Sheet

March 22, 2024

CRU outlook: Steel prices likely to hit the bottom soon

Written by Juliana Guarana

APAC steel prices are likely to bottom out in the near term as seasonally higher demand coupled with production cuts may support prices. In the EU, prices are likely to remain under pressure, while fresh price increases are expected in the US.

APAC steel prices are likely to bottom out in the near term

In China, delayed post-holiday restocking is likely to provide some support to steel prices in the near term. Moreover, some mills have already started production cuts in the face of recent losses, which will further aid prices.

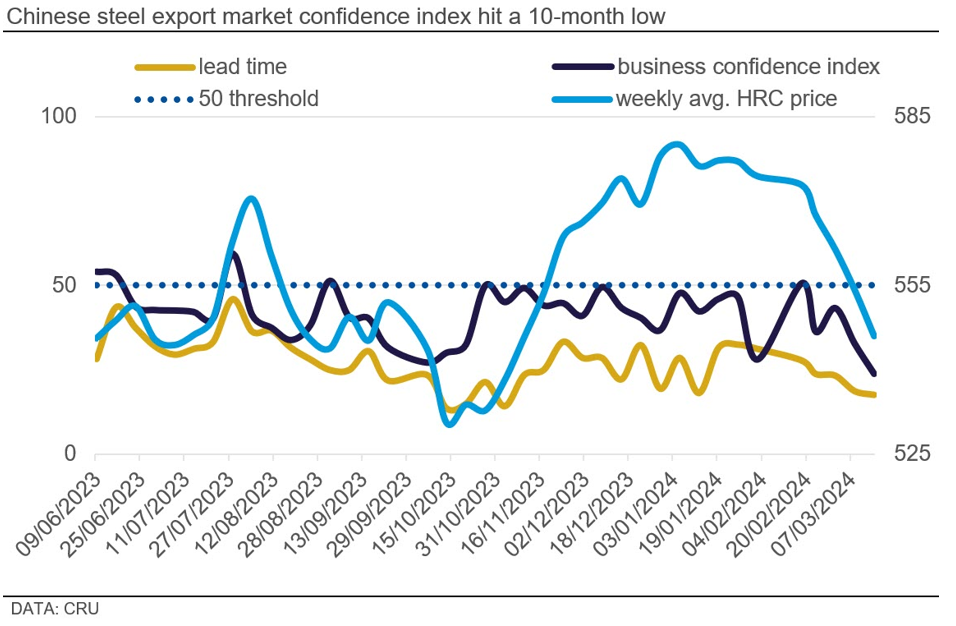

However, steel inventory levels in China are sufficient to prevent any large price rises, while market confidence is expected to remain depressed, which might deter buyers from purchasing large volumes in the short term. CRU’s China Steel Export Market Confidence Index remained stubbornly under the key threshold of 50, hitting a 10-month low for the week ending on March 15 (see chart below).

Price trends in the rest of the APAC region are likely to mirror those of China. In Japan, current low sheet export price levels will not be sustainable due to high production costs, and in case of no improvement in demand, steelmakers are likely to reduce output. Likewise, Indian steelmakers might implement production curtailments to support prices. However, the upside potential for steel prices in India is limited due to high inventory levels and weak underlying demand ahead of upcoming government elections. In parallel, Indian export sales are expected to increase as mills are planning to get more aggressive with offer prices.

Prices to weaken further in the EU and rise in the US

In the EU, the downtrend is likely to continue for steel prices as inventories are still at satisfactory levels and domestic demand is unlikely to pick up in the near term. However, if prices bottom out in Asia and in the US, European buyers might abandon their current wait-and-see approach and re-enter the market, posing an upside risk to steel prices in the region.

Meanwhile, Turkish steel prices are expected to remain rangebound in the near term as there is not much room for further declines, given that costs remain relatively stable and there is an upward potential for scrap prices after the Eid holidays in mid-April. Domestic steel demand is also expected to recover after the end of Ramadan, providing necessary support to prices.

In Russia, sheet export prices will likely remain under downward pressure due to weak demand in key export markets. Competitively priced Chinese exports have reduced the attractiveness of Russian steel in the seaborne market, and therefore, Russian producers will continue to offer more material in the relatively profitable domestic market.

In the US, the most recent sheet price increases announced by major mills are likely to halt further price cuts, and additional price hikes are expected in the near term. The success of these increases will be determined by the health of mills’ order books in the coming weeks. Moreover, as lower-priced imports acquired a few months ago are now arriving, and service center inventory levels are still high, an increase in import activity in Q2’24 is not expected, except for CR coils, which are currently tight in supply.

This article was first published by CRU. Learn more about CRU’s services at www.crugroup.com/analysis.