Market Data

November 7, 2024

SMU Survey: Mills remain flexible on sheet and plate prices

Written by Brett Linton

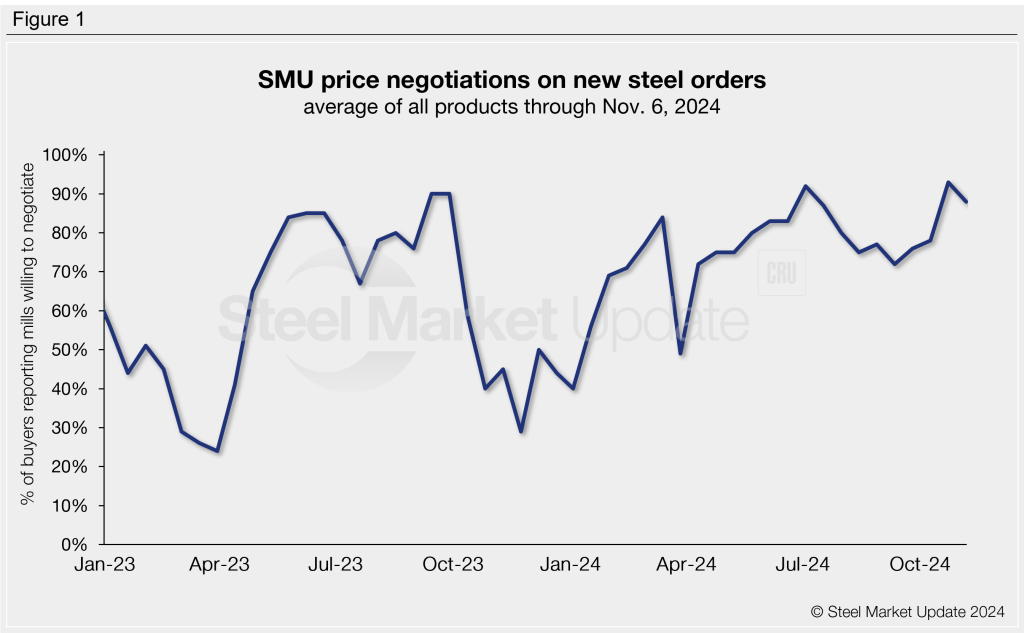

Most steel buyers polled in our market poll this week continue to report mills are open to negotiation on new order pricing. In fact, negotiation rates have been strong for the majority of 2024, trending higher since September.

Every other week, SMU surveys hundreds of steel market executives asking if domestic mills are willing to talk price on new spot orders. In this week’s poll, 88% of all buyers reported that mills were willing to negotiate to secure a new order (Figure 1). This is one of the higher rates recorded so far this year. Recall that in late October, we saw the highest negotiation rate recorded in our near-four-year history, 93%.

Negotiation rates by product

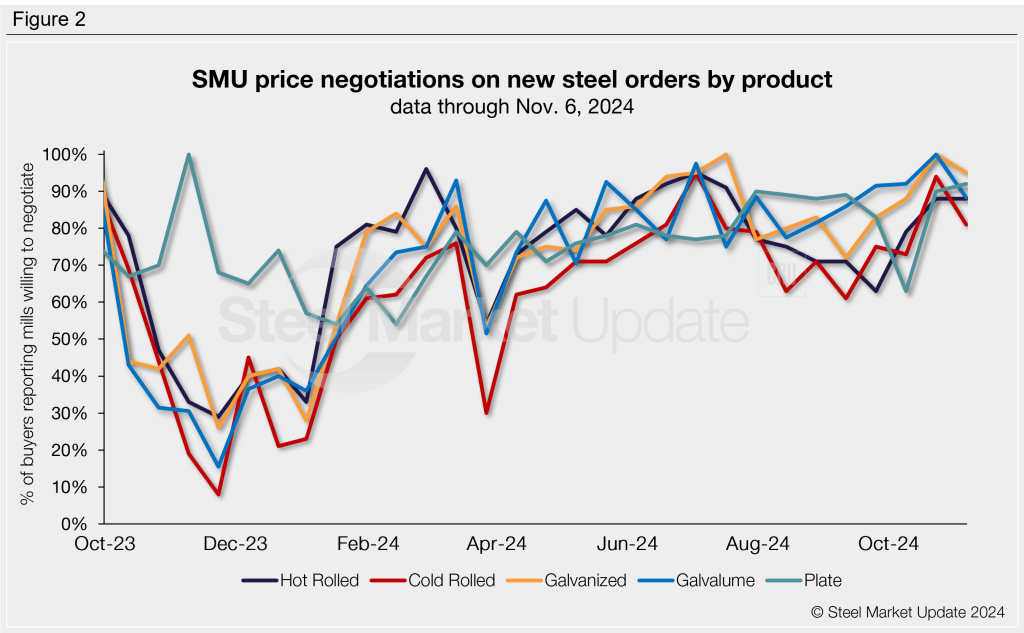

As seen in Figure 2, negotiation rates remained strong this week across all sheet and plate products. Negotiation rates were highest for galvanized and plate products. The most significant changes observed from our previous survey were in cold rolled and Galvalume rates. Negotiation rates by product this week are:

- Hot rolled: 88%, unchanged from Oct. 23 at the highest rate recorded since mid-July.

- Cold rolled: 81%, down 13 percentage points.

- Galvanized: 95%, down five percentage points.

- Galvalume: 88%, down 12 percentage points.

- Plate: 92%, up two percentage points to the highest rate seen in one year.

Here’s what some survey respondents had to say:

“Mills are generally slow and have open space in the order book.”

“Larger hot rolled tonnages can get something off.”

“We aren’t buying from the mills currently, but we are getting calls from reps asking – which is pretty telling.”

“If you want more than a load or two of coils to place, most mills are willing to talk.”

“Negotiable on plate with tons, with product mix and timing.”

Note: SMU surveys active steel buyers every other week to gauge their steel suppliers’ willingness to negotiate new order prices. The results reflect current steel demand and changing spot pricing trends. Visit our website to see an interactive history of our steel mill negotiations data.