Prices

May 2, 2024

HRC futures: Still waiting for clarity

Written by Daniel Doderer

“One thing we know for certain, however, is that when we write our next column, things will have certainly shaken loose.” – Daniel Doderer, April 4, 2024

Above is a good reminder that whenever someone is “certain” of anything, you should probably look at that line of thinking with a healthy dose of skepticism. So, what has transpired since our last column? To put it plainly, things have not “shaken loose,” and that is likely in large part due to the uncertainty around how the Nucor weekly price will impact near-term spot buying going forward. At this point it is far too early to have any certainty, but Monday will be an interesting stress test.

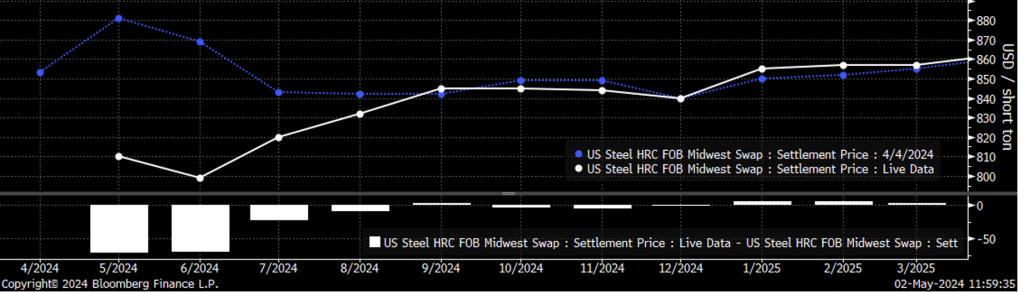

The chart below shows the forward curve from four weeks ago (blue) and today (white).

The overall takeaway, much like in the month prior, is that the front of the curve is where the action is. While it is not a new phenomenon, it should be noted with interest that the back of the curve continues to hold well above $800, which suggests that a new long-term expected average is being established.

The chart below is another way to think about the overall curve shape over time, but it takes a little more effort. The white line is the rolling second-month future, the blue line is the fifth-month future, and the orange line is the eighth-month future. Each can be thought of roughly as the front, middle, and back of the futures curve, respectively.

Here we see that the curve is once again back in contango (front of the curve trading below the back), which suggests there is a moderate surplus of material available in the market, resulting in a drag on spot prices. In this case, a major contributor is the fact that import arrivals are currently at their highest level in nearly two years. Another reason I pulled this chart in conjunction with the forward curve above, is to remind readers that any singular snapshot of the futures curve is a poor predictor of spot pricing due to reevaluations of risks. The market in Q4 will undoubtedly be impacted by something entirely unforeseen from today’s perspective. However, over that time supply-and-demand dynamics will cut through that noise and provide an underlying signal.

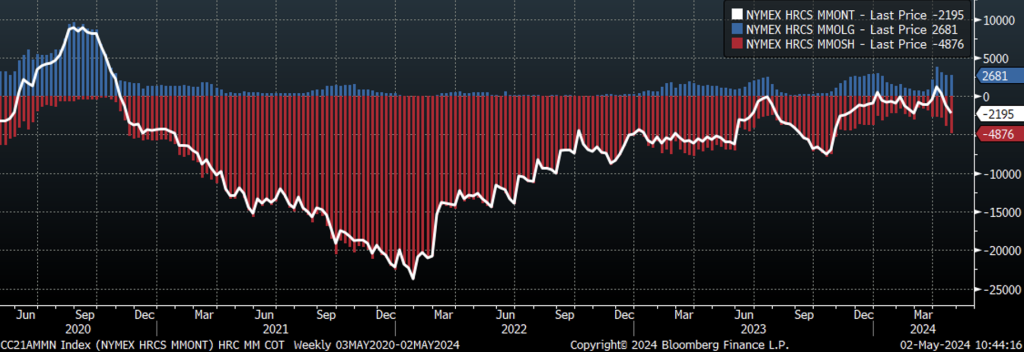

Finally, the chart below is managed money net contracts in white, with long (blue) and short (red) positioning broken out. The data is as of April 23, the most recent report, and we look at managed money because it is the best stand-in for speculative positioning – these are the firms that are furthest away from the physical market.

A few takeaways here:

- “Short” firms are positioned as short as they have been since the end of September last year.

- “Long” firms continue to hold some of the longest positions of the last three years. However, they peaked in the first week of April, and are starting to sell out of them.

- The overall net position is just shy of being as short as it was leading up to February/March when futures had their short-lived mini rally.

So, what is the difference between February and today? For one, seasonal maintenance is largely in the rearview mirror, but so is the expected lion-share of the surge in import arrivals. Another difference is that both BOF and EAF mill costs are lower now. Still another important factor to consider is that the demand outlook is improving, as the manufacturing sector recently started moving off low levels seen in 2023.

Disclaimer: The content of this article is for informational purposes only. The views in this article do not represent financial services or advice. Any opinion expressed by Flack Global Metals or Flack Metal Bank should not be treated as a specific inducement to make a particular investment or follow a particular strategy, but only as an expression of his opinion. Views and forecasts expressed are as of date indicated, are subject to change without notice, may not come to be and do not represent a recommendation or offer of any particular security, strategy or investment. Strategies mentioned may not be suitable for you. You must make an independent decision regarding investments or strategies mentioned in this article. It is recommended you consider your own particular circumstances and seek the advice from a financial professional before taking action in financial markets.