Prices

June 18, 2024

SMU price ranges: Sheet dips below $700/ton to 8-month low

Written by Brett Linton & David Schollaert

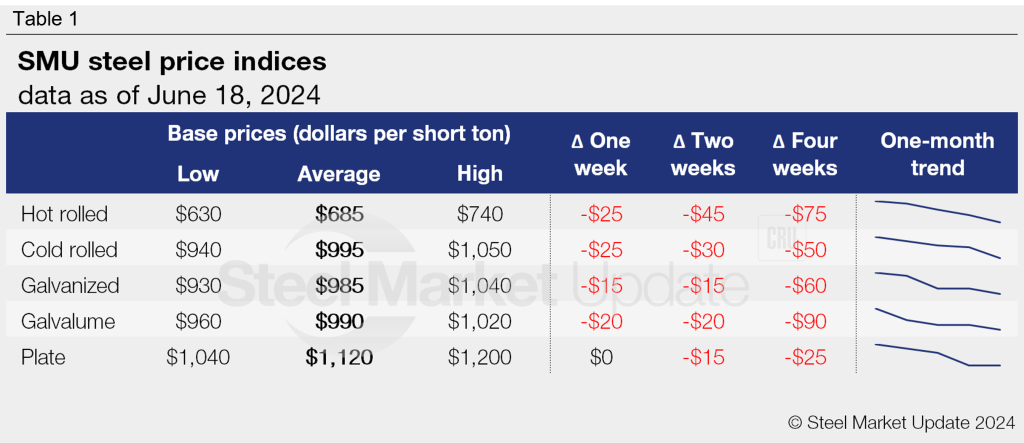

US sheet prices edged lower this week as discounting continues. Major factors remain ample supply, shorter lead times, and lower input costs. Meanwhile, demand had remained steady to soft, depending on the end market.

SMU’s hot-rolled (HR) coil price now stands at $685 per short ton (st) on average, down $25/st from last week. Hot band is down $160/st from a recent high of $845/st in early April. It now stands at an eight-month low.

The high end of our HR range is $740/st. The low end is $630/st. Prices below $700/st were not solely the preserve of big buyers, as they had been earlier in the month, sources told SMU. And larger deals were reported in the low-to-mid $600s/st – notably from certain mills in the North.

In the South, decreases stemmed in part from Nucor’s $60/st price cut last week. That was followed by a $5/st cut this week. And other mills in the region have followed it lower, sources said.

We observed a similar trend for tandem products. Cold-rolled (CR) coil prices were also down $25/st week over week (w/w) to $995/st on average. Galvanized and Galvalume base prices were also down w/w to $985/st (-$15/st) and $990/st (-$20/st), respectively.

Our plate price was unchanged vs. last week, though heavy discounting continues to be noted. There is speculation that more decreases could be on the horizon.

Our momentum indicators continue to point lower, with concerns about supply outstripping demand still weighing on the market.

Hot-rolled coil

The SMU price range is $630-740/st, averaging $685/st FOB mill, east of the Rockies. The lower end of our range is down $30/st w/w, while the top end is down $20/st. Our overall average is down $25/st w/w. Our price momentum indicator for HR remains at lower, meaning we expect prices to decline over the next 30 days.

Hot rolled lead times range from 3-7 weeks, averaging 4.9 weeks as of our June 5 market survey.

Cold-rolled coil

The SMU price range is $940–1,050/st, averaging $995/st FOB mill, east of the Rockies. The lower end of our range is down $20/st w/w, while the top end is down $30/st. Our overall average is down $25/st w/w. Our price momentum indicator for CR remains at lower, meaning we expect prices to decline over the next 30 days.

Cold rolled lead times range from 4-9 weeks, averaging 7.0 weeks through our latest survey.

Galvanized coil

The SMU price range is $930–1,040/st, averaging $985/st FOB mill, east of the Rockies. The lower end of our range is down $10/st w/w, while the top end is down $20/st. Our overall average is down $15/st w/w. Our price momentum indicator for galvanized remains at lower, meaning we expect prices to decline over the next 30 days.

Galvanized .060” G90 benchmark: SMU price range is $1,027–1,137/st, averaging $1,082/st FOB mill, east of the Rockies.

Galvanized lead times range from 5-9 weeks, averaging 6.9 weeks through our latest survey.

Galvalume coil

The SMU price range is $960–1,020/st, averaging $990/st FOB mill, east of the Rockies. The lower end of our range is unchanged w/w, while the top end is down $40/st. Our overall average is down $20/st w/w. Our price momentum indicator for Galvalume remains at lower, meaning we expect prices to decline over the next 30 days.

Galvalume .0142” AZ50, grade 80 benchmark: SMU price range is $1,254–1,314/st, averaging $1,284/st FOB mill, east of the Rockies.

Galvalume lead times range from 5-9 weeks, averaging 6.8 weeks through our latest survey.

Plate

The SMU price range is $1,040–1,200/st, averaging $1,120/st FOB mill. Our range is unchanged w/w. Our price momentum indicator for plate remains at lower, meaning we expect prices to decline over the next 30 days.

Plate lead times range from 3-8 weeks, averaging 5.4 weeks through our latest survey.

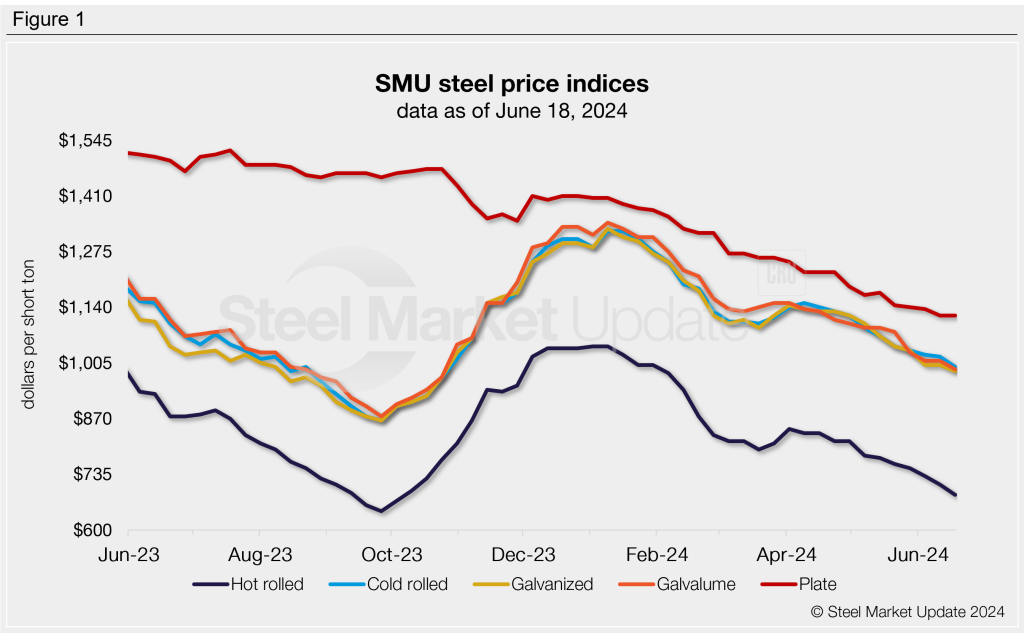

SMU note: Above is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is also available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@steelmarketupdate.com.

Brett Linton

Read more from Brett Linton