conditions were pretty much as expected.”

“Market remains sluggish.”

“We never hit our forecast, unless we adjust it down.”

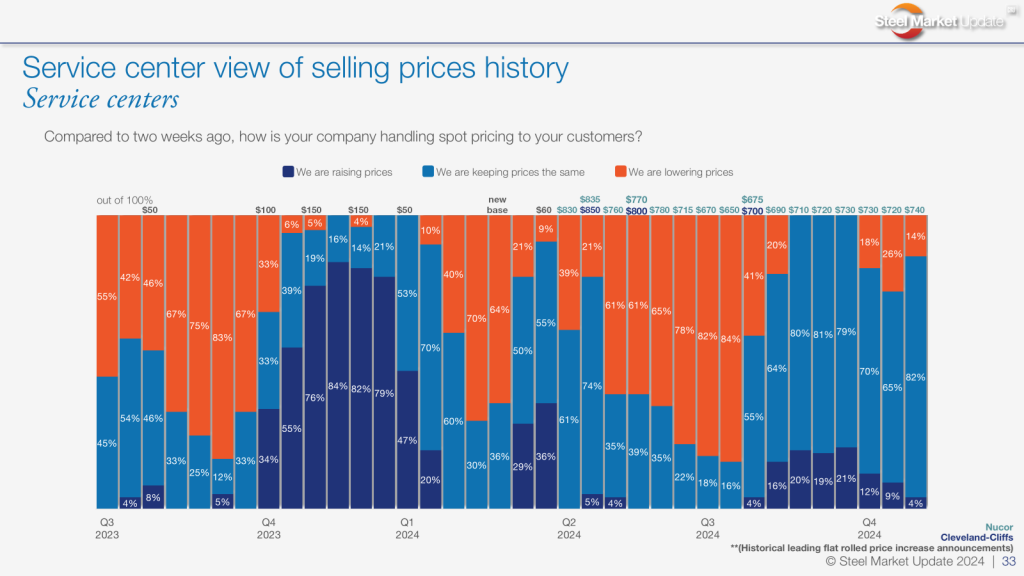

Mill price hikes lacking legs

Surprisingly, mills haven’t been able to find willing buyers at higher levels, and survey respondents continue to find mills willing to talk price. In fact, according to our data, mills have not been able to yield their “pricing power” since midway through Q3.

Despite repeated efforts to push tags higher, prices have been at best flat (see the chart below).

“Depends on the opportunity, but not much room to go down in most cases.”

“We were having some success but less luck in the past few weeks.”

“Much like the mills, every SSC is asking for a second look and bringing their numbers down week to week.”

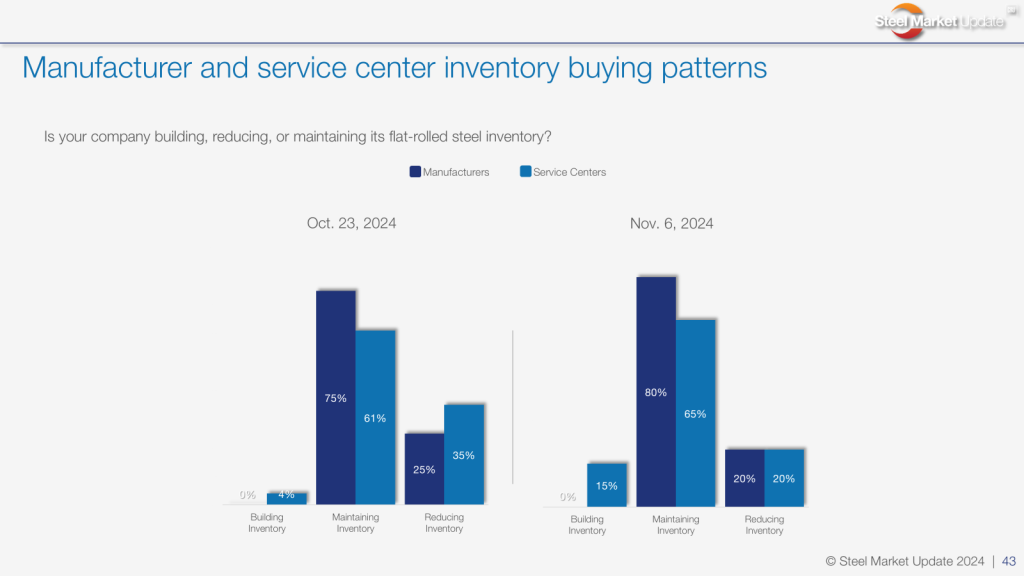

Buying patterns remain cautious

The common thread between service center and manufacturer (OEM) buying, is that most are strictly focused on maintaining inventories, to the tune of 65% to 80%. What stands out a bit, though, is that manufacturers have stepped back from building inventory of late, while some service centers might have recently secured volume at discounted levels.

“Maintaining but at a very low level.”

“No need to carry stock right now.”

“Accidentally building.”

That’s just some of the interesting data in our latest survey results, so do ensure you look through them all. In the meantime, there still could be a lot to unfold as 2024 ends and Trump prepares to take office. And… we’ll ensure to report exactly what steel buyers are seeing.

As always, all of us here at Steel Market Update truly appreciate your business.