Prices

July 18, 2024

HR futures complex slips from June

Written by Mark Novakovich

The CME steel futures complex saw a slight decrease in activity from levels seen at the end of June. This has coincided with a notable decline in flat prices for the nearby futures contract, now August HRC, which is lower by $81 per short ton (st) since last writing on June 13. It settled at $672/st on July 17.

For several weeks, many physical participants had been reporting spot trades well into the $600 range, and this has been confirmed by the major price reporting agencies and Nucor’s own Consumer Spot Price (CSP). This physical spot weakness has translated into front-end futures weakness, but has not materially impacted the back-end of the curve. December settled at $795/st on July 17, unchanged since last writing. Persistent market chatter of a near-term bottom has failed to support the front-end of the futures complex thus far. Still, the expectation for lower-interest rates, inventory rebuilding, and potentially improving economic conditions in Q4 and 2025 have supported the back-end of the steel futures curve. The contango structure has widened dramatically, however, with the August-December structure settling at -$124/st as of yesterday, down roughly $80/st since mid-June.

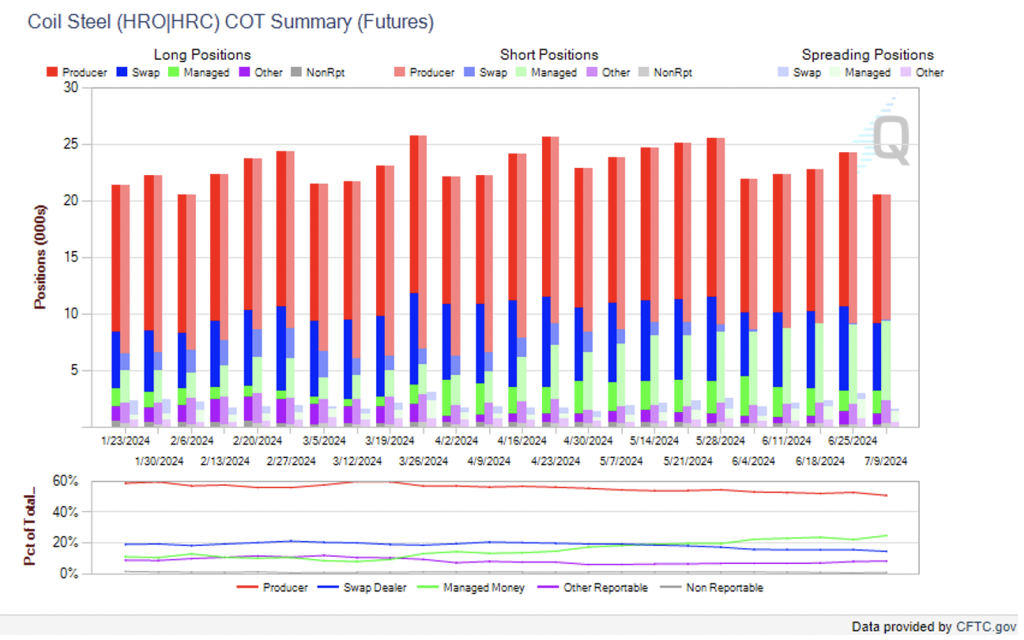

Open Interest (OI) for June reached ~550,000/st towards the end of the month, but as the front-end of the curve has dropped, new positions have failed to materialize and current open interest stands at 462,000/st. Recent trading activity has seen some significant tonnages trading in August and September futures contracts, but this is likely to be short-covering as open interest has not increased. The latest Commitment of Traders is not available yet, but as of last week’s posting, total positions are below levels seen earlier this year (see chart below). Overall, producer totals as a percentage of open interest have been declining since April, while the managed money group has been increasingly slightly. Daily futures trading volumes in CME HRC have been somewhat muted as well, with the market seeing roughly 15,000/st traded daily on average so far in July.

Unfortunately, it’s more of the same with the CME ferrous scrap busheling contract (BUS): traders have been expressing skepticism about the quality of the underlying assessment and the lack of convergence/correlation between the physical and futures markets. Open interest continues to decline, with OI now at 50,000 gross tons (gt) (2,500 contracts). That’s down nearly 60% from open interest seen as recently as April of this year. The August BUS contract is largely unchanged over the past 30 days, though it did dip down to $380/gt at the end of June before recovering recently, settling at $405/gt yesterday, down $7 from last writing on June 13.