Analysis

August 9, 2024

June steel exports fall to 5-month low

Written by Brett Linton

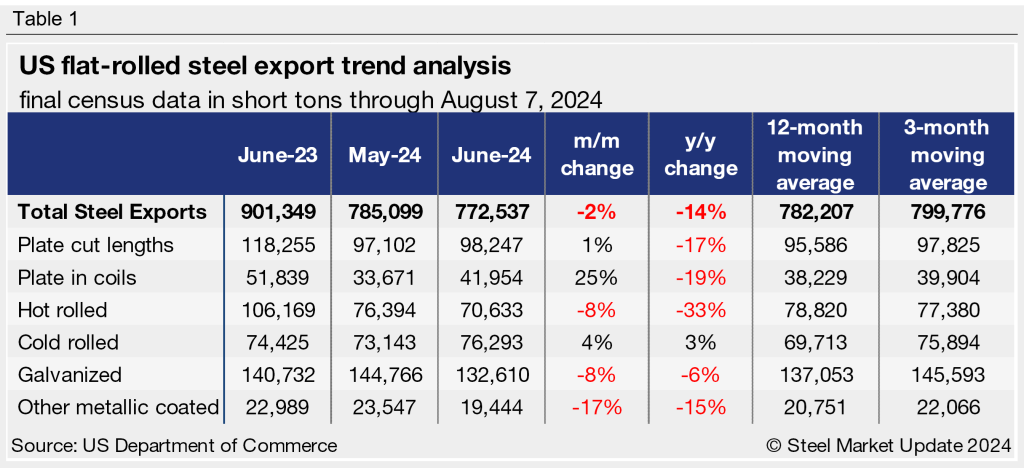

Total US steel exports declined again in June, down 2% month-on-month (m/m) to 773,000 short tons (st), according to the latest US Department of Commerce data. Following April’s eight-month high, June represents the second-lowest monthly export rate of the year, slightly higher than the 771,000-st rate recorded in January.

Steel exports averaged 801,000 st per month over the first six months of this year, 30,000 st less than the same period of 2023. June exports are 14% lower than the same month last year, back when export levels were beginning to ease from multi-year highs.

Monthly averages

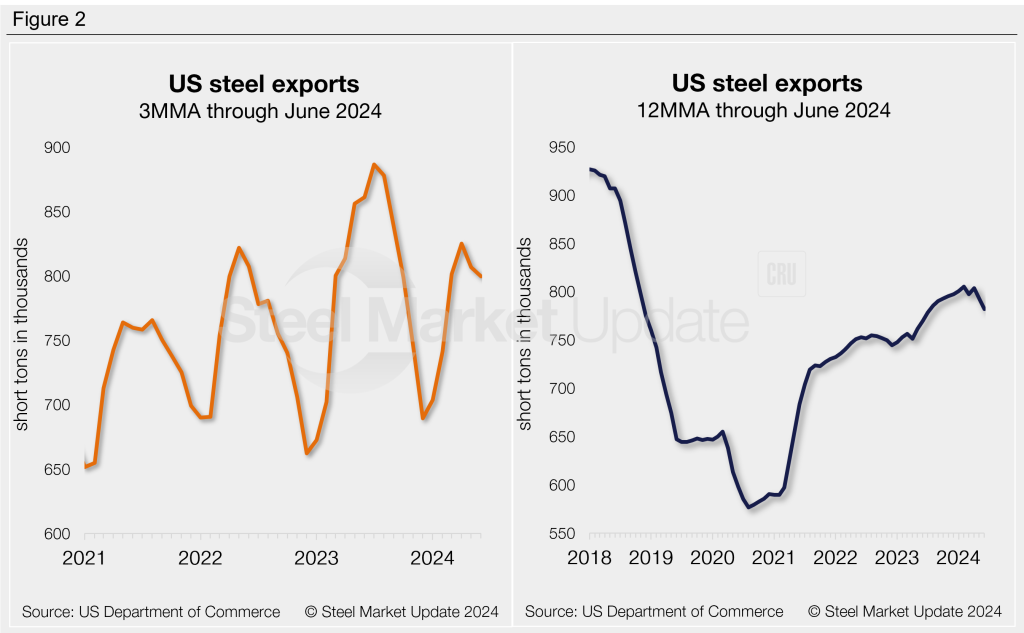

Looking at exports on a 3-month moving average (3MMA) basis can smooth out the monthly fluctuations. Shipments had trended downward throughout the second half of 2023, falling to an 11-month low in December. The 3MMA changed course as it entered 2024, rising each month through April. The latest 3MMA through June remains relatively high at 800,000 st, down 3% from the seven-month high in April.

Exports can be annualized on a 12-month moving average (12MMA) basis to further dampen month-to-month variations and highlight historical trends. From this perspective, steel exports have steadily trended upwards since bottoming out in mid-2020. The 12MMA reached a five-and-a-half-year high of 805,000 st in February. The 12MMA has eased since then but remains strong through June at 782,000 st.

