Analysis

June 11, 2024

Steel exports grow in April to an eight-month high

Written by Brett Linton

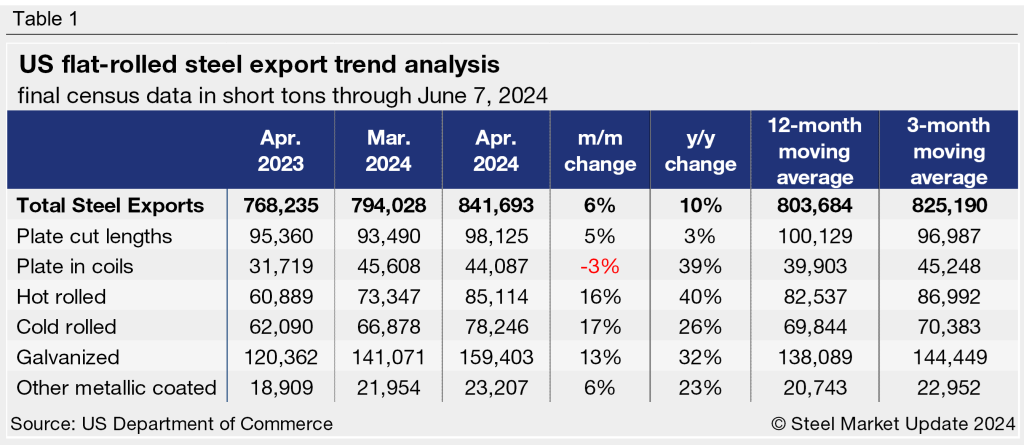

Total steel exports rebounded 6% in April, rising to 842,000 short tons (st), according to the latest US Department of Commerce data. This marks the highest monthly rate observed since August. Steel exports have trended higher since bottoming out in December. Notably, galvanized exports are now up to levels not seen in almost seven years.

Monthly averages

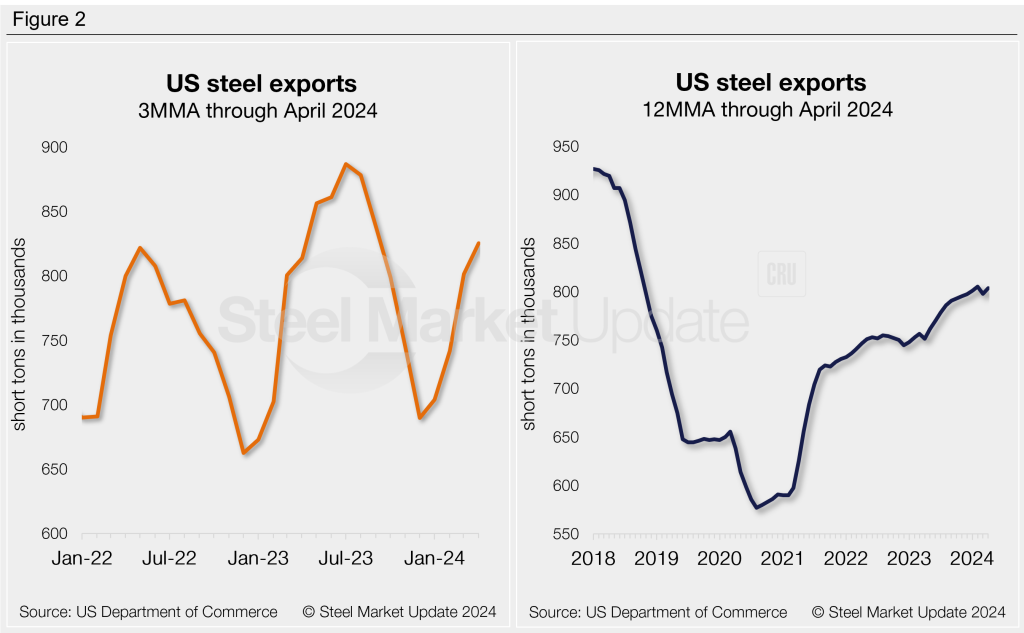

Looking at exports on a 3-month moving average (3MMA) basis can smooth out the monthly fluctuations. Shipments had trended downward throughout the second half of 2023, falling to an 11-month low in December. The 3MMA changed course as it entered 2024, rising each month since. The latest 3MMA through April is up to 825,000 st, an 3% increase from March and now at a seven-month high.

Exports can be annualized on a 12-month moving average (12MMA) basis to further dampen month-to-month variations and highlight historical trends. From this perspective, steel exports have steadily trended upwards since bottoming out in mid-2020. The 12MMA reached a five-and-a-half year high in February of 805,000 st. This measure remains historically strong through April at 804,000 st.

