Market Data

October 11, 2024

SMU survey: Steel Buyers' Sentiment Indices diverge

Written by Brett Linton

SMU’s Steel Buyers’ Sentiment Indices moved in different directions this week. Our Current Steel Buyers’ Sentiment Index eased to a six-week low, while Future Buyers’ Sentiment ticked up to a four-week high. Both of our Indices continue to indicate optimism among steel buyers.

Every other week, we poll hundreds of steel buyers on their companies’ chances of success in today’s market, as well as business expectations in three to six months. We use this information to calculate our Current Steel Buyers’ Sentiment Index and our Future Sentiment Index, measures tracked since SMU’s inception.

SMU’s Current Sentiment Index indicates that buyers remain optimistic about their business’ ability to thrive in today’s market, though not as confident as they were at the beginning of this year. Meanwhile, our Future Sentiment Index shows that buyers continue to expect favorable business conditions ahead.

Current Sentiment

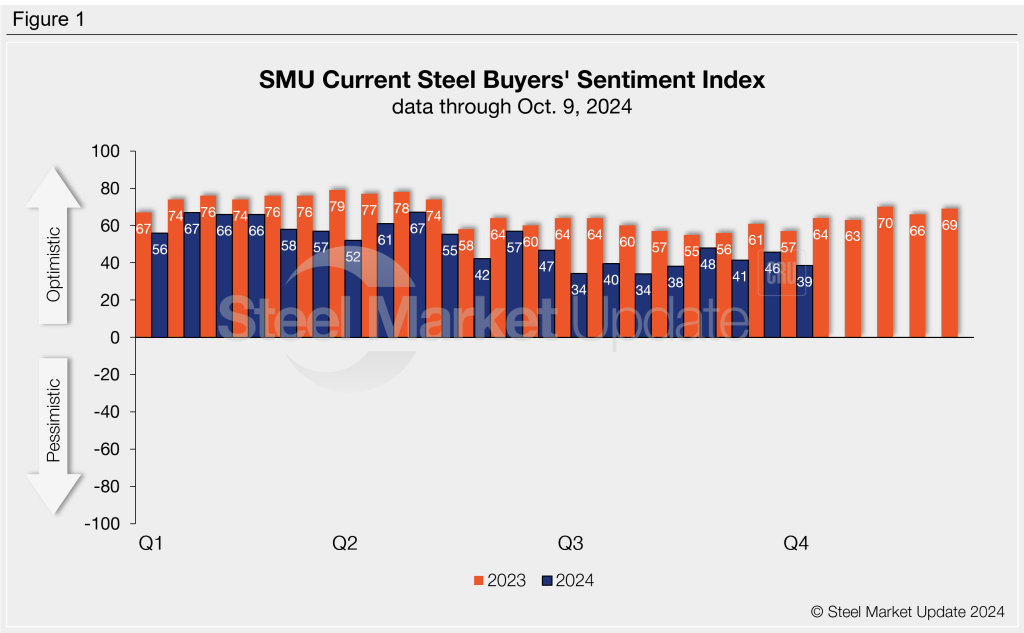

SMU’s Current Buyers’ Sentiment Index slipped seven points to +39 this week (Figure 1). This is the lowest measure since mid-August. Current Sentiment readings of 2024 continue to fall short of levels recorded this time last year (+57).

Year to date (YTD), Current Sentiment has averaged +51 across the first 42 weeks of 2024. This is significantly lower than the 2023 YTD average of +67.

Future Sentiment

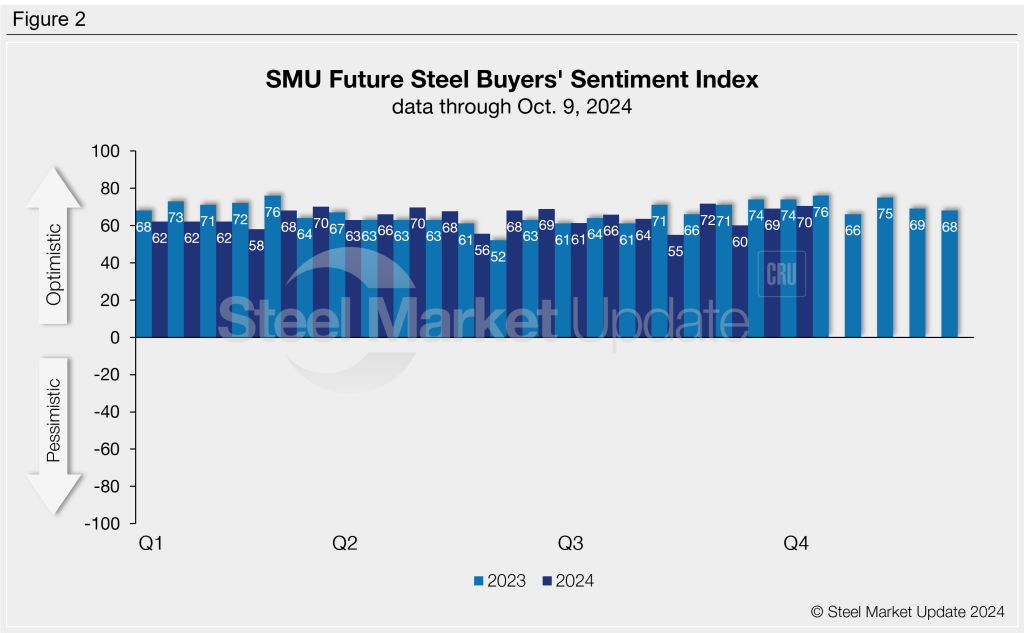

SMU’s Future Buyers’ Sentiment Index rose one point to +70 this week, the second-highest measurement recorded this year. Recall that in early August Future Sentiment dipped to the lowest reading seen in over a year (+55), recovering to a nine-month high of +72 just two weeks later. (Figure 2).

Future Sentiment has averaged +65 since the beginning of this year, down two points from the same time frame last year. This time last year Future Sentiment was +74.

What SMU survey respondents had to say:

“For us this market is worse than 2009 in terms of volume.”

“We expect more volume and higher prices in 2025.”

“I am highly confident that my company will remain successful for many years to come.”

“Outlook on plate is pointing north.”

Moving averages

Buyers’ Sentiment also moved in opposite directions this week when measured as a three-month moving average (Figure 3).

The Current Sentiment 3MMA eased to +40.96 this week, slightly greater than the four-year low recorded one month prior. The Current Buyers’ Sentiment 3MMA has generally trended downward over the last year. The Future Sentiment 3MMA increased to +64.91 this week, slowly recovering from the one-year low seen in early September.

About the SMU Steel Buyers’ Sentiment Index

The SMU Steel Buyers Sentiment Index measures the attitude of buyers and sellers of flat-rolled steel products in North America. It is a proprietary product developed by Steel Market Update for the North American steel industry. Tracking steel buyers’ sentiment is helpful in predicting their future behavior. A link to our methodology is here. If you would like to participate in our survey, please contact us at info@steelmarketupdate.com.