Analysis

April 2, 2024

Final thoughts

Written by Michael Cowden

You might have noticed that SMU has been publishing more articles about scrap in recent months. That was no accident.

In fact, we’ve found enough of an audience that CRU, our parent company, has decided to launch a new publication – Recycled Metals Update, or RMU. It covers both ferrous and nonferrous scrap.

RMU’s website is here. You can go there now and request a 30-day free trial. It’s that simple.

Today marks the official launch of RMU, which we hope will grow to be a hub for the recycled metals community in the way that SMU has become for the steel community.

Expert staff

You can expect to see columns from scrap industry veterans like Phil Hoffman and Steve Miller. Both predicted a potential bottom to the domestic scrap market this month.

Hoffman based his call on observations of trends in Asian scrap markets and the West Coast export market. Miller came to a similar conclusion based on domestic scrap market trends and a firming of Brazilian pig iron prices.

Speaking of Brazilian pig iron, Miller raised good questions about whether there will be enough of it going forward. It’s unclear, for example, whether Ukraine will continue to ship pig iron to the US given higher costs stemming from the war with Russia.

RMU has also hired veteran Pittsburgh Post-Gazette business journalist Stephanie Ritenbaugh. She has experience covering natural gas markets for Gas Business Briefing as well. The RMU team is led by Gabrielle Vagnini, who has deep expertise on the nonferrous side. She has worked as chief commercial officer of Metro International and as a trader of LME metal at Triland, a Mitsubishi Company. Details on the RMU team are here.

RMU survey

Many of you are familiar with the surveys that SMU regularly sends out to the market. It’s how we keep tabs not only on prices and lead times but also on service center inventories and market sentiment.

RMU will be doing something similar. And SMU members will receive a complimentary sample of the latest RMU survey in their inbox on Friday.

In the meantime, I want to draw your attention to a few key items from the latest RMU survey, which was released in late March.

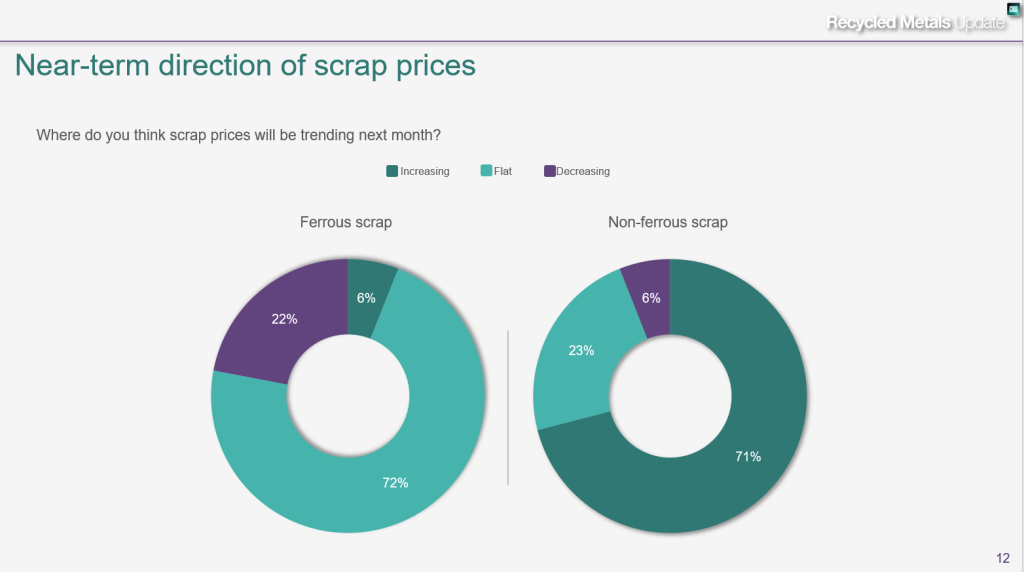

For starters, most people RMU surveyed predicted that ferrous scrap prices would be stable in April. That’s a big change from the steep declines recorded in March:

Sentiment around nonferrous scrap was even more bullish, with more than 70% expecting gains in April.

