Market Data

June 17, 2024

May service center shipments and inventories report

Written by Estelle Tran

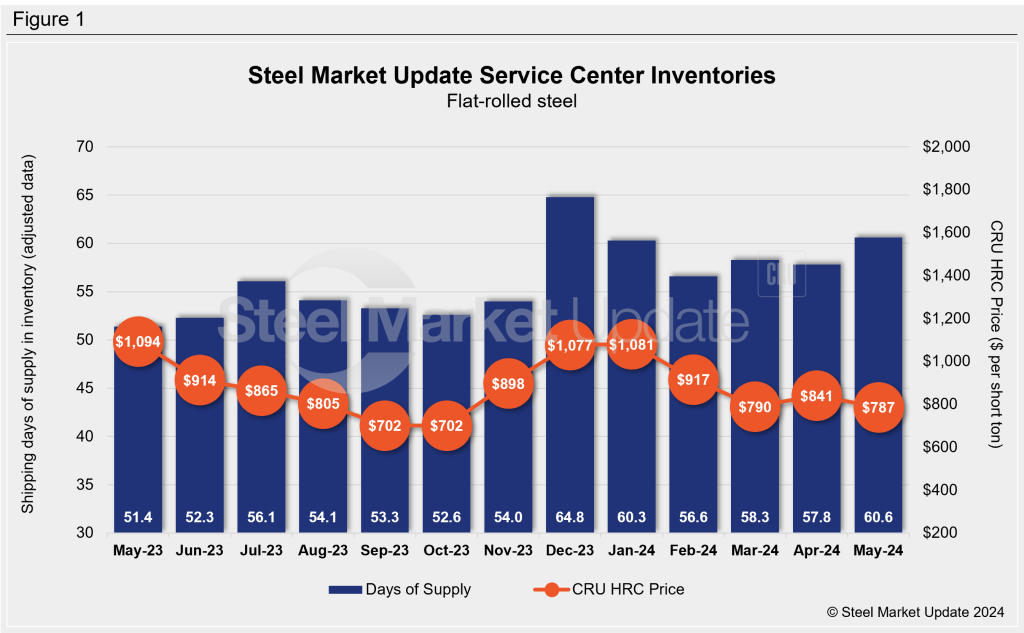

Flat Rolled = 60.6 Shipping days of supply

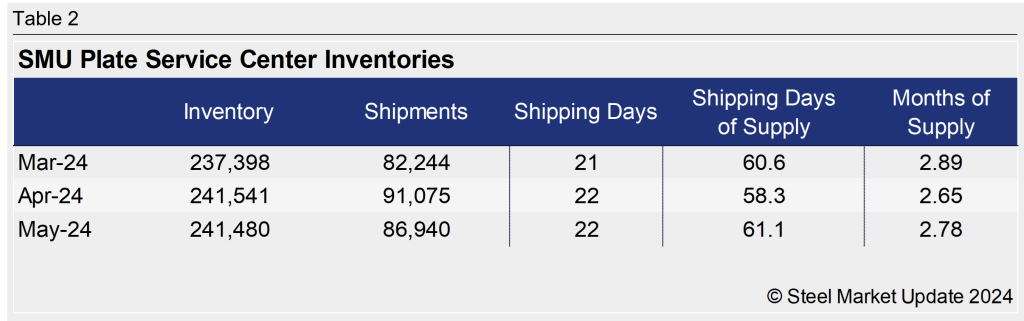

Plate = 61.1 Shipping days of supply

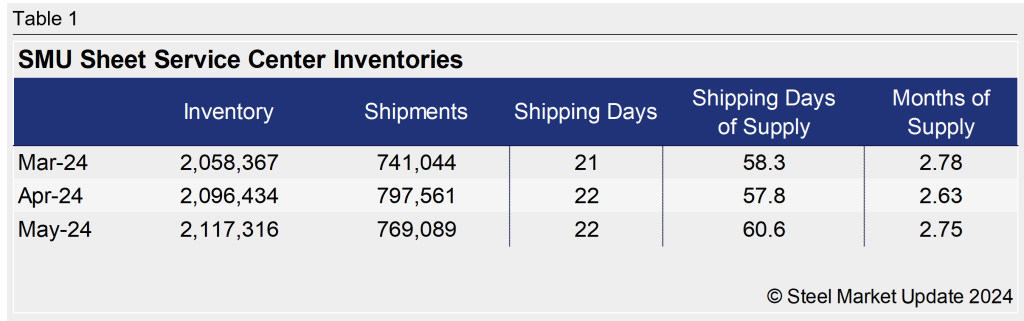

Flat Rolled

US service center flat-rolled steel supply rose in May with a drop-off in shipments. At the end of May, service centers carried 60.6 shipping days of supply on an adjusted basis, up from 57.8 shipping days of supply in April. Inventories in May represented 2.75 months of supply, up from 2.63 months in April.

May had 22 shipping days, the same as April. The daily flat-rolled steel shipping rate in May was lower year on year, and this was the sixth consecutive month of this trend. The latest SMU survey published June 5th reported that 68% of service centers said they were releasing less steel compared to one year ago, and 28% said they were releasing the same amount of steel.

Bearish outlooks for demand and pricing have caused service centers to pull back on new orders. Multiple market contacts said that weaker-than-expected demand in recent months caused their inventories to bloat. The latest SMU survey also reported that 65% of service centers were lowering spot prices to customers, compared to 61% two weeks ago, and 35% were keeping prices the same. Inventories could also be higher because of import arrivals.

In May, the amount of flat-rolled steel on order fell again, as service centers have been content to buy material only as needed. Material on order hit the lowest level seen since July 2022. The amount of flat-rolled steel on order dropped to 37.9 shipping days of supply in May, down from 38.8 in April. Material on order represented 62.5% of inventories, down from 67.2% in April.

Mill lead times seem to have stabilized. The June 5th SMU survey published hot-rolled coil lead times at 4.94 weeks, nearly flat compared to 4.92 weeks a month ago. Market contacts report that mills remain very eager to make deals, and service centers have not yet made the large, opportunistic deals that typically signal the bottom of the market.

Plate

US service centers also saw a growth in plate supply in May because of a decline in shipments. At the end of May, service centers carried 61.1 shipping days of plate supply on an adjusted basis, up from 58.3 shipping days in April. Plate inventories at service centers represented 2.78 months of supply in May, up from 2.65 months in April.

Similar to sheet, the daily shipping rate for plate in May was down month on month and year on year. Market contacts said that plate demand was disappointing in May, and the weaker-than-expected shipments caused May inventories to remain too high relative to demand.

Plate lead times in the June 5th SMU survey edged down to 5.42 weeks from 5.5 weeks the month before. Service center contacts said they felt no urgency to buy material, and mills were still aggressively offering material.

The amount of plate on order fell again in May, reflecting negative outlooks for plate demand and softer prices. Plate on order at the end of May represented 30.4 shipping days of supply, down from 33.7 shipping days in April. The amount of plate on order represented 49.8% of inventories, down from 57.7% in April.