Prices

July 30, 2024

SMU price ranges: HR bottom realized? Tandem products hold

Written by Brett Linton & David Schollaert

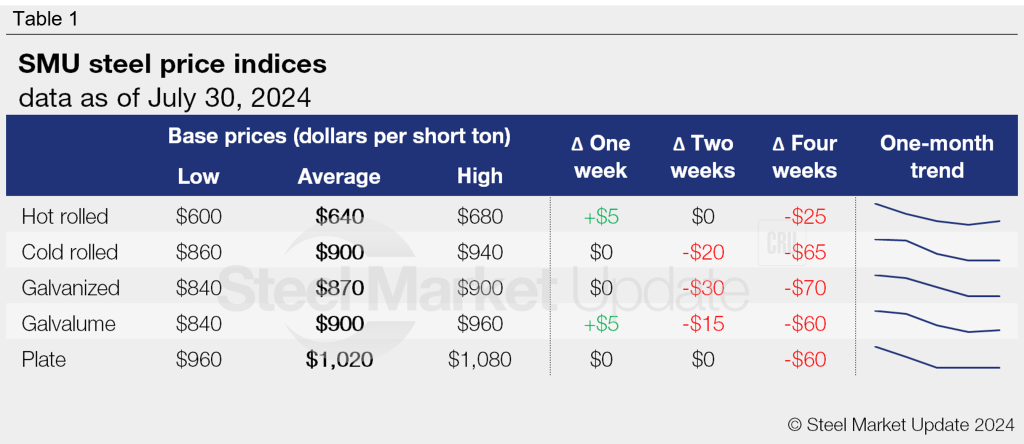

SMU’s sheet price was largely flat this week, an unusual sight for the better part of the past four months. The same trend was seen for tandem products and plate as well.

Our price for HR coil edged up to $640 per short ton (st), $5/st higher from a week ago. While HR prices are still near their lowest point since November 2022, they have ticked up for the first time in seven months.

It comes after Cleveland-Cliffs announced on Friday that it would seek $670/st for HR, followed by Nucor pushing its consumer spot price (CSP) for HR up $25/st to $675/st on Monday.

The result also could signal a bottom has been reached as we’re seeing some stability in prices for the first time since December.

SMU’s CR price stands at $900/st on average, unchanged from a week ago. Our galvanized price is at $870/st on average, also flat week over week (w/w). And Galvalume is at $900/st on average, up $5/st from last week.

Some sources think mills have set a floor and prices should go up from here. Others think it could be some time before we see demand increase enough to cause a sustained uptrend in pricing.

SMU’s sheet price momentum indicator has been shifted from lower to neutral. Our plate price momentum indicator remains pointing lower.

Hot-rolled coil

The SMU price range is $600-680/st, averaging $640/st FOB mill, east of the Rockies. The lower end of our range is down $10/st w/w, while the top end is up $20/st. Our overall average is up $5/st w/w. Our price momentum indicator for HR has been adjusted to neutral, meaning we see no clear direction for prices over the next 30 days.

Hot rolled lead times range from 3-6 weeks, averaging 4.5 weeks as of our July 17 market survey.

Cold-rolled coil

The SMU price range is $860–940/st, averaging $900/st FOB mill, east of the Rockies. The lower end of our range is up $20/st w/w, while the top end is down $20/st. Our overall average is unchanged w/w. Our price momentum indicator for CR has been adjusted to neutral, meaning we see no clear direction for prices over the next 30 days.

Cold rolled lead times range from 4-8 weeks, averaging 6.2 weeks through our latest survey.

Galvanized coil

The SMU price range is $840–900/st, averaging $870/st FOB mill, east of the Rockies. The lower end of our range is up $20/st w/w, while the top end is down $20/st. Our overall average is unchanged w/w. Our price momentum indicator for galvanized has been adjusted to neutral, meaning we see no clear direction for prices over the next 30 days.

Galvanized .060” G90 benchmark: SMU price range is $937–997/st, averaging $967/st FOB mill, east of the Rockies.

Galvanized lead times range from 5-8 weeks, averaging 6.8 weeks through our latest survey.

Galvalume coil

The SMU price range is $840–960/st, averaging $900/st FOB mill, east of the Rockies. The lower end of our range is unchanged w/w, while the top end is up $10/st. Our overall average is up $5/st w/w. Our price momentum indicator for Galvalume has been adjusted to neutral, meaning we see no clear direction for prices over the next 30 days.

Galvalume .0142” AZ50, grade 80 benchmark: SMU price range is $1,134–1,254/st, averaging $1,194/st FOB mill, east of the Rockies.

Galvalume lead times range from 6-8 weeks, averaging 6.8 weeks through our latest survey.

Plate

The SMU price range is $960–1,080/st, averaging $1,020/st FOB mill. Our range is unchanged w/w across the board. Our price momentum indicator for plate remains at lower, meaning we expect prices to decline over the next 30 days.

Plate lead times range from 3-6 weeks, averaging 4.2 weeks through our latest survey.

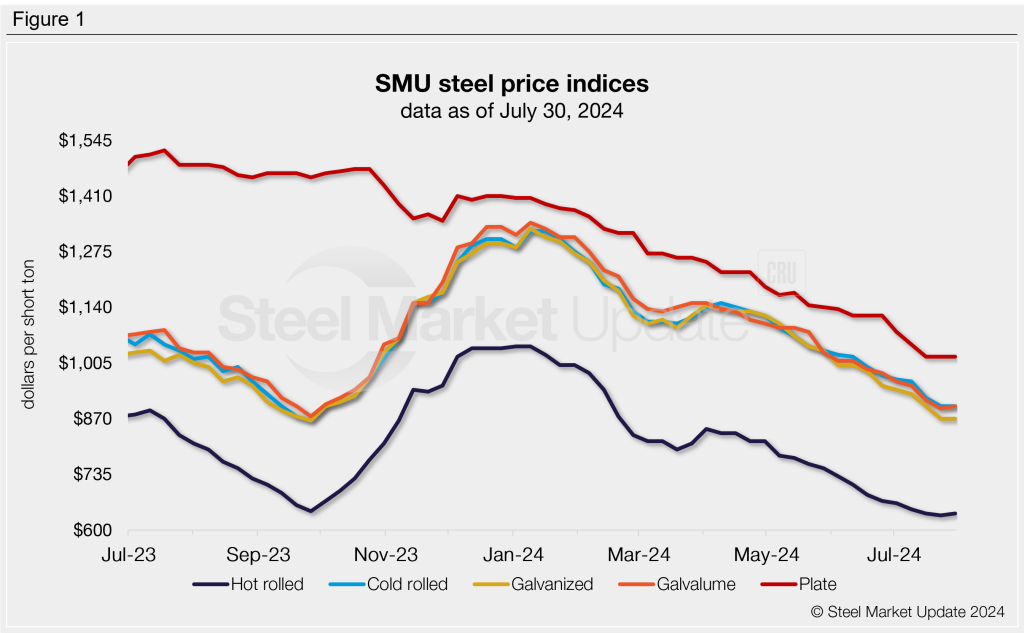

SMU note: Above is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is also available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@steelmarketupdate.com.

Brett Linton

Read more from Brett Linton