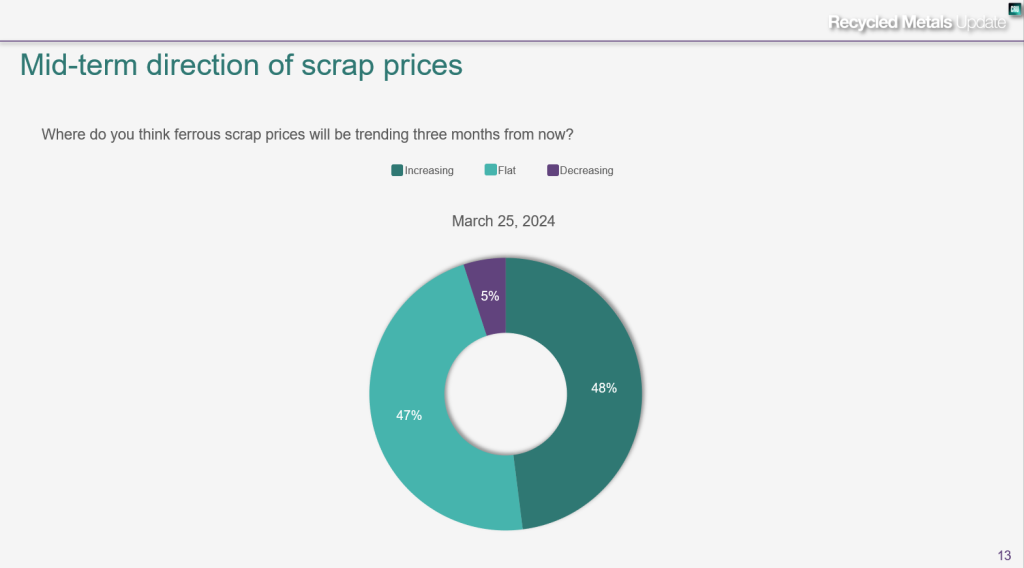

Note, too, that RMU asks people not only where they think prime scrap prices will go directionally but also specifically by gross tons:

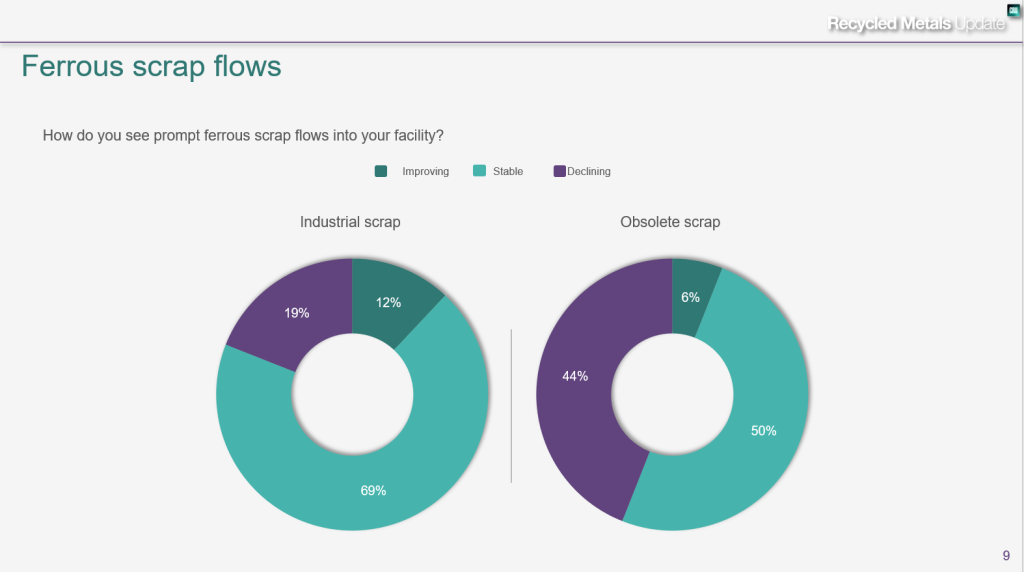

As for obsoletes, with prices falling in March, 44% of survey participants reported decreasing flows of obsolete scrap into their facilities:

Recall that obsoletes are more price sensitive than prime. When prices are low, less tends to be collected. And when prices are high, more tends to be scooped up. Prime is less price sensitive. It’s availability depends less on price and more on manufacturing activities such as stamping.

So could we see more upside for obsoletes in April?

The broadly constructive view we’re seeing for April scrap settlements extends into early summer.

