Market Data

October 3, 2024

SMU's September at a glance

Written by Brett Linton

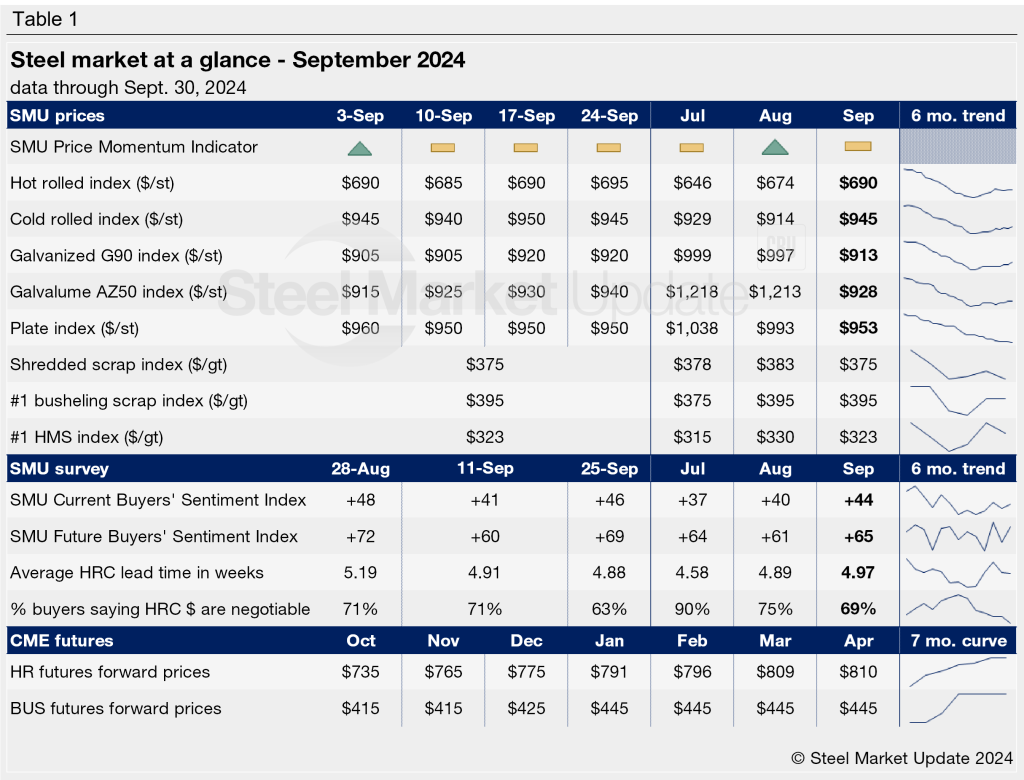

SMU’s monthly review provides a summary of important steel market metrics for the previous month. This latest report includes data updated through Sept. 30.

Prices of sheet and plate steel showed little movement in September, as buyers reported lackluster demand, high inventories, and caution related to the upcoming election. Sheet mills attempted to raise prices via multiple increases but failed to gain much traction.

The SMU Price Momentum Indicator on sheet was adjusted from higher to neutral in the first week of the month, indicating no clear direction for prices in the short term. Our Price Momentum Indicator for plate remains as it has been since April, pointing lower.

September scrap prices were sideways to down from August, easing as much as $8 per gross ton for some products. Buyers are uncertain about what prices could do in October.

We saw a dip in Steel Buyers’ Sentiment in the middle of September, but it mostly recovered by the end of the month. Our Future and Current Buyers’ Sentiment Indices indicate that buyers remain optimistic about their companies’ chances of success now and in the future.

Steel mill lead times eased slightly through the month and remain near some of the shortest levels recorded in some time. The percentage of buyers reporting that mills were willing to negotiate on new orders edged lower from August to September but remains relatively strong.

See the chart below for other key metrics for September. Historical charts can be found here on our website.