Distributors/Service Centers

July 16, 2024

June service center shipments and inventories report

Written by Estelle Tran

Flat Rolled = 60.9 Shipping Days of Supply

Plate = 59 Shipping Days of Supply

Flat Rolled

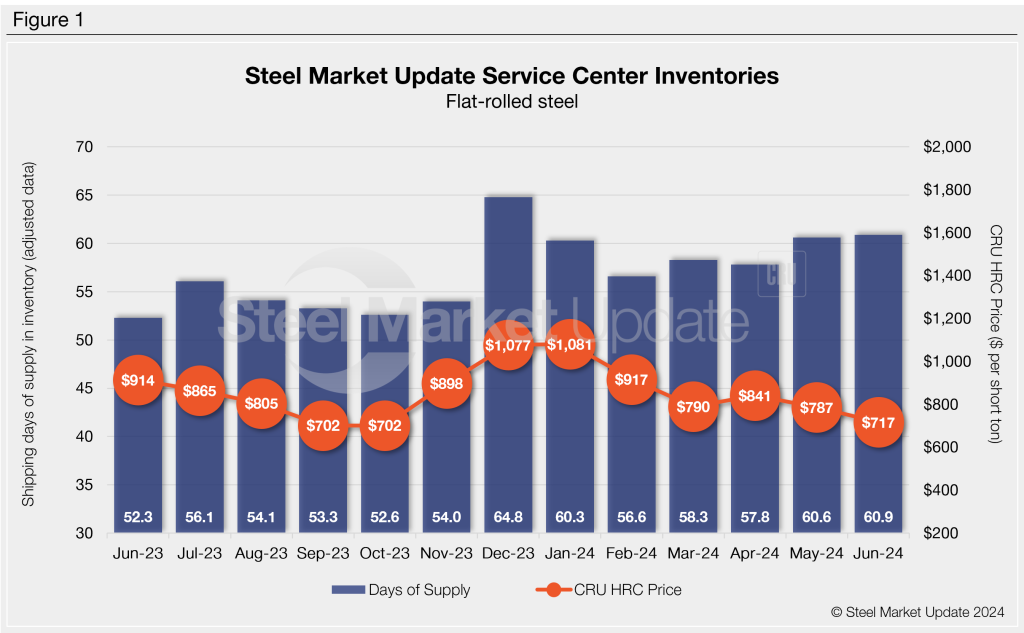

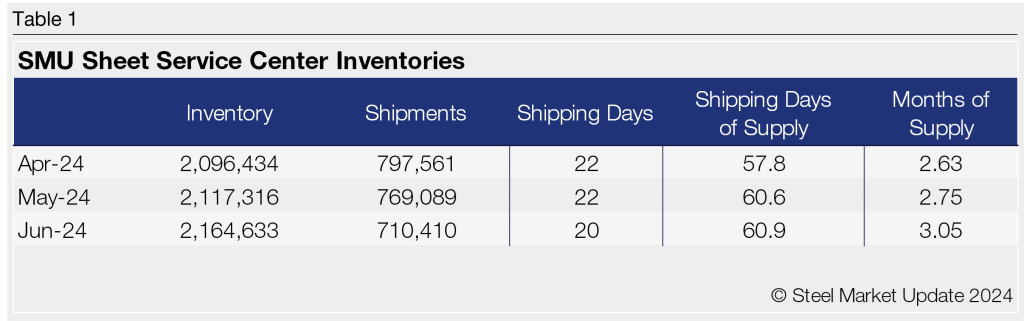

US service center flat-rolled steel supply remained high at the end of June at 60.9 shipping days of supply, according to adjusted SMU data. This translates to 3.05 months of supply in June. At the end of May, flat-rolled steel supply represented 60.6 shipping days or 2.75 months of supply. In contrast, service centers carried 52.3 shipping days or 2.38 months of supply in June 2023.

June had 20 shipping days, while May and June 2023 had 22. The daily shipping rate in June fell y/y, and anecdotally, service centers continue to report that their shipments have been slow. The latest SMU survey with data through July 3rd showed that 71% of service center respondents said their customer releases for their products were less than a year ago, while 23% said they were the same. and 6% said they were releasing more. The reading of 71% is the highest it has been all year.

Material on order picked up in June, which may be attributable to some sizeable deals done at low prices. While the amount of material on order increased in June, it was not across the board, and there does not appear to be a strong urge to restock. The latest SMU survey reported mill hot-rolled coil lead times at 4.66 weeks, flat from two weeks prior but still down from 4.94 weeks a month ago.

Looking ahead toward July, we do not expect a meaningful drop in inventory levels. While there has been speculation about mill price increase announcements coming, there does not appear to be a lot of demand-side support for price increases yet.

Plate

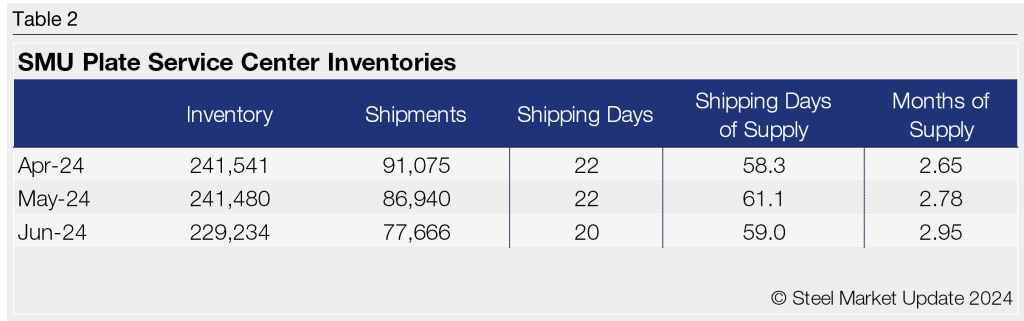

US service center plate inventories decreased in June, and while total inventories are lower y/y, shipments have also been particularly weak this year. At the end of June, service centers carried 59 shipping days of plate supply or 2.95 months of supply, according to adjusted SMU data. This is down from 61.1 shipping days of plate supply in May, representing 2.78 months of supply.

In June 2023, service centers carried 58.1 shipping days of supply, representing 2.64 months of supply. Service centers report that orders from their customers are weaker this year because of delayed projects, concerns about layoffs, and falling prices.

The latest SMU survey reported plate mill lead times at 4.62 weeks, down from 5.42 weeks a month ago. However, some market contacts have reported receiving their material much sooner and there is no urgency to fill in holes in their inventories.

The lack of restocking has caused plate intake to go down to the lowest level seen since February 2022. At the same time, material on order has also fallen m/m for plate.

With such low levels of material on order, we expect plate inventories to decline in July. While demand outlooks remain bearish, inventories will look low if outbound shipments increase abruptly.