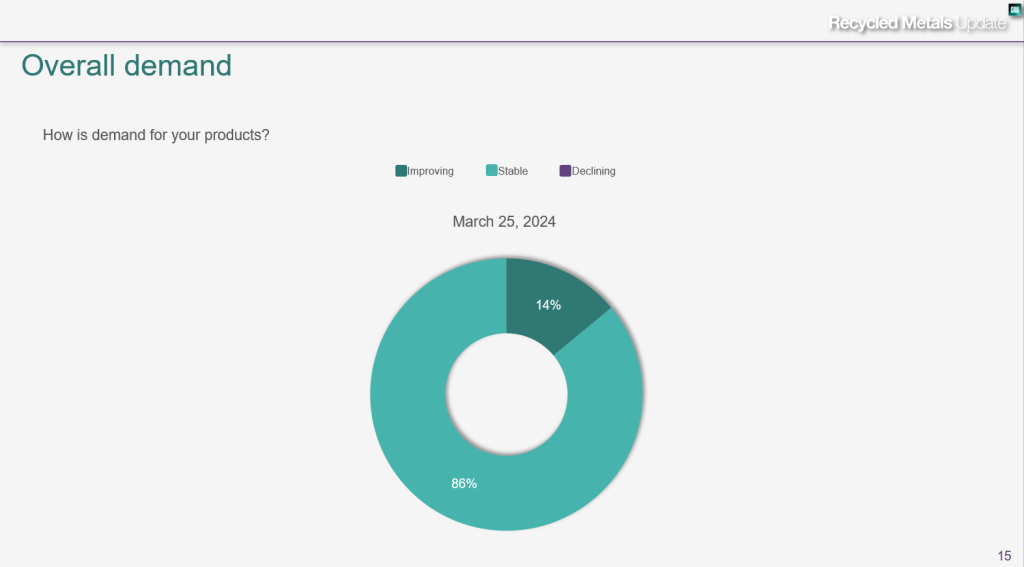

That probably dovetails with all survey respondents reporting that scrap demand is stable or improving. (SMU has recorded similar results in its surveys when it comes to demand for flat-rolled steel.)

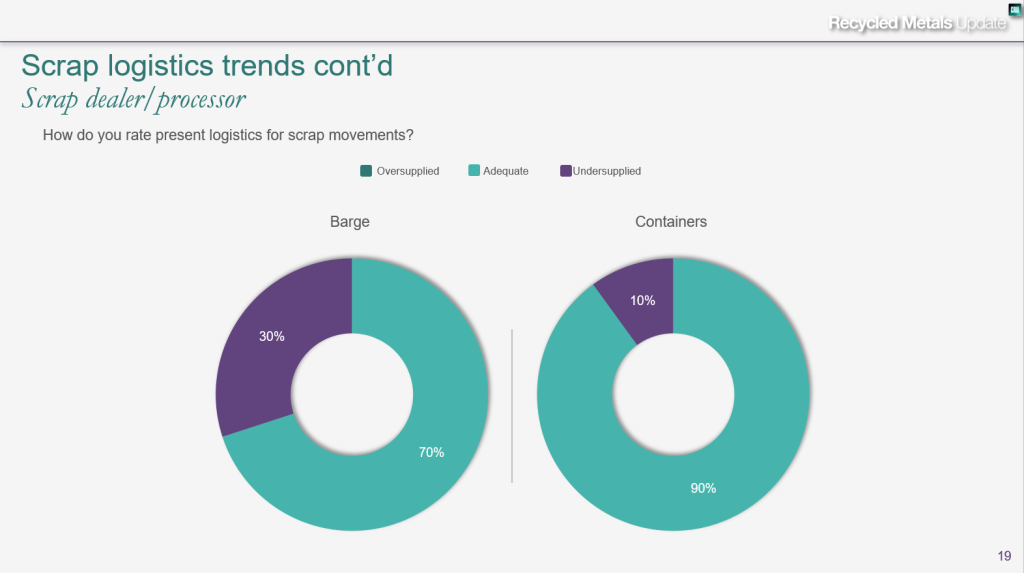

Another thing I want to flag is RMU’s focus on logistics, something that SMU does not at present track in its surveys:

Container availability hasn’t been an issue for most RMU survey respondents. But some are still having trouble finding barges.

The half dozen charts above are from a 35-slide deck of recycled metals market intelligence that you can expect from RMU on a regular basis.

If you’d like to learn more about RMU, again, go to the RMU website and request a free, 30-day trial. If you like what you see, contact my colleague Luis Corona (luis.corona@crugroup.com) to subscribe.

SMU Community Chat

Because of a scheduling conflict, SMU’s planned Community Chat webinar with Mercury Resources CEO Anton Posner has been postponed. We’ve moved the webinar from Wednesday, April 3, at 11 a.m. ET to Wednesday, April 10, at the same time.

If you can’t make the new time, don’t worry – a recording will be available to SMU members. If you haven’t already registered, you can still do so here.

Thank you for your continued support of SMU!