Market Data

August 29, 2024

SMU survey: Lead times edge higher for sheet

Written by Brett Linton

Steel mill lead times were steady to higher this week for all products tracked by SMU, according to buyers responding to our latest market survey.

Sheet lead times marginally increased this week, an ongoing trend since late July. We attribute this to buyers restocking ahead of upcoming mill maintenance outages rather than recovering demand. Plate lead times saw little change from our previous market check.

Current lead time averages are a few days longer than levels seen a month ago but remain near historical lows for both sheet and plate products.

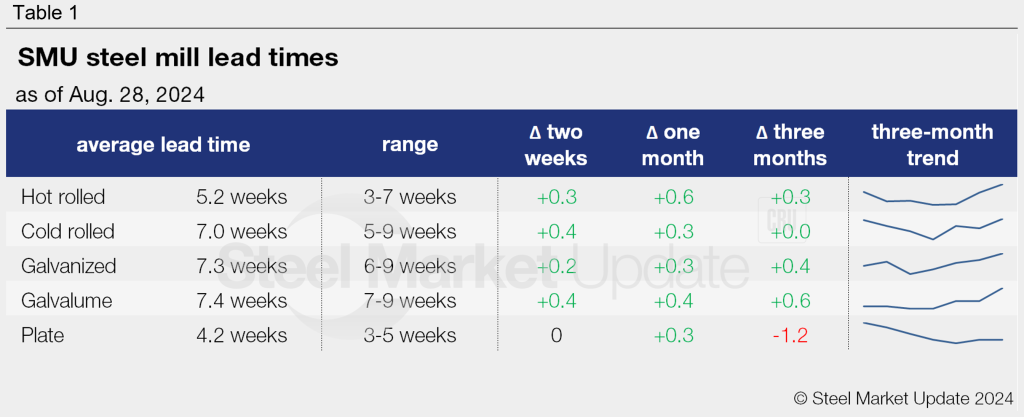

Table 1 below summarizes current lead times and recent trends.

Our lead time ranges’ upper and lower limits are almost identical to the mid-August limits, with only two changes seen this week. The shortest lead time in our Galvalume range has increased from six weeks to seven weeks, and the upper range for plate lead times has declined from six weeks to five weeks.

Survey results

Just over half (51%) of respondents this week remarked that current mill production times were within typical levels. The remainder said lead times were shorter than normal (41%), while 8% commented they were slightly longer than normal.

We also polled buyers on where they think lead times would be two months down the road. Most respondents believe lead times will be flat through October (60% this week vs. 66% in our prior survey). Only 24% forecast production times will extend further (down from 29% previously). The percentage of buyers expecting lead times to shrink increased (17% this week compared to 5% in mid-August).

Here’s what respondents are saying about lead times:

“Mills will try to manipulate lead times with outages, but they can easily make up the downtime by running at 80% plus capacity the days they are operational.”

“They can’t get much shorter.”

“Flattening – after extending a little bit more in the near future.”

“Even with the planned outages, we are expecting pretty weak demand in Q4 at the mill level.”