Exports by product

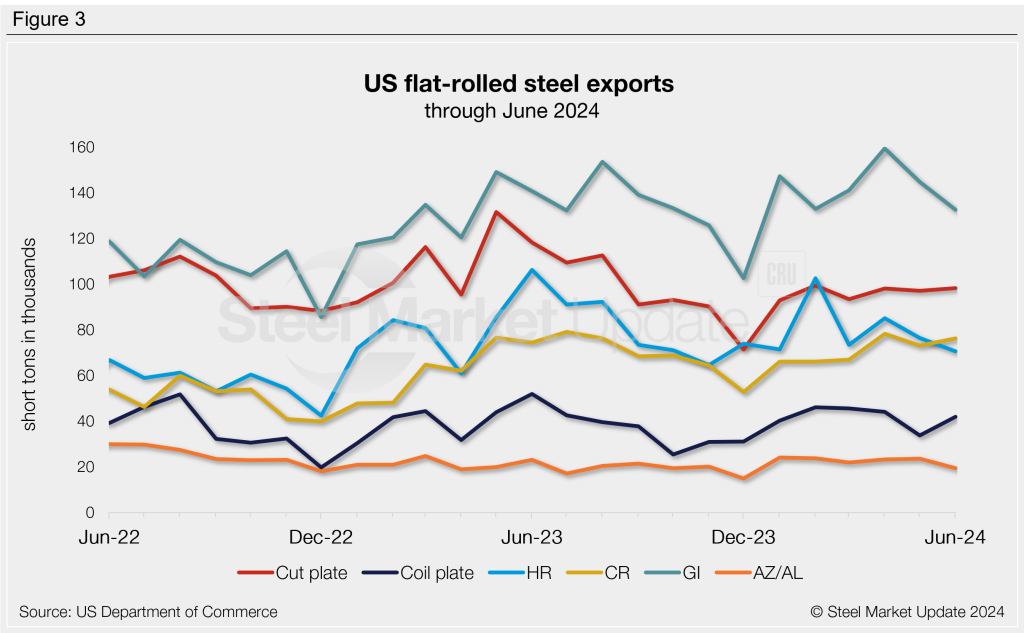

Changes in monthly export rates were mixed across the major flat-rolled steel products we track. The biggest monthly movers from May to June were plate in coils (+25%), other-metallic coated (-17%), galvanized (-8%), and hot rolled (-8%).

Significant year-on-year (y/y) declines were seen in June exports of hot rolled (-33%), plate in coils (-19%), plate cut lengths (-17%), and other-metallic coated (-15%). Cold-rolled steel was the only product with a y/y increase (+3%).

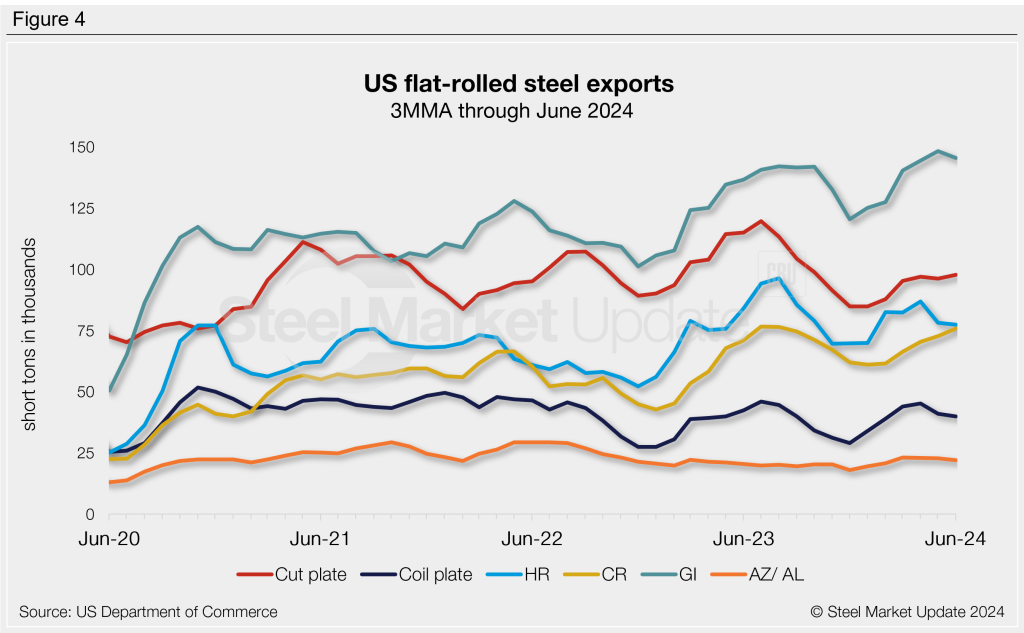

Figure 4 shows a history of exports by product on a 3MMA basis.

Note that most steel exported from the US is destined for USMCA trading partners Canada and Mexico. 51% of all exports in June went to Mexico, followed by 41% to Canada. The next largest recipients were the Dominican Republic and China at less than 1% each.