Canada

July 16, 2024

Cliffs explains 'no-brainer' buy of Stelco, market responds

Written by Laura Miller

Cleveland-Cliffs has been pursuing M&A opportunities for some time now and thinks it has found a solid partner with aligned interests in Stelco.

The companies announced on Monday that Cliffs would acquire the integrated Canadian steelmaker. That same day, Cliffs held a conference call with analysts to discuss the acquisition.

Lourenco Goncalves, Cliffs’ chairman, president, and CEO, said on the call that Stelco was “incredibly undervalued” with an enterprise value of $2.5 billion. Additionally, it is an extremely low-cost producer with a cost structure lower than that of a greenfield mill.

“The acquisition of Stelco is a no-brainer. When the opportunity became available, we had to pursue it,” he said. “We saw the value. We seized the opportunity. That’s how we operate.”

Goncalves said Cliffs is buying Stelco at the bottom of the market because it understands the cyclicality of the steel business.

He teased analysts that, “There’s more to come, and things are still very much in play.” The Stelco acquisition has not “changed our resolve to continue to consolidate the American steel industry,” he added.

Spot market exposure

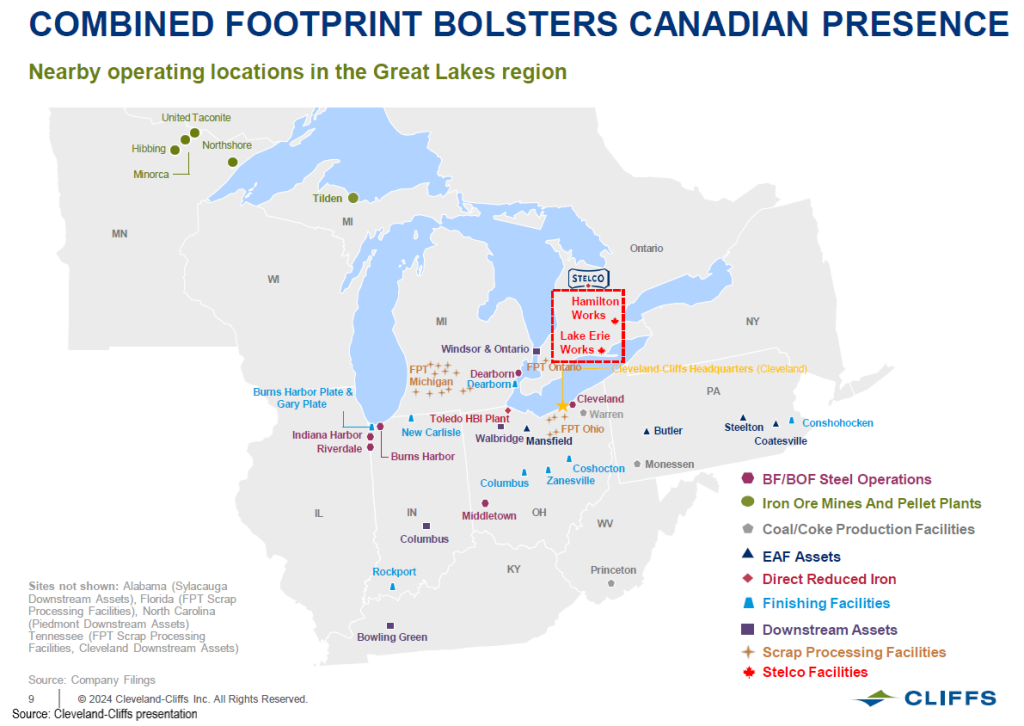

Cliffs said the acquisition will double its exposure to the North American spot market.

As approximately 95% of its sales are on the spot market, Stelco will add ~2.5 million short tons (st) of flat-rolled products to Cliffs’ annual FR spot sales of 2.6 million st.

According to a Cliffs presentation accompanying the conference call, the combined company’s pro forma annual spot sales of ~5.1 million st would account for ~27% of its total sales volumes.

