Market Data

March 15, 2024

February service center shipments and inventories report

Written by Estelle Tran

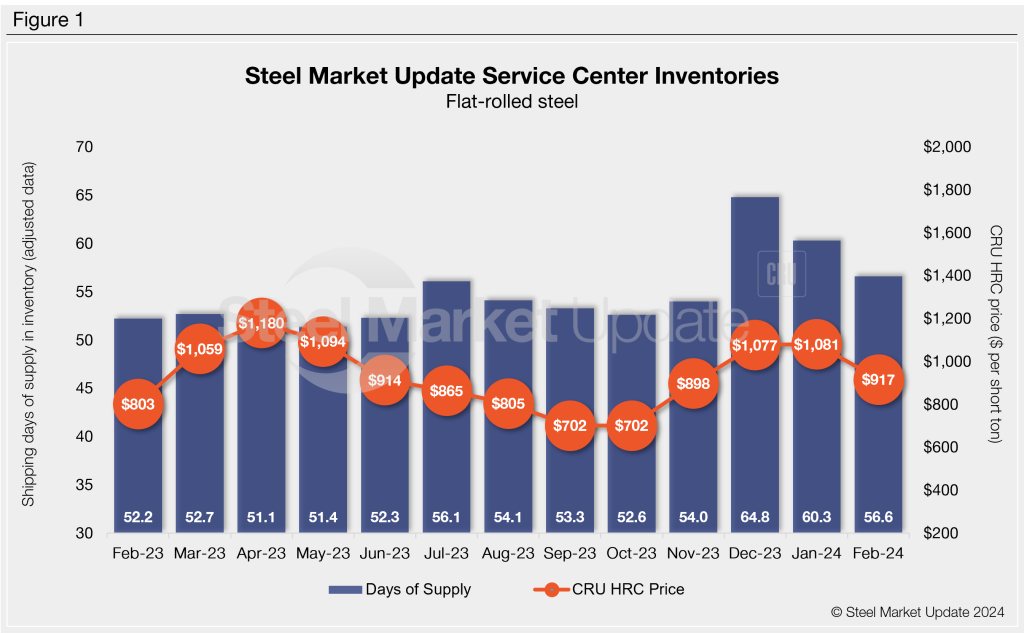

Flat Rolled = 56.6 Shipping Days of Supply

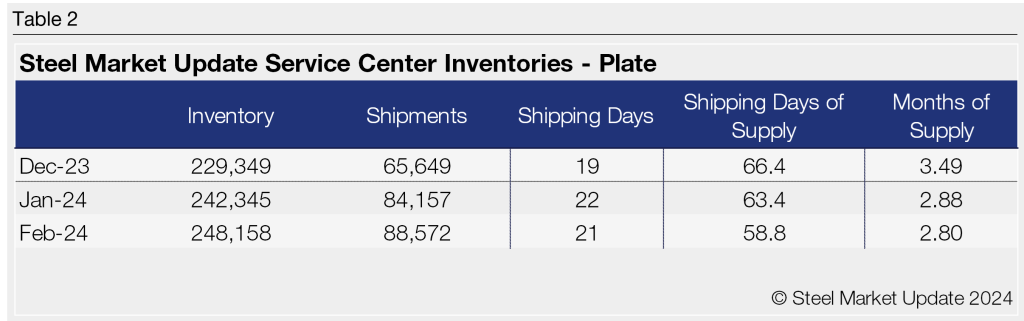

Plate = 58.8 Shipping Days of Supply

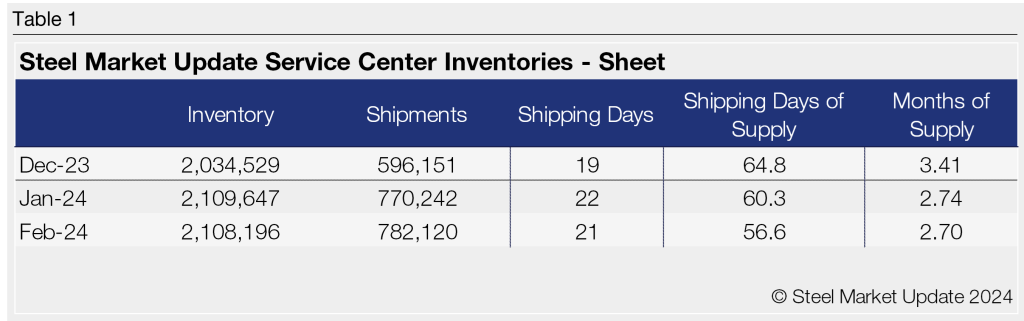

Flat Rolled

After weaker-than-expected shipments in January, US service center shipments of flat-rolled steel picked up in February, which caused supply to decrease. At the end of February, service centers carried 56.6 shipping days of flat-rolled steel supply on an adjusted basis. This is down from 60.3 shipping days of supply at the end of January but up year on year (y/y) from 52.2 shipping days of supply in February 2023. Inventories represented 2.7 months of supply at the end of February, down from 2.74 months in January.

February had 21 shipping days, compared to January’s 22 shipping days. The daily shipping rate in February was flat y/y, while January’s daily shipping rate was down 8% y/y. Shipments rose to more normal levels in February, after a slow January, though market contacts have said that demand has been steady but not great. High inventories at the start of the year, when demand was weak, drove significant weekly price declines in February.

For the first time since October, shipments exceeded intake at service centers – but only slightly. Inventories were still fairly heavy in February relative to demand. While lead times were short in February, we expect to see lead times extend in March with heavier bookings and spring outages.

The latest SMU survey published Feb. 28 showed hot-rolled coil (HRC) lead times contracted to 4.96 weeks, compared to 5.16 weeks a month earlier.

The amount of flat-rolled steel on order declined to the lowest level seen since August 2023. Service centers had fewer shipping days of supply on order at the end of February vs. January. Material on order was also down on a percentage basis of inventories in February vs. January.

We believe the amount of material on order will rise in March with the large-volume deals placed ahead of the price increase announcements made in early March, and with additional ordering on contracts at pre-price increase levels.

Plate

US service center plate supply declined again month on month (m/m) in February, though inventories remain at elevated levels. At the end of February, service centers carried 58.8 shipping days of plate supply, down from 63.4 shipping days in January. In terms of months of supply, service centers carried 2.8 months of plate supply in February, down from 2.88 months in January. Plate supply in February was much higher than February 2023, when service centers carried 45 shipping days of supply or 2.25 months of supply.

In the last two months, service center intake for plate significantly outpaced shipments, and this has contributed to persistently high inventory levels. Market contacts commented that demand was slow to steady with some project delays, especially for government-funded projects. Demand in the first two months of the year has been weaker than expected, and supply remains readily available from mills and service centers.

Nucor announced a $90-per-ton price decrease at the end of February, though all the plate mills had been competing aggressively on price, according to market contacts. With prices declining steadily and demand subdued, plate buyers feel no urgency to place orders, and service centers have been cutting resale prices to compete.

The amount of plate on order decreased m/m, with fewer shipping days of supply in February vs. January. The amount of material on order represented on a percentage basis of inventories was also down in February vs. January.

Lead times have also shortened for plate mills. At the end of February, the SMU survey recorded plate mill lead times at 5.38 weeks, down from 5.8 a month earlier.