CRU

September 13, 2024

CRU: HRC futures market prices in rosy Q4’24 and 2025

Written by Josh Spoores

Prices in the hot-rolled coil futures market have fallen m/m in early September, yet they remain little changed since our last review on Aug. 14. As of Monday, Sept. 9, futures prices showed an average of $753 per short ton for Q4’24 and an average of $817/st for all of 2025. Spot prices, meanwhile, have slowly inched higher after mills were able to stop discounting orders. Yet our most recent price assessment for HR coil remains below recent mill asking prices.

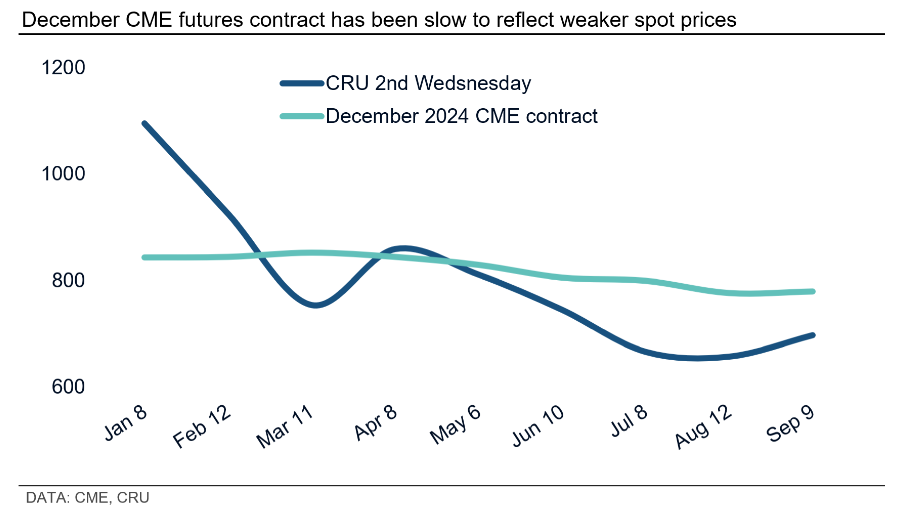

While the slow acceptance of higher mill asking prices is starting to come about, the futures market seems particularly optimistic about further gains to come. The December 2024 contract was near steady m/m at $780/st vs. our Sept. 11 price assessment of $698/st. Just two months ago, in July, we suggested that the November and December contracts looked interesting as, at the time, physical buyers were able to buy HR coil well below $650/st and could sell it forward for nearly $800/st. Perhaps some of this took place as the amount of open interest in the December contract surged higher, having gained 57% over the last two months.

Futures prices remain high through 2025 with a current average of $817/st, a level only exceeded twice outside of the pandemic era: in 2008 and 2018. Prices have spiked up over $1,000/st in each of the last two years, though a spike of this nature seems unlikely due to new capacity continuing to ramp up through 2025. Regardless, while the futures market may be mispriced, it may also be providing a warning for buyers. Perhaps it is wise for buyers and sellers to mitigate a portion of a potential price spike or decline.

This analysis was first published by CRU. To learn more about CRU’s services, visit www.crugroup.com.