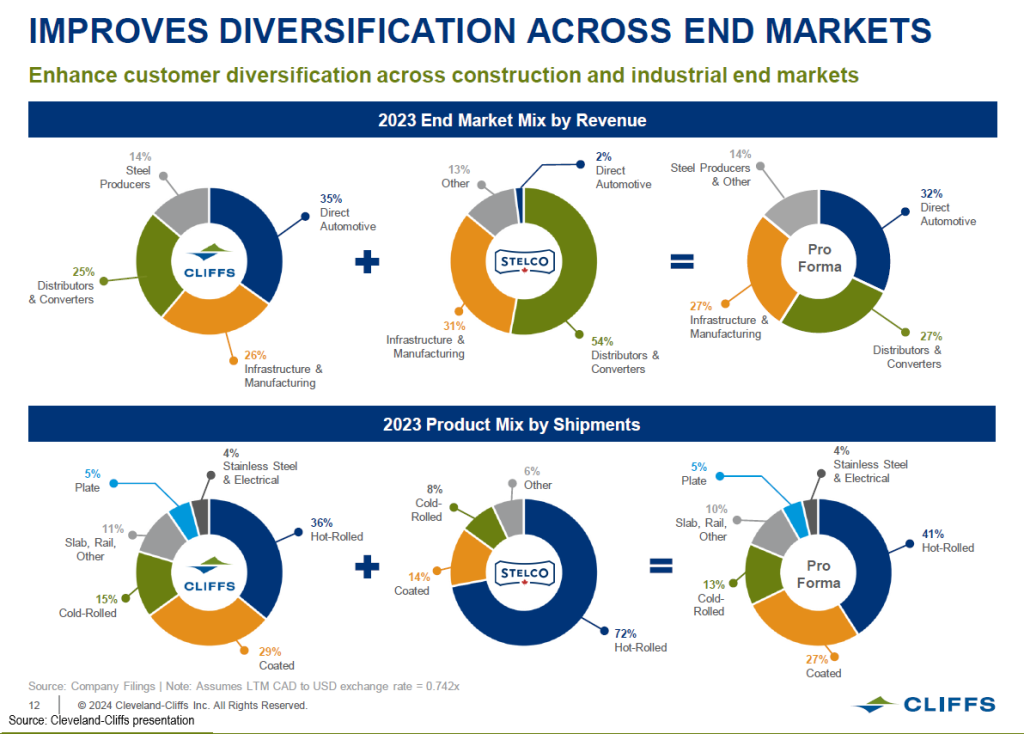

“[Stelco] has substantial HRC exposure at over 70% of its volume and will increase [Cliffs’] exposure to over 40% from 36%. Interestingly, [Cliffs] was keen to diversify away from automotive, at 35% direct exposure last year to 32% proforma,” said a research note sent to SMU from Martin Englert, senior analyst at Seaport Research Partners.

Wolfe Research’s Timna Tanners said in a research note that, “While [Stelco’s] earnings have been quite volatile with steel price fluctuations given a big spot focus and fixed costs, less discounting than we’ve seen in its past could result in better results under [Cliffs].”

Goncalves commented that Cliffs no longer needs to grow its automotive business: “At this point, I would not mind shrinking automotive a little bit. … I’m done with automotive.”

He said he’s now looking to grow Cliffs in other areas, including the spot market (“Stelco fits perfectly on that.”) and in grain-oriented electrical steels for transformers.

Cliffs estimated total synergies generated by the merger to be $120 million annually.

As the two companies are both integrated steel producers, they rely on much of the same raw materials, including refractory, limestone, coal, coke, and iron ore. This should help some of their bulk purchase prices.

Goncalves remarked that Stelco has “two of the best coke plants I have ever laid my eyes on.” Cliffs will be able to use the excess capacity to feed its own existing US blast furnaces with in-house coke, he said.

Additionally, injecting Cliffs’ HBI into the blast furnace at Stelco’s Lake Erie Works “will both increase the throughput and reduce the cost structure,” he noted.

Iron ore

In 2020, Stelco entered into an eight-year pellet sale and purchase agreement with U.S. Steel. The contract runs until Jan. 31, 2028.

Goncalves said the agreement was one of the attractive points in the deal to acquire Stelco.

The agreement includes an option for Stelco to purchase a 25% share of the USS Minntac iron ore operations. It paid USS $100 million in 2020 and has until Jan. 31, 2027, to exercise its option to purchase the 25% share for another $500 million.

