Analysis

October 27, 2024

Final Thoughts

Written by Ethan Bernard

We all know the American news cycle moves pretty fast. Viral today, cached tomorrow. So it is with the US presidential election on Tuesday, Nov. 5. People have election fatigue. They’ve moved on to other things like planning holiday parties, debating Super Bowl hopefuls, or even starting to look forward to our Tampa Steel Conference in February. OK, maybe we are getting ahead of ourselves (except for the Tampa Steel part).

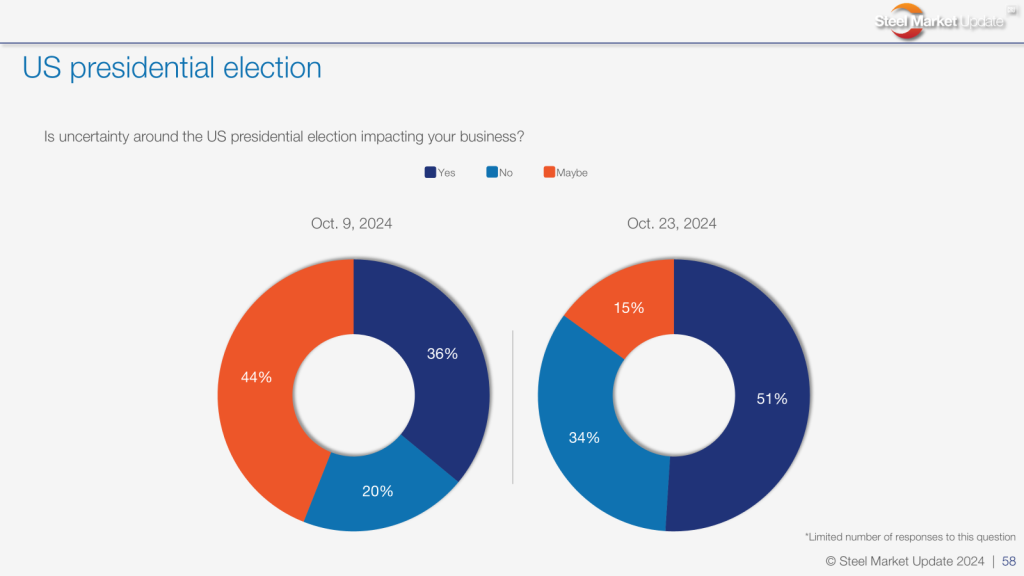

From our latest survey results, 51% of respondents said uncertainty around the election is impacting their business vs. 36% on Oct. 9. Clearly, this is a top-of-mind issue.

Looking for a consensus? There really isn’t one to be found. We have responses varying from:

“It’s the newest excuse and an easy stall for many of our conversations.”

That’s compared to:

“I know it’s cliché, but it’s very impactful as all seems on hold.”

Of the many, many comments to this question (there were a lot), we even had that rarest of variant: the all-caps response. Trigger warning: All-caps responses seldom signal mild viewpoints. Hence:

“EVERYONE IN THE METAL INDUSTRY IS SCARED TO DEATH KAMALA WILL WIN.”

I did not find a counterpoint among the comments to that sentiment. But our sample set might be a little less left-leaning than, say, the entertainment industry.

