Prices

May 7, 2024

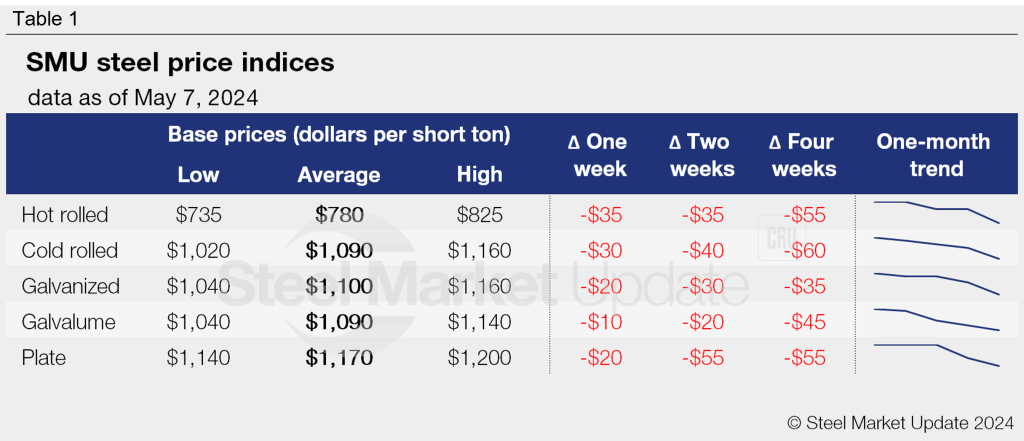

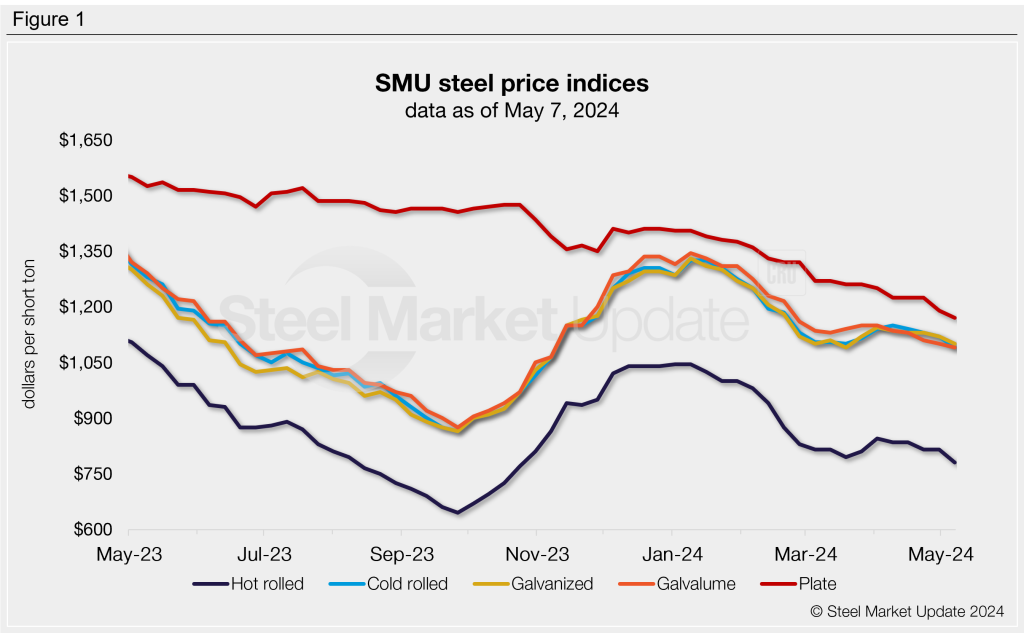

SMU price ranges: Sheet down broadly, HR $35/t lower

Written by Brett Linton & David Schollaert

Sheet prices fell across the board this week – largely in response to Nucor’s $65-per-short-ton price cut for hot-rolled (HR) coil on Monday morning.

SMU’s HR coil price is $780/st on average, a $35/st decrease week over week (w/w). Our average cold-rolled coil price is $1,090/st (down $30/st w/w). Our galvanized base price is $1,100/st on average (down $20/st w/w). And our Galvalume price now stands at $1,090/st on average (down $10/st w/w).

Nucor’s move surprised most people we contacted. Some said it could reflect a market that might be slowing down.

“I hope prices level off because continued declines will just make it more of a shock when they inevitably turn upwards,” said one service center executive. “But no signs from here of anything changing that trajectory.”

“They (US mills) blamed the importers. But that business had already been sold. And the next import offers will probably be $80 to $100 a ton below current domestic pricing – so the cycle continues,” said another service center executive.

Our plate price this week is $1,170/st on average – $20/st lower than last week. Prices continue to edge lower following Nucor’s plate price cut.

SMU has shifted its sheet price momentum indicators from neutral to lower. Our plate price momentum indicator remains lower.

Hot-rolled coil

The SMU price range is $735-825/st, with an average of $780/st FOB mill, east of the Rockies. The lower end of our range is $45/st lower w/w and the top end is $25/st lower. Our overall average is down $35/st compared to last week. Our price momentum indicator for HR has been adjusted to lower, meaning we expect prices to decline over the next 30 days.

Hot rolled lead times range from 3-7 weeks, averaging 5.0 weeks as of our April 24 market survey.

Cold-rolled coil

The SMU price range is $1,020–1,160/st, with an average of $1,090/st FOB mill, east of the Rockies. The lower end of our range is $60/st lower w/w, while the top end is unchanged. Our overall average is down $30/st from the previous week. Our price momentum indicator for CR has been adjusted to lower, meaning we expect prices to decline over the next 30 days.

Cold rolled lead times range from 5-10 weeks, averaging 7.5 weeks through our latest survey.

Galvanized coil

The SMU price range is $1,040–1,160/st, with an average of $1,100/st FOB mill, east of the Rockies. The lower end of our range is $40/st lower w/w, while the top of our range is unchanged. Our overall average is $20/st lower than last week. Our price momentum indicator for galvanized has been adjusted to lower, meaning we expect prices to decline over the next 30 days.

Galvanized .060” G90 benchmark: SMU price range is $1,137–1,257/st with an average of $1,197/st FOB mill, east of the Rockies.

Galvanized lead times range from 5-10 weeks, averaging 7.3 weeks through our latest survey.

Galvalume coil

The SMU price range is $1,040–1,140/st, with an average of $1,090/st FOB mill, east of the Rockies. The lower end of our range is $20/st lower w/w, while the top end was unchanged. Our overall average is down $10/st compared to the previous week. Our price momentum indicator for Galvalume has been adjusted to lower, meaning we expect prices to decline over the next 30 days.

Galvalume .0142” AZ50, grade 80 benchmark: SMU price range is $1,334–1,434/st with an average of $1,384/st FOB mill, east of the Rockies.

Galvalume lead times range from 7-9 weeks, averaging 7.6 weeks through our latest survey.

Plate

The SMU price range is $1,140–1,200/st, with an average of $1,170/st FOB mill. The lower end of our range is unchanged w/w, while the top end is $40/st lower. Our overall average is down $20/st from last week. Our price momentum indicator for plate remains at lower, meaning we expect prices to decline over the next 30 days.

Plate lead times range from 4-7 weeks, averaging 5.7 weeks through our latest survey.

Brett Linton

Read more from Brett Linton