Analysis

June 30, 2024

Final thoughts

Written by David Schollaert

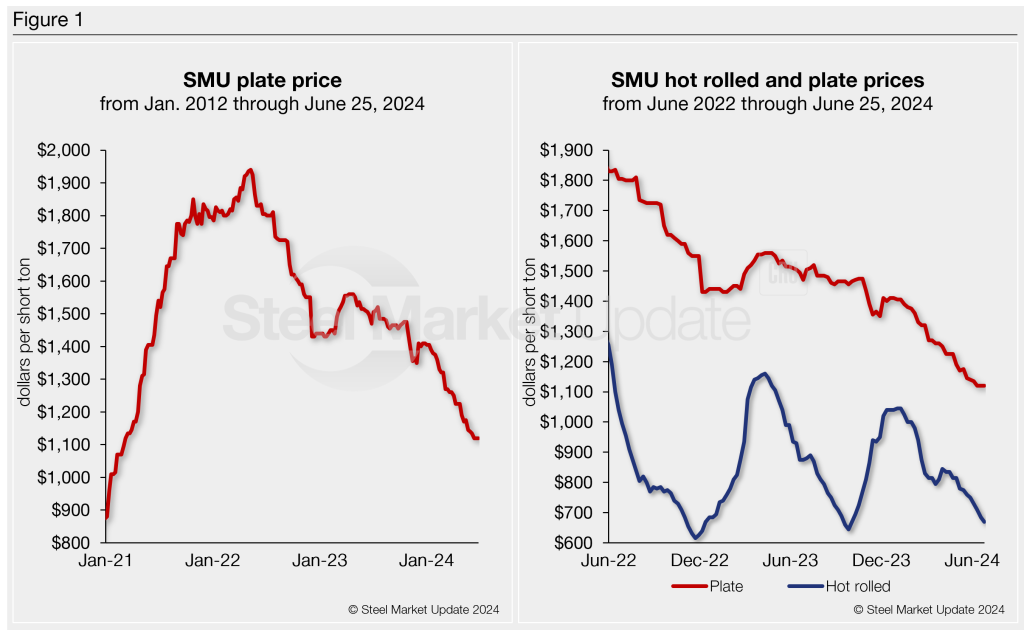

Domestic plate prices have been on a historic run since they began surging in January 2021. Tags reached an all-time high of $1,940 per short ton (st) in May 2022, though they have mostly trended lower over the past two years.

During this three-and-a-half-year period, tags have averaged roughly $1,500/st. But prior to the rally, US plate prices averaged roughly $790/st, according to Steel Market Update data.

SMU’s plate price stands at $1,120/st on average based on our latest check of the market on Tuesday, June 25. (Figure 1, left-side chart). By comparison, our HR coil price is $670/st, down $15/st from last week and down $375/st since reaching a recent high of $1,045/st at the start of the year.

But even though plate prices have seen less volatile swings vs. HRC, plate tags have been largely trending down since peaking more than two years ago (Figure 1, right-side chart). Now they’re at their lowest level since March 2021.

More price erosion on the horizon

The market is anticipating a price cut – any day now – when Nucor’s plate mill group opens its August order book. Most sources expected an announcement last week but aren’t surprised by the apparent delay. Many are pointing to shorter lead times as the culprit.

And while opinions across the market differ some, most anticipate a sizable price cut – down by at least $100/st.

But some service center and OEM executives told SMU they wouldn’t be surprised if the price cut was more around $150/st. Still, a few others suggest the Charlotte, N.C.-based steelmaker could make an unprecedented cut of as much as $200/st.

Nucor last slashed prices by $90/st on April 29 when it opened its June order book. But then the company held tags flat on May 24 with the opening of its July order book. Despite the sideways move in its most recent pricing notice last month, discounting has been a standard practice by most, if not all, mills.

So, while Nucor “officially” held the line last month, the bulk of transactions were being seen around $1,040/st. And several spot deals were reported as low as $960/st by some mills in the Midwest and the South.

Some dynamics at play

The US plate market has been largely quiet and demand trending down.

The lack of stability has been highlighted by slower-than-expected infrastructure spending, and maybe more significantly by a wave of wind farm project cancellations.

The likes of Ørsted, Equinor, BP, and Avangrid canceled contracts or sought to renegotiate them despite facing cancellation penalties ranging from $16 million to several hundred million dollars per project.

The move resulted in Siemens Energy – the world’s largest maker of offshore wind turbines – anticipating loses of $2.2 billion in 2024.

Its been bad news for the US plate market, especially the likes of Nucor and SSAB.

Nucor built its $1.7-billion ultramodern plate mill in Brandenburg, Ky., and its new sustainable, heavy-gauge steel plate Elcyon, suggesting that the clean energy transition in the US could increase steel demand by two-to-three million tons per year.

Not to mention Nucor’s goal of deploying 30 gigawatts of offshore wind capacity by 2030 would require 7 million tons of steel to build wind towers.

SSAB Americas said its low-carbon SSAB Zero steel made at its plate mill in Montpelier, Iowa, would supply GE Vernova Onshore Wind for wind towers in North America.

The takeaway

With spot plate demand limited, sellers have been discounting and undercutting published mill prices. That trend is expected to continue as most are still focused on controlling order books. Another price cut could highlight that trend.

Also, keep an eye on discrete plate lead times. They have been trending down since April and our most recent analysis on June 19 suggested they were at five weeks on average. But several sources have argued recently that lead times are trending more around 2-4 weeks.

Steel Summit

Steel Summit is less than two months away! The preeminent North American flat-rolled event kicks off on Aug. 26.

Nearly 900 people have registered from just about 400 companies. And the numbers are still trending upward. If you haven’t registered yet, what are you waiting for? You can do so here.

Also, our room blocks are sold out. But there are plenty of hotels available around Hartsfield-Jackson Atlanta International Airport – so not far from where the event will be held.

And, most importantly, from all of us at SMU, we thank you for your continued support.