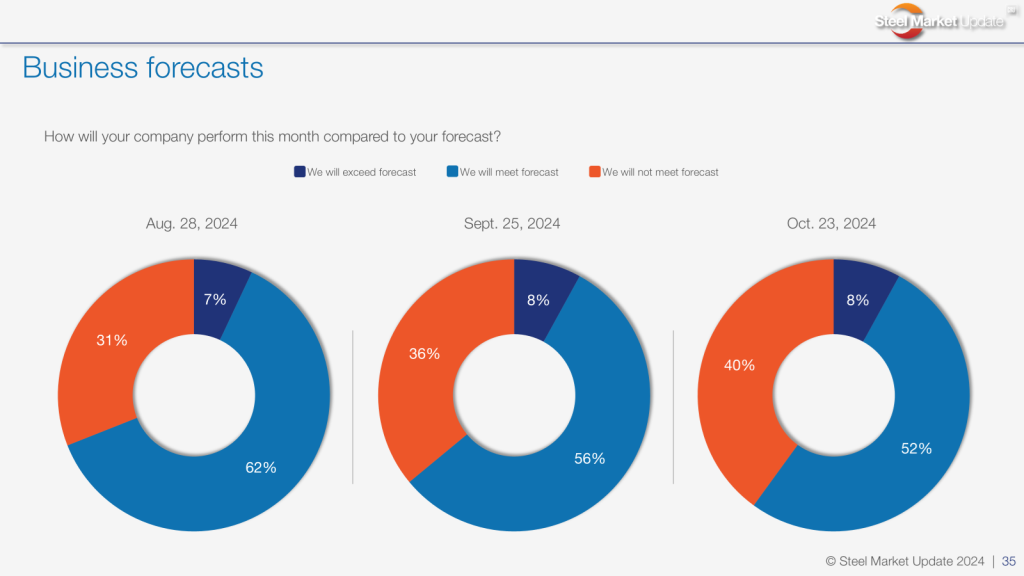

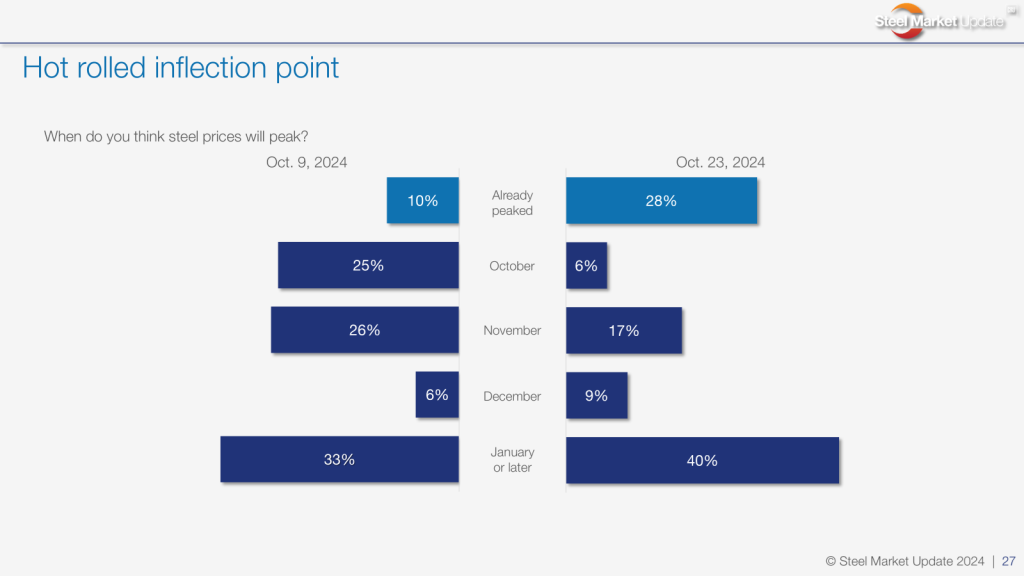

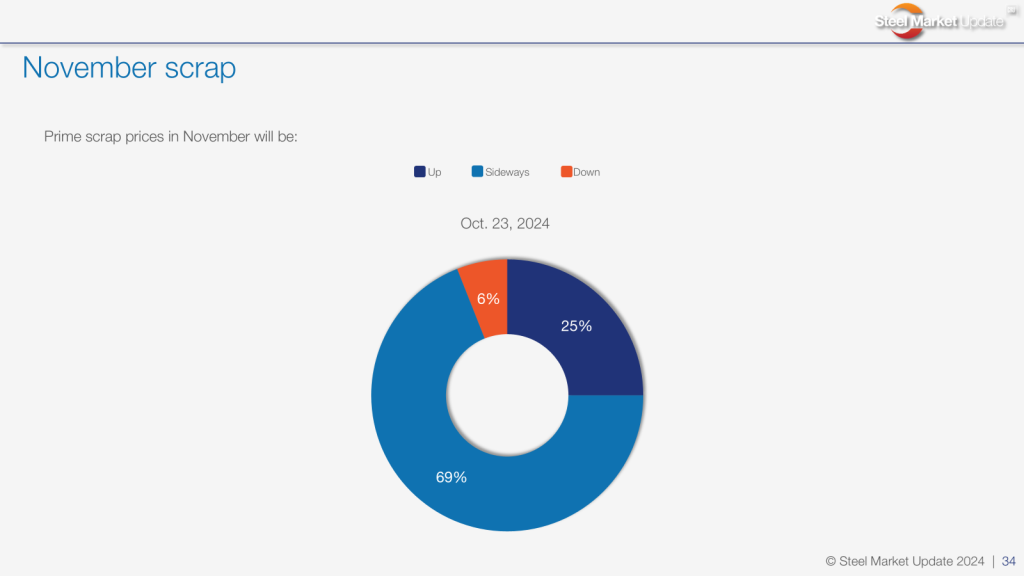

Without further ado, I present to you more election commentary; business forecasts (worsening from last survey); views on a hot rolled price inflection point (40% say peaking in January or later); and a November scrap tag forecast (sideways).

Still, I can’t help myself. One final election comment before I let them speak for themselves.

“Interest rates, tariffs, pending wars.”

To me that statement wasn’t so much about the election. Rather, just a commentary on life as we muddle towards the middle of the 21st century.

Is uncertainty around the presidential election impacting your business?

“Because policies are very different from one candidate to the other. Depending on the winner, the result in industry and economy perspectives could be very different.”

“New construction projects seem to be waiting for the election results, which may impact the type and amount of projects that begin. Internally, our expectation is that post-election there will be greater demand regardless of the election results.”

“Psychologically, yes, but in all actuality the election pause is more of a myth than reality over the past 20-30 years.”

“Inflation Reduction Act uncertainty.“

“Typical industry behavior prior to an election.”

“Buyers are hesitating to understand what the rules will be.”

“UNCERTAINTY kills everything.”

How will your company perform this month compared to your forecast?

“Demand is weak and bookings are down.”

“Down 25% to 30%.”

“Our customers are projecting slower than normal activity through year end.”

When do you think steel prices will peak?

“They have peaked – we are in a new cycle.”

