Canada

July 17, 2024

HRC vs. prime scrap spread narrows to lowest level since Covid-19 pandemic

Written by Ethan Bernard

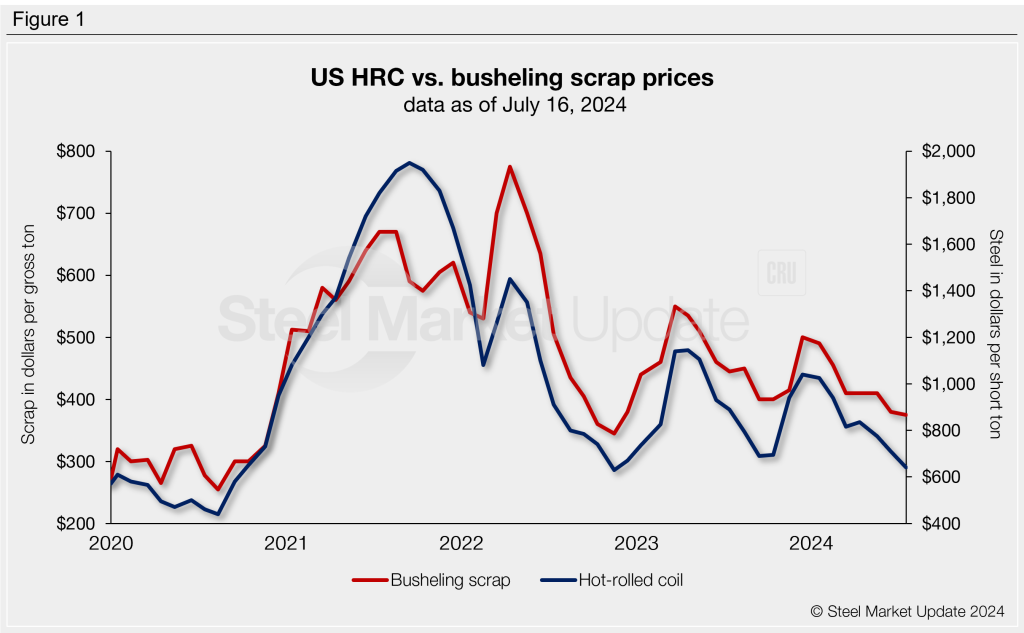

The price spread between hot-rolled coil (HRC) and prime scrap narrowed for a third consecutive month, hitting a level in July not seen since 2020, according to SMU’s most recent pricing data.

SMU’s average HRC price declined this week, and the July price for busheling scrap edged down from June.

Our average HRC price stood at $640 per short ton (st) as of July 16, down $10 from the prior week.

Meanwhile, busheling tags slipped $5 month over month to an average of $375 per gross ton (gt) in July. Figure 1 shows price histories for each product.

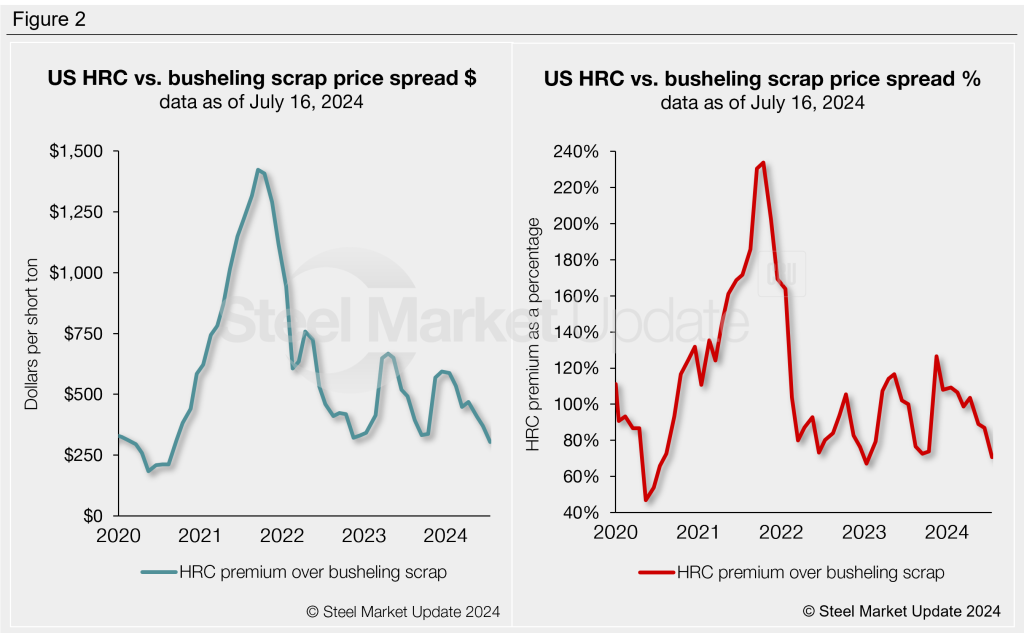

After converting scrap prices to dollars per short ton for an equal comparison, the differential between HRC and busheling scrap prices is $305/st as of July 16, down $66 from a month earlier (Figure 2). This is the lowest level seen since the Covid-19 pandemic in August 2020 when it stood at $212.

A scrap source told SMU, “Now that the prime scrap market has stabilized and is likely to increase, the descent of HRC prices has to stop to prevent the further narrowing of the spread.”

The chart on the right-hand side below explores this relationship differently: We have graphed HRC’s premium over busheling scrap as a percentage. HRC prices now carry a 71% premium over prime scrap, tumbling from 87% a month ago. That represents the lowest premium since January 2023 when it was 67%.

Here’s what some of our SMU survey participants are saying about the prime scrap situation and August outlook:

“Scrap seems to be leveling off and mills are ready to draw the line.”

“I think scrap going sideways and Stelco being purchased (by Cliffs) helps the market find a bottom.”

“Unsure how much scrap prices matters when there is no demand for the end product.”

“I think scrap will be up (in August) and the mills will try and get ahead of that.”

“Scrap inventories are lower, I am reading, and as demand increases, prices will follow.”

Note: By the way, did you know SMU’s Interactive Pricing Tool can show steel and scrap prices in dollars per short ton, dollars per metric ton, and dollars per gross ton?