Market Data

April 11, 2024

SMU survey: Mills more willing to negotiate price on spot deals

Written by Ethan Bernard

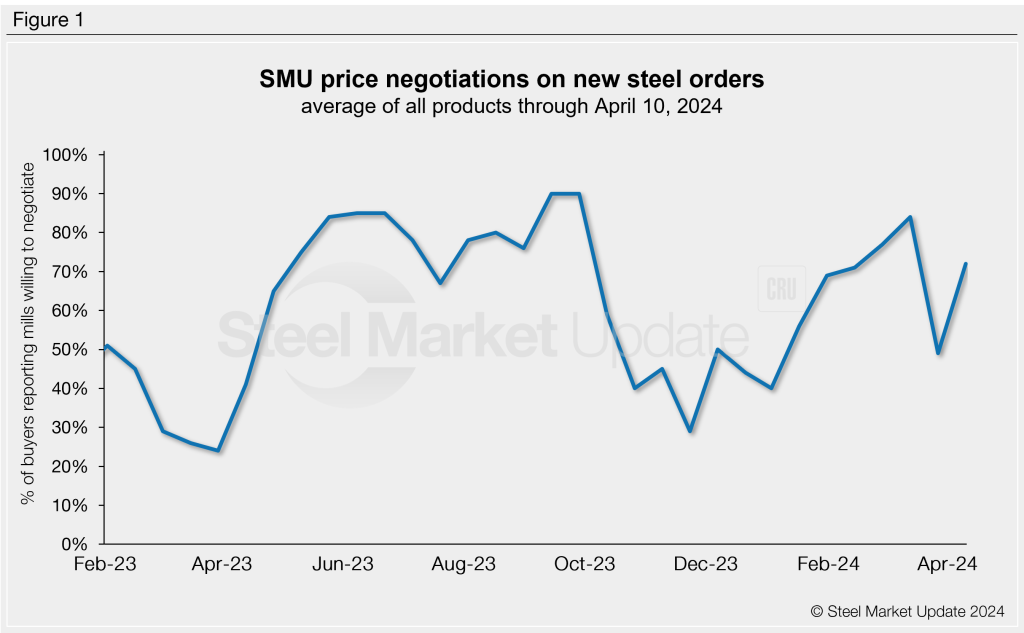

Steel buyers said mills are more willing to talk price on spot orders on all the products SMU covers, according to our most recent survey data.

Every other week, SMU polls steel buyers asking if domestic mills are willing to negotiate lower spot pricing on new orders.

This week, 72% of participants surveyed by SMU reported mills were willing to negotiate prices on new spot orders. This is a steep jump from 49% two weeks earlier. The 23-percentage-point increase is the largest bump we’ve seen between two surveys this year. This follows the largest drop we’ve seen so far in our previous survey, which was 35 percentage points. (Figure 1).

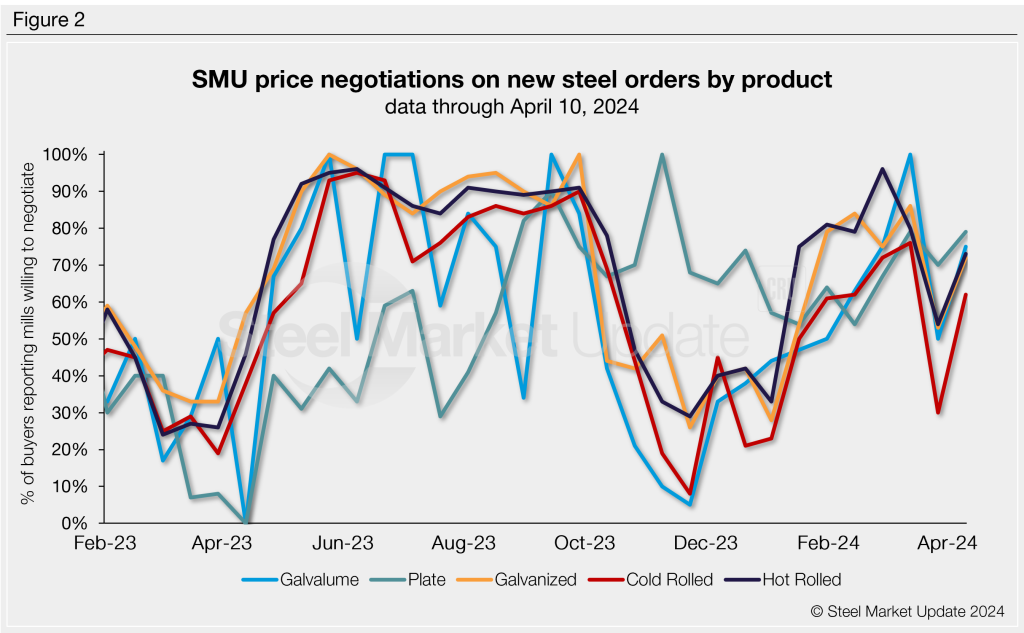

Figure 2 below shows negotiation rates by product. The rates for hot-rolled coil increased 19 percentage points to 73% this week; cold rolled stood at 62% (+30); galvanized was 72% (+19); Galvalume was 75% (+25); and plate stood at 79% (+9).

Here’s what some survey respondents had to say:

“It takes more than 1,000 tons to budge from $840 (on hot rolled), but they will move $20.”

“Believe you can get short lead times (on hot rolled) if needed with decent volume.”

“Depends on the starting point (for cold rolled).”

“Within reason. Not pushing for galv deals.”

“Giving us one week to place orders at old costs (on plate).”

Note: SMU surveys active steel buyers every two weeks to gauge their steel suppliers’ willingness to negotiate pricing. The results reflect current steel demand and changing spot pricing trends. SMU provides our members with a number of ways to interact with current and historical data. To see an interactive history of our steel mill negotiations data, visit our website.