Englert called this a “favorably priced iron ore feedstock agreement” in his research note.

Cliffs will “be taking advantage of the contract that the supplier conceded to Stelco,” Goncalves stated on the call.

Flat rolled market

An analyst asked if Cliffs would be taking down any capacity due to the current state of the flat-rolled steel market, i.e. excess supply and tepid demand.

Goncalves said definitively: “No, we’re not taking down capacity,” adding that only “happens when the economy is in disarray, prices are low, and you have a footprint that’s bigger than you need.”

He noted that the market will be very different by the time the deal closes in Q4, so conversations about taking down capacity won’t be necessary.

In fact, he said Cliffs will likely produce more hot rolled at Stelco’s Hamilton facility once the merger is finalized. Can the market absorb more HR steel? “We will see. But at this point, I don’t think that’s a problem,” he commented. He said other steelmakers should be the ones to shut down capacity.

He later reminded analysts of the cyclicality of the steel business: “Keep in mind prices will not stay low forever. Prices will rebound.”

USS/Nippon sale

Goncalves continued to take shots at the handling of the sale of U.S. Steel to Nippon Steel.

“The international president of the USW, Dave McCall, fully supports this (Stelco) deal. And for abundance of clarity, Dave McCall does not support any other deal in our space,” he commented on the call.

He later added, “Stelco is the only steel company on the continent whose relationship with the union is similar to our own – not hostile, but rather centered around the achievement of shared goals.”

Goncalves explained that, when the opportunity to acquire Stelco became available, Cliffs first had to seek the approval of the United Steelworkers union to satisfy “the most important closing condition.” This differs “from others that are learning through a very painful and very embarrassing death by 1,000 cuts type process,” he commented.

Analyst reaction

Most industry analysts approached by SMU responded favorably to the acquisition announcement.

“Strategically, the deal makes sense and valuation implications appear reasonable,” said Alex Hacking and Steven Stroup in a research note from Citi.

Josh Spoores, principal analyst at CRU, agreed: “This looks like a good acquisition by Cleveland-Cliffs as they gain more productive assets that are at the low end of the cost curve. Potentially, these assets will allow Cliffs more operational optionality when it comes to not only running the furnaces they want to run but also in rolling slabs produced at their Dearborn Works.”

Tanners said the deal “makes strategic sense operationally, in our view, but adds operating leverage into what we consider a challenging sheet market outlook.”

Still, the deal is not without risk.

One potential risk cited by Citi and CRU analysts is a negative reaction by Canada’s government to a foreign buyer of the company.

“This seems to be a hot M&A topic in the North American steel market. As you know, there were issues with prior foreign owners of steelmakers in Canada when Essar owned Algoma and U.S. Steel owned Stelco,” Spoores pointed out.

Note that under USS’ ownership from 2007 to 2016, Stelco’s facilities experienced labor strife, including multiple lockouts.

Another risk the analysts see is Cliffs’ exposure to the spot market.

“Due to recent capacity additions in North America and further additions coming this year and in the near term, the spot market may not be as profitable over the next three years as it was in the prior three years,” Spoores told SMU.

Steel buyers’ reaction

SMU’s survey results this week show 60% of responding steel buyers are ‘neutral’ on Cliffs’ acquisition of Stelco, while 16% see it as ‘positive’ and 23% see it as ‘negative.’

Comments from buyers show mixed feelings on the merger and industry consolidation overall.

“Too early to see any positive or negative impact from the sale. If Cleveland-Cliffs invests, good for Stelco.”

“It’s probably good news for seemingly ailing Stelco, and perhaps consolidation will bring a little more price stability.”

“Fewer suppliers is never good for the customer.”

“Too much ownership consolidation.”

“Cliffs is approaching monopoly level, even more so if/when they get NLMK.”

“Consolidation has gone far enough.”

“Unexpected, but consolidating a lower-priced seller is never a bad thing.”

“Not a bad consolation prize for missing out on USS, I guess. I wonder if they’ll double dip and get part of Evraz NA too?”

“I couldn’t care less what Cliffs does.”