Market Data

April 10, 2024

HRC vs. prime scrap spread widens in April

Written by Ethan Bernard

After narrowing for three months, the spread between hot-rolled coil (HRC) and prime scrap prices widened this month, according to SMU’s most recent pricing data.

SMU’s average HRC price slipped this week, while the average April price for busheling scrap was flat month over month.

Our average HRC price stood at $835 per short ton (st) as of April 9, down $10 from a week earlier.

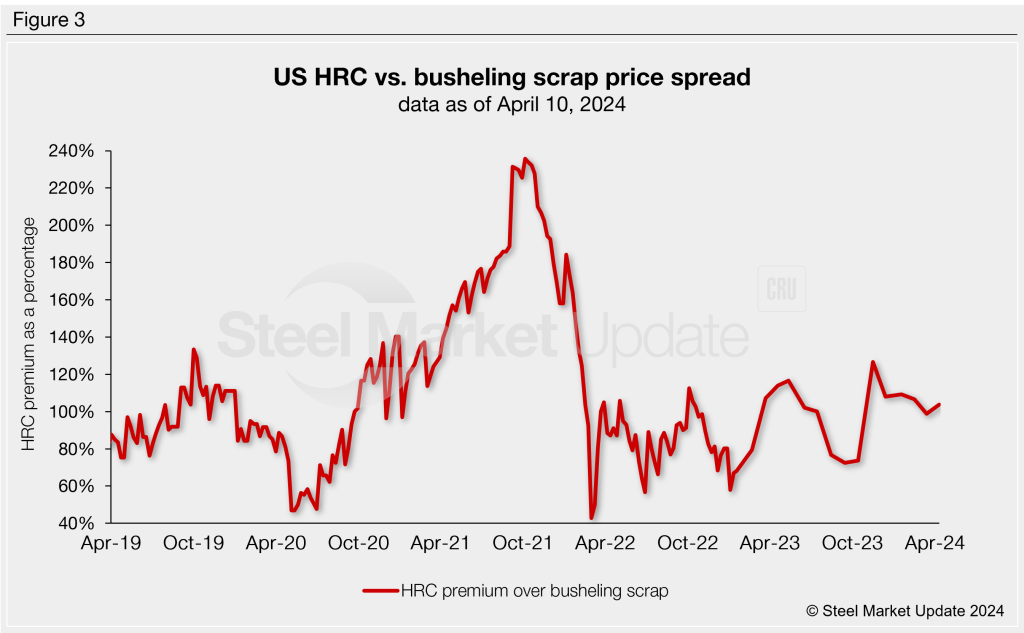

Meanwhile, busheling tags remained level at $410 per gross ton in April. Figure 1 shows price histories for each product.

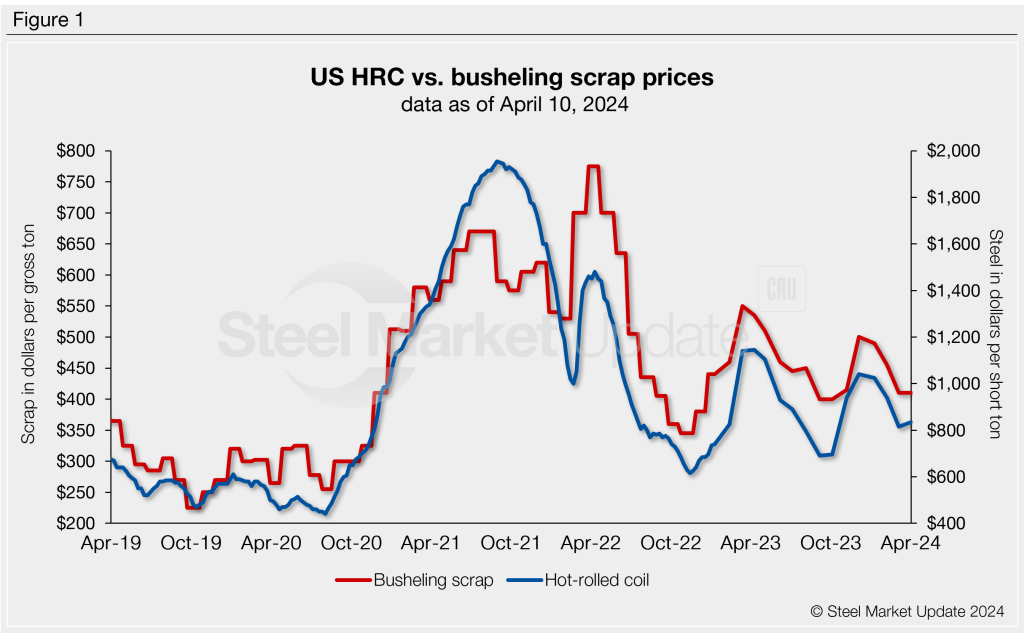

After converting scrap prices to dollars per short ton for an equal comparison, the differential between HRC and busheling scrap prices is $469/st as of April 10, up $20 from a month earlier (Figure 2). This is the first time the spread has widened since December.

By the way, did you know SMU’s Interactive Pricing Tool can show steel and scrap prices in dollars per short ton, dollars per metric ton, and dollars per gross ton?

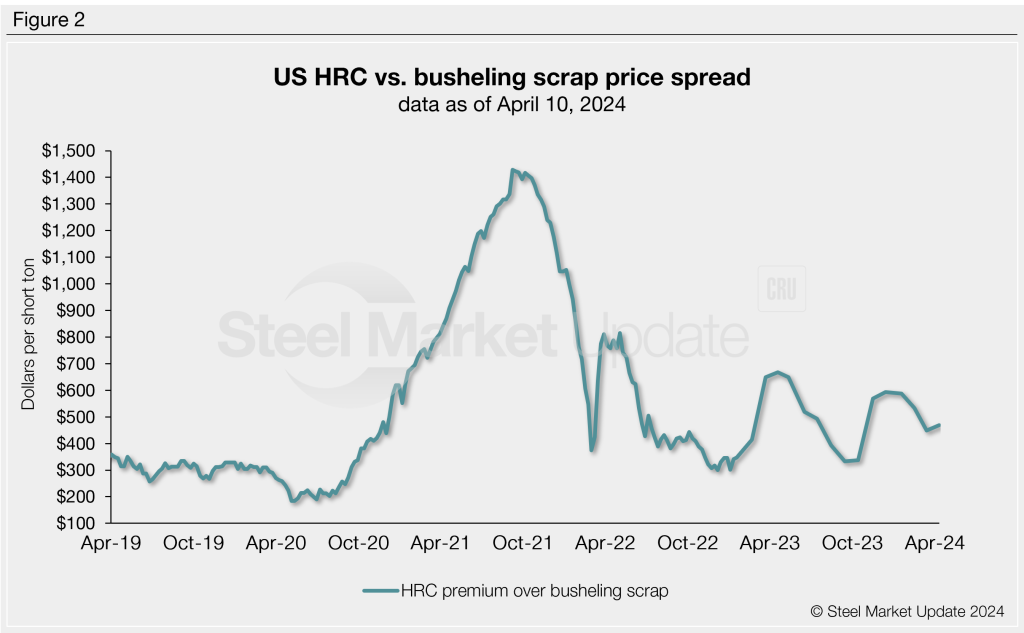

Figure 3 explores this relationship differently: We have graphed HRC’s premium over busheling scrap as a percentage. HRC prices now carry a 104% premium over prime scrap, up from 99% a month ago.