Market Data

August 15, 2024

SMU survey: Mills' willingness to negotiate spot prices continues to decline

Written by Brett Linton

Three out of four of our market survey respondents reported that steel mills are open to negotiating prices for new orders this week. That’s a slight decline from our previous market check.

Every two weeks, SMU asks steel buyers whether domestic mills are willing to negotiate lower spot pricing on new orders. As shown in Figure 1, 75% of all participants surveyed this week reported mills were willing to talk price on new orders. This is five percentage points lower than the rate of two weeks prior and down from our early-June high of 92%. This is now the lowest negotiation rate seen in the last three months, tied with the rate in early May.

Negotiation rates by product

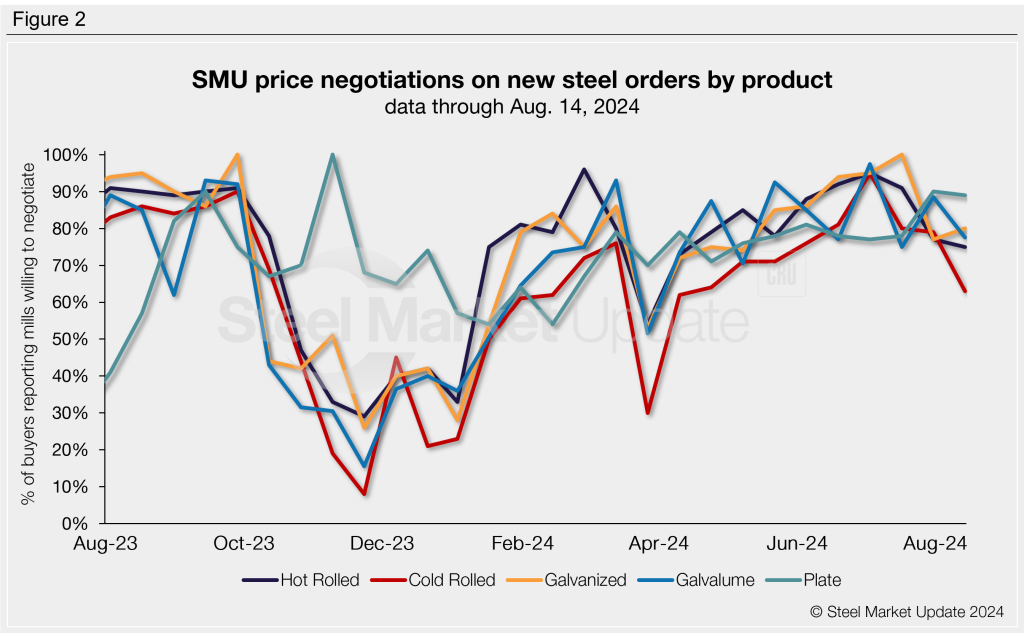

The negotiation rate for hot-rolled coil declined two percentage points from two weeks ago and is now at 75% and in territory not seen since April (Figure 2). Cold rolled buyers reported a negotiation rate of 63%, a considerable drop from late July (79%) and also down to levels last seen in April. Mills’ willingness to negotiate on galvanized products ticked three percentage points higher over the last two weeks to 80%, while Galvalume’s rate eased from 89% to 78%. Plate remains the most negotiable product, with 89% of buyers reporting mills are willing to talk price. This is the second-highest rate recorded since November, just behind the late-July rate of 90%.

Here’s what some survey respondents had to say about mills’ willingness to negotiate:

“If you have tons, they will move on price.”

“Mills will only flex on pricing with higher-than-normal tons.”

“Yes, on big orders.”

“Negotiable, but slowing.”

“Seems to be more room for negotiation on this product [galvanized].”

“[Negotiable on plate] – with tons.”

“Quietly negotiable.”

“The mills are holding pricing now and not very negotiable.”

Note: SMU surveys active steel buyers every other week to gauge their steel suppliers’ willingness to negotiate new order prices. The results reflect current steel demand and changing spot pricing trends. Visit our website to see an interactive history of our steel mill negotiations data.