“After trade case preliminary decisions are announced and election is completed.”

“Has been a very slow or no reaction to the coated trade cases. All 10 countries will stay involved, which is surprising. Should begin to have an effect by end of November, and then again in early February when we will see actual subsidy and dumping numbers. This is when it becomes serious.”

“I feel optimistic for things to improve in 2025 to create a more ‘normal’ year with prices peaking in the summer.”

“There’s too much capacity, too little demand, and too little certainty in buyers’ minds to support higher prices.”

“If scrap moves up and demand picks up, we could see the mills push another round of increases.”

“Price will deteriorate from here.”

“Offshore pricing has moved up, and capacity has dropped due to maintenance shutdowns.”

Prime scrap prices in November will be:

“Up slightly.”

“There have been decreases all year. If pricing is going to increase on coil, scrap will have to start that.”

“Tighter supply and increased demand.”

“Scrap prices may get a dead-cat bounce in December or January. The increases will be minor and short-lived.”

“I don’t have any confidence in what folks are telling us about the scrap market. All guessing right now.”

“I think prices are up in the next two months, but most likely December when people look to restock.”

By the time you read our next survey results…

Well, that’s the view for now. The next time our survey results are released, the election will have taken place. As we’ve said previously, that doesn’t necessarily mean a winner will have been declared. But… I’m sure we’ll all be glad that the “October Surprises” are behind us. Until then, we’ll just be grabbing our popcorn and watching the wheels go by.

Thank you for your continued support!