CRU

March 15, 2024

CRU: World sheet markets face downward demand-side pressure

Written by Ryan McKinley

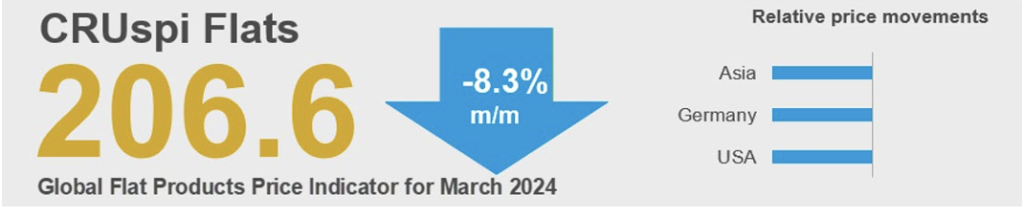

The CRUspi fell by 8.3% month over month (m/m) in March to 206.6 as weaker-than-expected demand weighed on markets around the world. Price falls were notable across all regions, with elevated inventory levels pushing prices in the US and Europe, and disappointing stimulus measures from the Chinese government weighing on those in Asia.

Weakening demand was the story for sheet markets across the globe this month. US price falls were again large m/m as end-use demand surprised to the downside, inventory levels remained elevated, and new capacity fought for market share. Early-year price rises in Europe also came to a halt, and buyers pulled back from the market on weakness in many key end-use sectors and competitive import offer levels. These same market dynamics were at play across Asia, with Chinese stimulus measures less supportive than hoped and production costs falling.

North American prices again faced pressure due to an ongoing imbalance between supply and demand. Mill lead times are still relatively short, service center inventories plentiful, and newly installed capacity is finally up and fighting for market share. What is more, import price levels remain quite competitive relative to the current domestic market. Compounding this is a slowdown in demand, with market participants growing increasingly bearish on market direction in the coming months even after recently announced mill price increases.

European sheet demand is also low. Stockholders have restored inventories back to sufficient levels, and key end-use sectors activity remains subdued. Steel production capacity that has restarted in recent months is still up, although we do not expect that there will be additional restarts any time soon. Meanwhile, in Turkey, inflation, currency devaluation, and stricter monetary policy are constraining demand and, in addition to attractive import levels, are weighing on prices.

Post-holiday demand in Asia has not returned to the market as strong as some expected. The Two Sessions meeting in China, which typically drives prices higher because of newly announced stimulus measures, did not live up to expectations this year—particularly for the construction sector. Prices in Southeast Asia also fell this month in the lead up to Ramadan, which reduced buying activity and because of falling costs. Japanese prices fell for the first time this year as well on weakening export demand by key export destinations, except by the US.

This article was first published by CRU. Learn more about CRU’s services at www.crugroup.com/analysis.