Exports by product

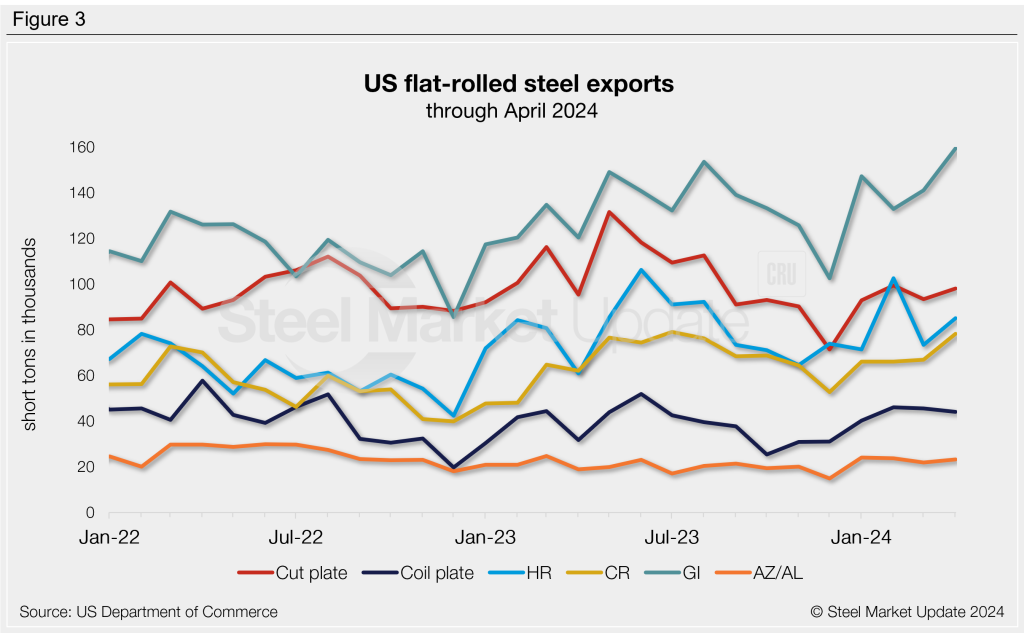

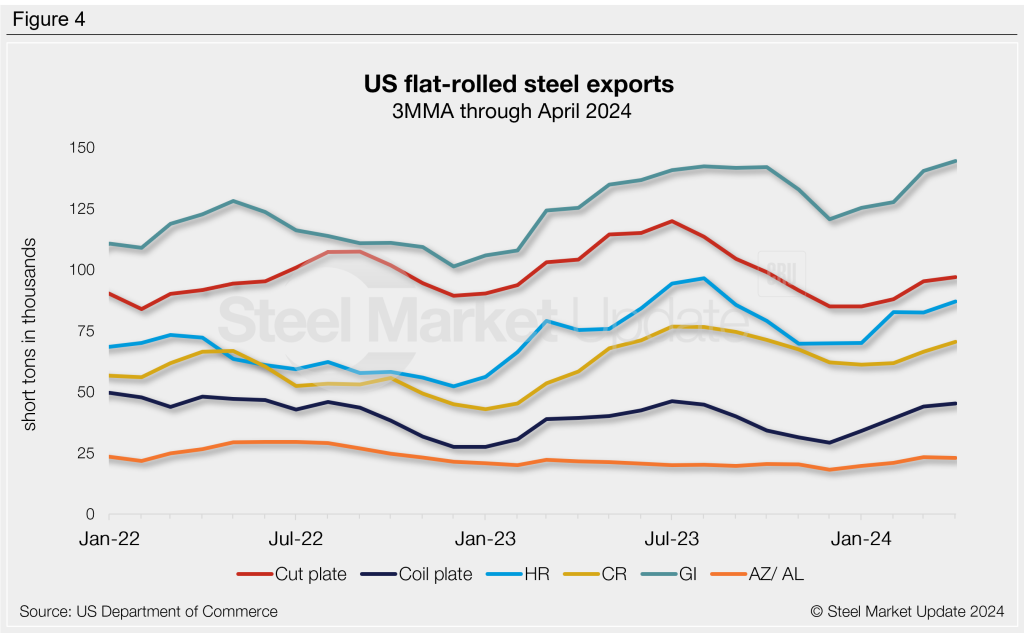

Exports of most major flat-rolled steel products saw gains month on month (m/m). The biggest monthly movers were cold-rolled (+17%), hot-rolled (+16%), and galvanized sheet (+13%). As previously mentioned, galvanized exports are now at the highest level seen since mid-2017. Cold rolled exports are up to a nine-month high.

April exports are 10% higher than levels one year prior. Significant year-on-year (y/y) increases were seen in exports of hot rolled, plate in coils, galvanized, cold rolled, and other metallic coated, with all up 23-40%.

On a 3MMA basis, all but one of the steel product exports we track saw increases from March to April (other metallic coated). Hot-rolled and cold-rolled sheet both increased 6% m/m, while the remaining products saw increases of 2-3%. 3MMA rates for all products other than other metallic coated are at multi-month highs through April.

Note that most steel exported from the US is destined for USMCA trading partners Canada and Mexico. Of all exports in April 52% went to Mexico, followed by 41% to Canada. The next largest recipients were the Dominican Republic and China at less than 1% each.