Market Data

March 28, 2024

SMU survey: Steel Buyers' Sentiment slips to 16-month low

Written by Brett Linton

SMU’s Current Steel Buyers’ Sentiment Index fell again this week and now stands at its lowest reading recorded since October 2022. Our Future Sentiment Index also declined and is in line with levels seen at the start of the year. Though down, both indices continue to indicate optimism among steel buyers.

Every other week, we poll steel buyers about their companies’ chances of success in the current market as well as three to six months down the road. We use this information to calculate our Current Steel Buyers’ Sentiment Index and our Future Sentiment Index. (We have historical data dating to 2008. You can find that here.)

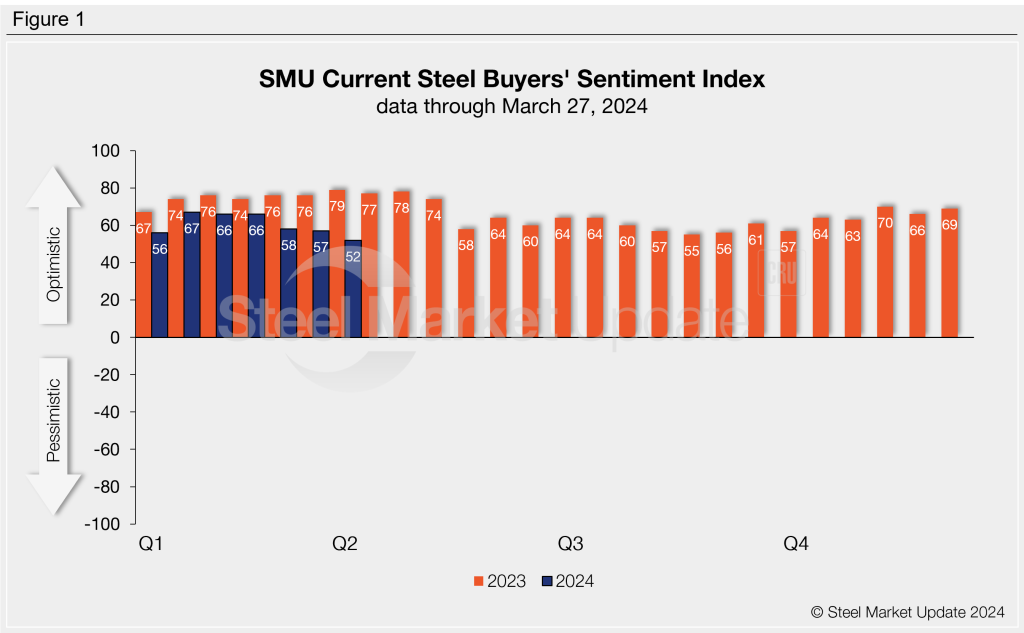

SMU’s Current Buyers’ Sentiment Index measured +52 this week, down five points from two weeks earlier (Figure 1). The index reached a high of +70 last November and had predominantly stayed in the 60s through mid-February.

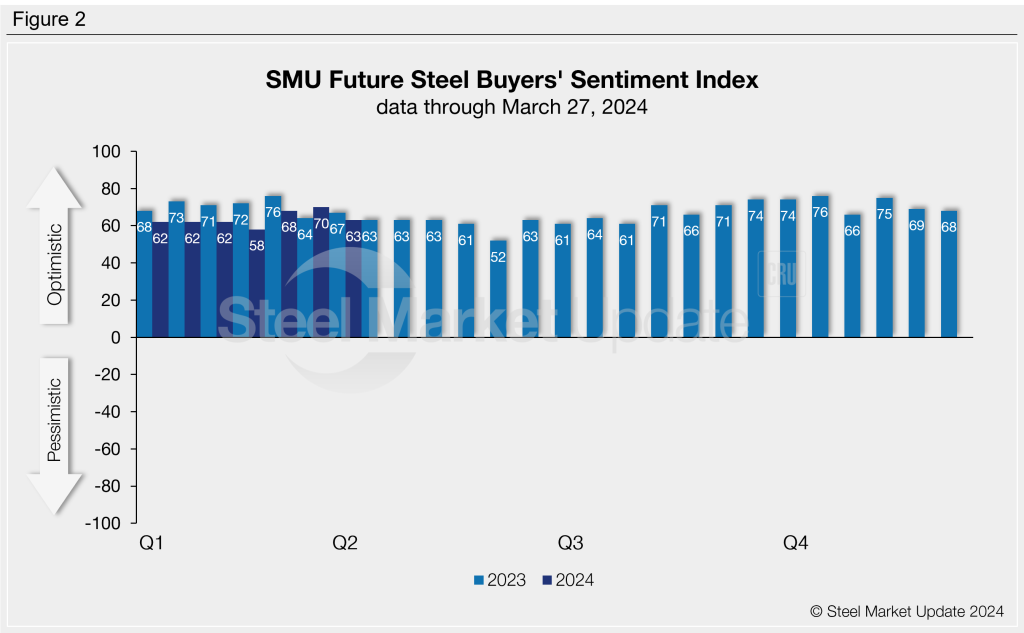

SMU’s Future Buyers’ Sentiment Index measures buyers’ feelings about business conditions three to six months in the future. The index fell seven points this week to +63, down from the three-month high seen two weeks prior (Figure 2). The last time we saw a survey-to-survey decline this large was in November.

