Prices

June 11, 2024

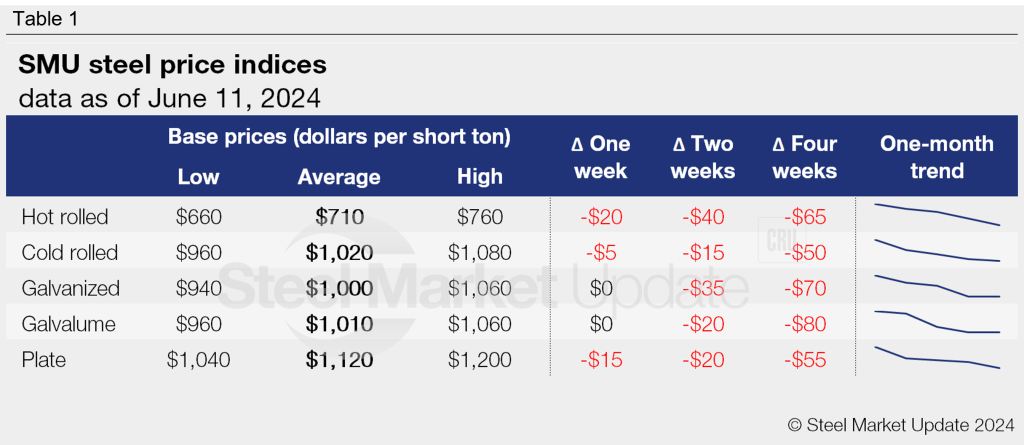

SMU price ranges: Sheet moves lower, demand struggling

Written by Brett Linton & David Schollaert

US sheet prices continued to tick down this week as supply seems to outweigh demand, and deep discounts are not only for large-ton buys.

SMU’s hot-rolled (HR) coil price now stands at $710 per short ton (st) on average, down $20/st from last week and down $135/st from a recent high of $845/st in early April.

The high end of our HR range is now $760/st, while the lower end dipped further, nearing the mid-$600s. Though larger deals could be leveraged in the low-to-mid $600s/st, deep discounts are not only reserved for large-ton buys, sources told SMU.

Nucor cut its published hot rolled spot price by $60/st to $720/st on Monday, but some mills were still trying to hold the line at $760/st.

Though not as sharp, a similar trend has been seen for tandem products and plate. Cold-rolled (CR) coil prices slipped $5/st week over week (w/w) to $1,020/st on average. Our plate prices were down $15/st to $1,120/st on average. Our galvanized and Galvalume base prices were unchanged w/w at $1,000/st and $1,010/st, respectively.

Several sources indicated that inventories, while not robust, are deep enough to service summer demand, an indication some believe will lead to deeper discounts in the near term. Thus, some expect at least one more round of large buys that could cover Q3 needs before prices start to stabilize and move up.

Our momentum indicators continue to point lower, with concerns about supply outstripping demand weighing on the market.

Hot-rolled coil

The SMU price range is $660-760/st, averaging $710/st FOB mill, east of the Rockies. Both the lower and upper ends of our range are down $20/st w/w. Our overall average is down $20/st w/w. Our price momentum indicator for HR remains at lower, meaning we expect prices to decline over the next 30 days.

Hot rolled lead times range from 3-7 weeks, averaging 4.9 weeks as of our June 5 market survey.

Cold-rolled coil

The SMU price range is $960–1,080/st, averaging $1,020/st FOB mill, east of the Rockies. The lower end of our range is down $10/st w/w, while the top end is unchanged. Our overall average is down $5/st w/w. Our price momentum indicator for CR remains at lower, meaning we expect prices to decline over the next 30 days.

Cold rolled lead times range from 4-9 weeks, averaging 7.0 weeks through our latest survey.

Galvanized coil

The SMU price range is $940–1,060/st, averaging $1,000/st FOB mill, east of the Rockies. Our range is unchanged w/w. Our price momentum indicator for galvanized remains at lower, meaning we expect prices to decline over the next 30 days.

Galvanized .060” G90 benchmark: SMU price range is $1,037–1,157/st, averaging $1,097/st FOB mill, east of the Rockies.

Galvanized lead times range from 5-9 weeks, averaging 6.9 weeks through our latest survey.

Galvalume coil

The SMU price range is $960–1,060/st, averaging $1,010/st FOB mill, east of the Rockies. Our range is unchanged w/w. Our price momentum indicator for Galvalume remains at lower, meaning we expect prices to decline over the next 30 days.

Galvalume .0142” AZ50, grade 80 benchmark: SMU price range is $1,254–1,354/st, averaging $1,304/st FOB mill, east of the Rockies.

Galvalume lead times range from 5-9 weeks, averaging 6.8 weeks through our latest survey.

Plate

The SMU price range is $1,040–1,200/st, averaging $1,120/st FOB mill. The lower end of our range is down $30/st w/w, while the top end is unchanged. Our overall average is down $15/st w/w. Our price momentum indicator for plate remains at lower, meaning we expect prices to decline over the next 30 days.

Plate lead times range from 3-8 weeks, averaging 5.4 weeks through our latest survey.

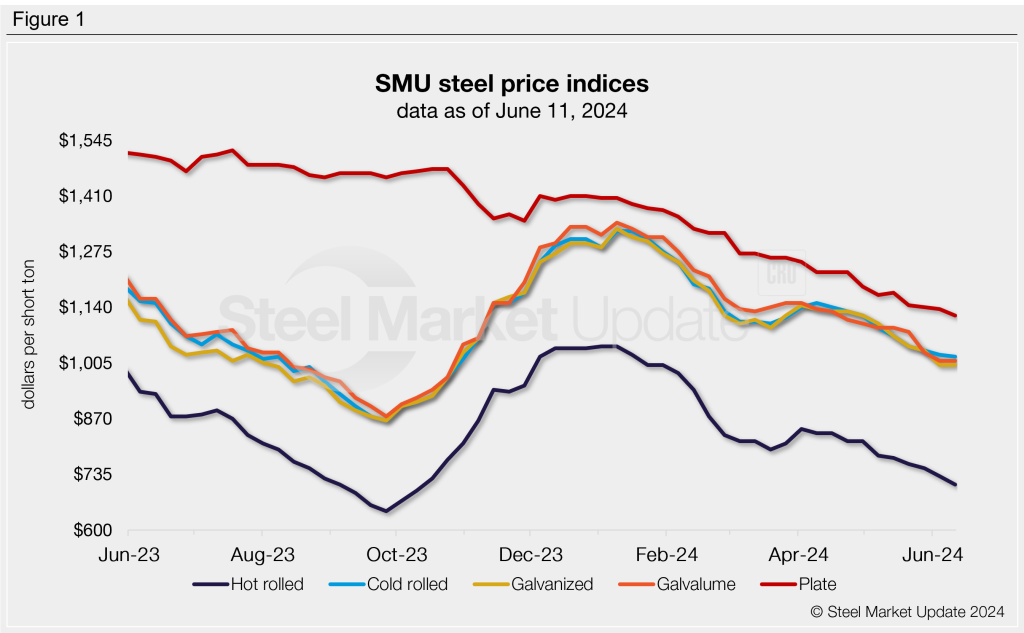

SMU note: Above is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is also available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@steelmarketupdate.com.

Brett Linton

Read more from Brett Linton