Market Data

October 24, 2024

SMU Survey: Mill lead times tick lower

Written by Brett Linton

Mill lead times for both sheet and plate products pulled back further this week, according to steel buyers responding to our latest market survey,

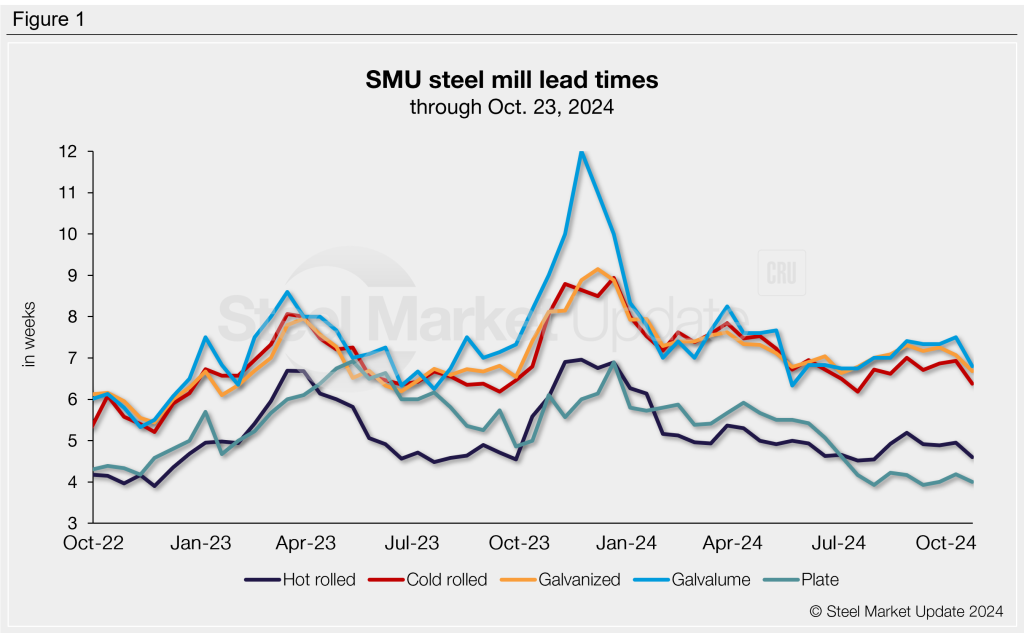

Sheet lead times have eased across the board compared to levels reported one month ago, returning to lows last seen in July. On average, lead times for hot-rolled steel are around four-and-a-half weeks, while tandem products are all hovering around six to seven weeks. Plate lead times continue to fluctuate near the four-week mark, territory they have been in since July. Overall, lead times remain near some of the shortest levels witnessed this year.

Table 1 below summarizes current lead times and recent trends.

Compared to our Oct. 9 market check, the upper and lower limits for some of our lead-time ranges this week have changed:

- The longest lead time considered in our hot rolled range decreased from seven weeks to six weeks.

- The shortest lead time in our cold rolled range increased from four weeks to five weeks.

- The longest lead time in our galvanized range decreased from 10 weeks to eight weeks.

- The longest lead time in our Galvalume range decreased from nine weeks to seven weeks.

Figure 1 below tracks lead times for each product over the past two years.

Survey results

Over half of the companies we surveyed this week believe lead times will be flat two months from now. This rate is in line with our prior survey but down compared to prior months. Nearly a third forecast production times to extend further, also in line with early-October responses. However, this is up slightly from August and September results. The small remainder believe lead times will shrink further, similar to inputs received over the past two months.

We also asked buyers how they classify current mill production times. Most continue to respond that they are either shorter than normal (48%) or within typical levels (40%). A small portion of buyers said lead times are slightly longer than normal (12%).

Here’s what respondents are saying:

“[Lead times will contract as] there is way too much capacity domestically (especially after the fall outages wrap up), not to mention Mexico. Imports are still lurking, too.”

“Flat demand combined with compromised supply will help hold the line, at least somewhat.”

“Demand spike needed to extend lead times will not happen until CY25.”

“[Lead times will extend as] year-end inventory reductions will be behind us and people will be placing orders.”

“Our crystal ball is a little cloudy, but once we move past the election, we expect there to be an increase in business, which may impact mill lead times.”

“Lead times will contract through November and then begin to recover.”

“They will extend beginning when customers start placing more 2025 orders, so extend in about 4-6 weeks.”

“Hopefully extending in the new year.”

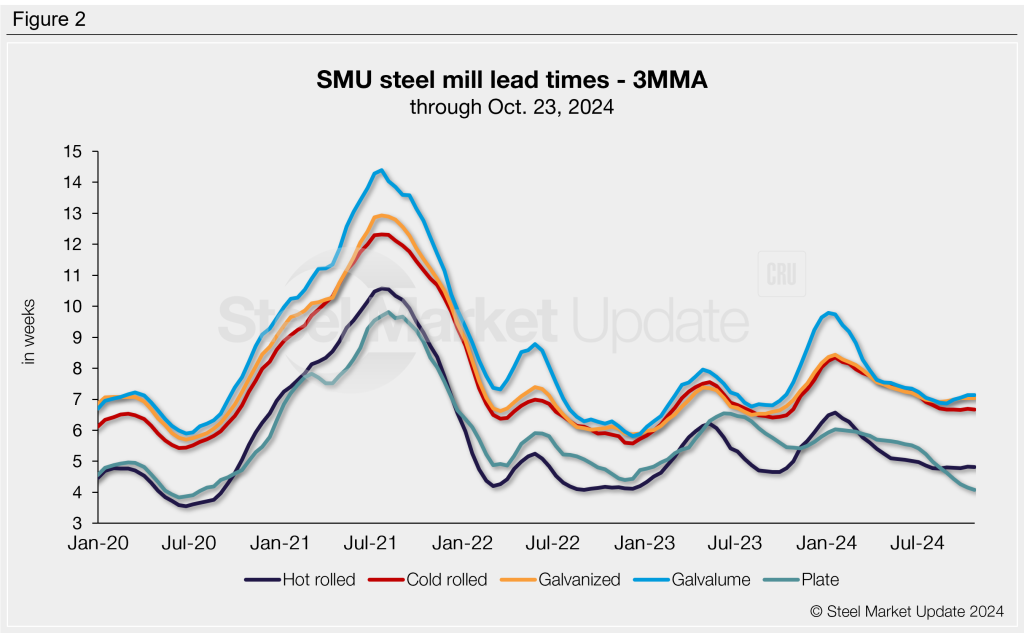

3MMA lead times

To smooth out the variability seen in our biweekly readings and better highlight trends, we present lead time data on a three-month moving average (3MMA) basis in Figure 2.

Through Oct. 23, 3MMA lead times were steady to down for both sheet and plate products. Overall, 3MMA lead times have trended downwards since February and remain near one-year lows. Sheet 3MMA lead times have begun to level out in recent months, while plate 3MMA lead times continue to slide lower.

The hot rolled 3MMA is now at 4.81 weeks, cold rolled at 6.67 weeks, galvanized at 7.04 weeks, Galvalume at 7.14 weeks, and plate at 4.07 weeks.

Note: These lead times are based on the average from manufacturers and steel service centers participating in this week’s SMU market trends analysis survey. SMU measures lead times as the time it takes from when an order is placed with the mill to when it is processed and ready for shipping, not including delivery time to the buyer. Our lead times do not predict what any individual may get from any specific mill supplier. Look to your mill rep for actual lead times. To see an interactive history of our steel mill lead times data, visit our website. If you’d like to participate in our survey, contact us at info@steelmarketupdate.com.