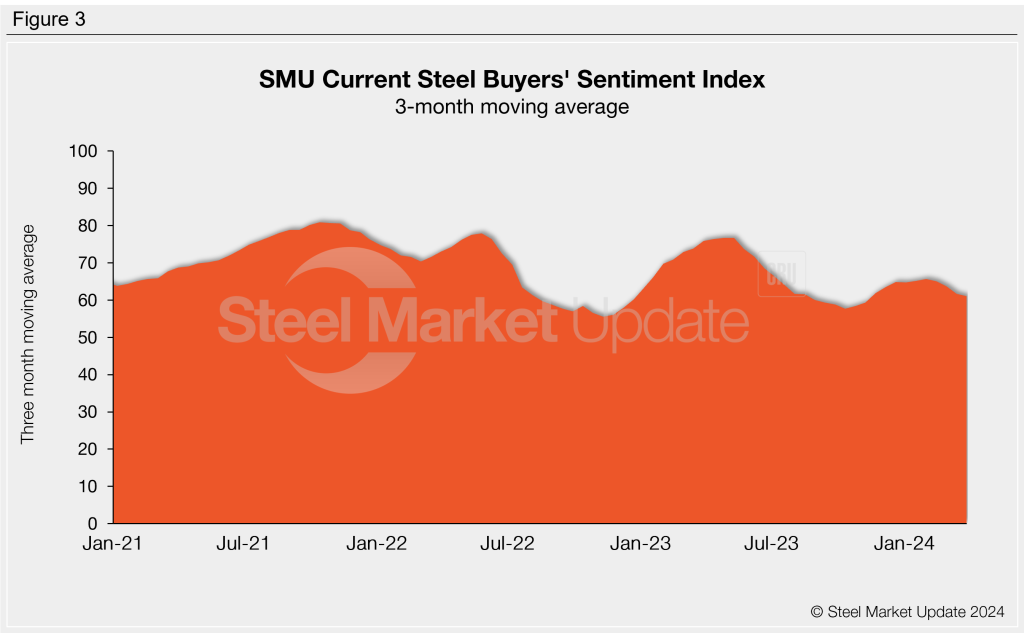

Measured as a three-month moving average, the Current Sentiment 3MMA declined to a four-month low of +61.00 (Figure 3). The highest 3MMA of this year was +65.67 in late January.

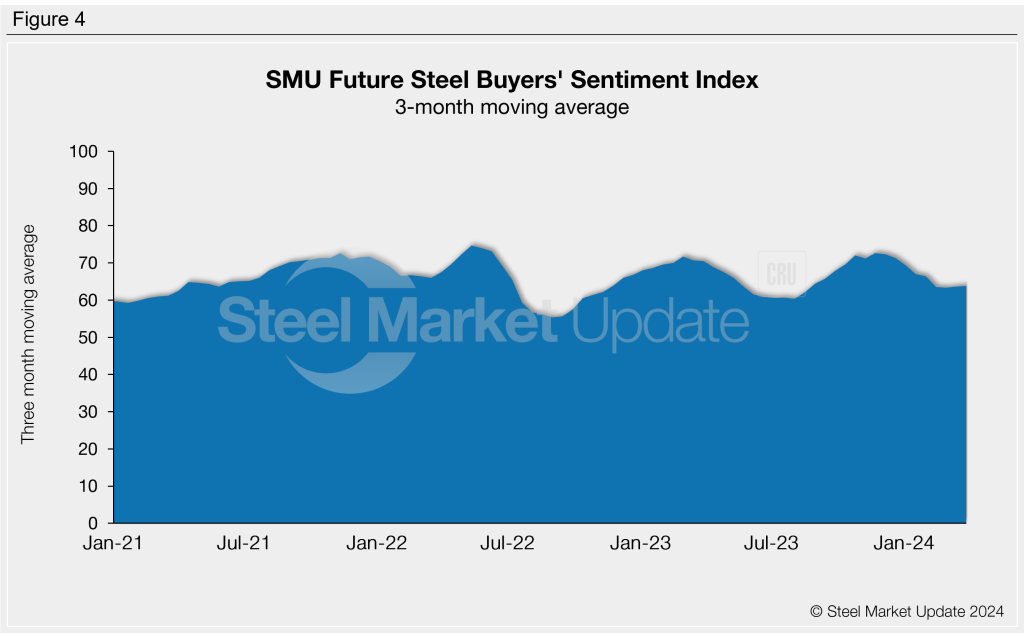

This week’s Future Sentiment 3MMA increased slightly to an eight-week high of +63.83 (Figure 4).

What SMU respondents had to say:

“Contract and spot buying is better than previous months.”

“Bookings are still down due to caution from buyers. … It might improve next month.”

“Demand has picked up, and we are working to support that.”

“Depends on demand.”

“Segments of our business have shown near-term weakness. We expect this to persist but steadily improve through H1.”

About the SMU Steel Buyers’ Sentiment Index

The SMU Steel Buyers Sentiment Index measures the attitude of buyers and sellers of flat-rolled steel products in North America. It is a proprietary product developed by Steel Market Update for the North American steel industry. Tracking steel buyers’ sentiment is helpful in predicting their future behavior. A link to our methodology is here. If you would like to participate in our survey, please contact us at info@steelmarketupdate.com.