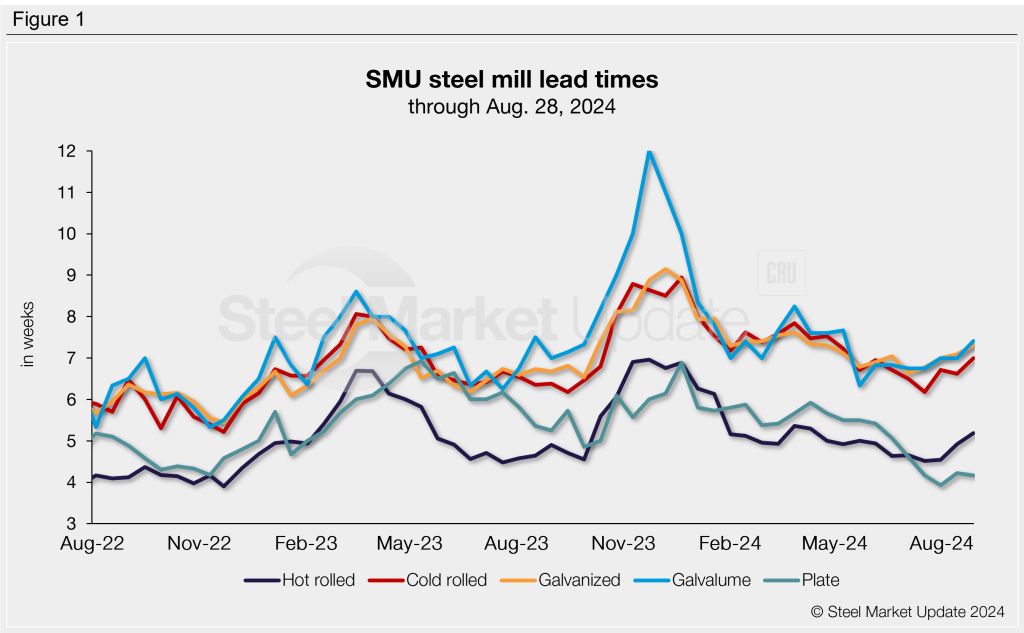

Figure 1 below tracks lead times for each product over the past two years.

3MMA lead times

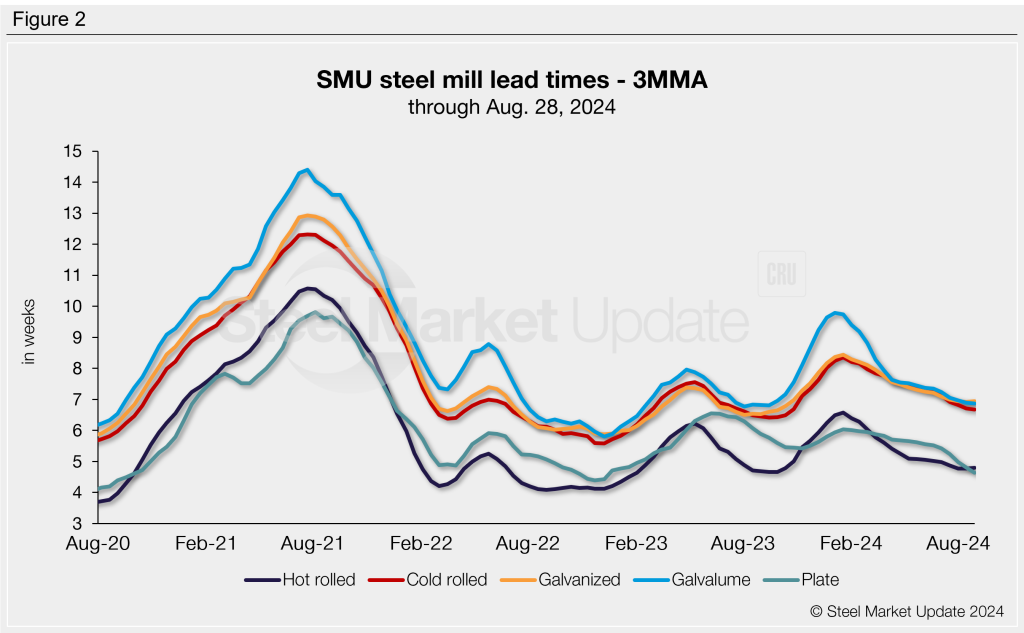

To better highlight trends, we can view lead time data on a three-month moving average (3MMA) basis to smooth out the variability in our biweekly readings. Through the end of August, 3MMA lead times were steady to slightly down for all sheet and plate products, remaining near lows not seen since late 2023. This downward trend has been evident for the last six months.

The hot rolled 3MMA is now at 4.80 weeks, cold rolled at 6.67 weeks, galvanized at 6.94 weeks, Galvalume at 6.86 weeks, and plate at 4.64 weeks.

Figure 2 highlights lead time movements across the past four years.

Note: These lead times are based on the average from manufacturers and steel service centers participating in this week’s SMU market trends analysis survey. SMU measures lead times as the time it takes from when an order is placed with the mill to when it is processed and ready for shipping, not including delivery time to the buyer. Our lead times do not predict what any individual may get from any specific mill supplier. Look to your mill rep for actual lead times. To see an interactive history of our steel mill lead times data, visit our website. If you’d like to participate in our survey, contact us at info@steelmarketupdate.com.