Plate

March 5, 2024

SMU price ranges: Can outages offset sheet and plate declines?

Written by David Schollaert & Michael Cowden

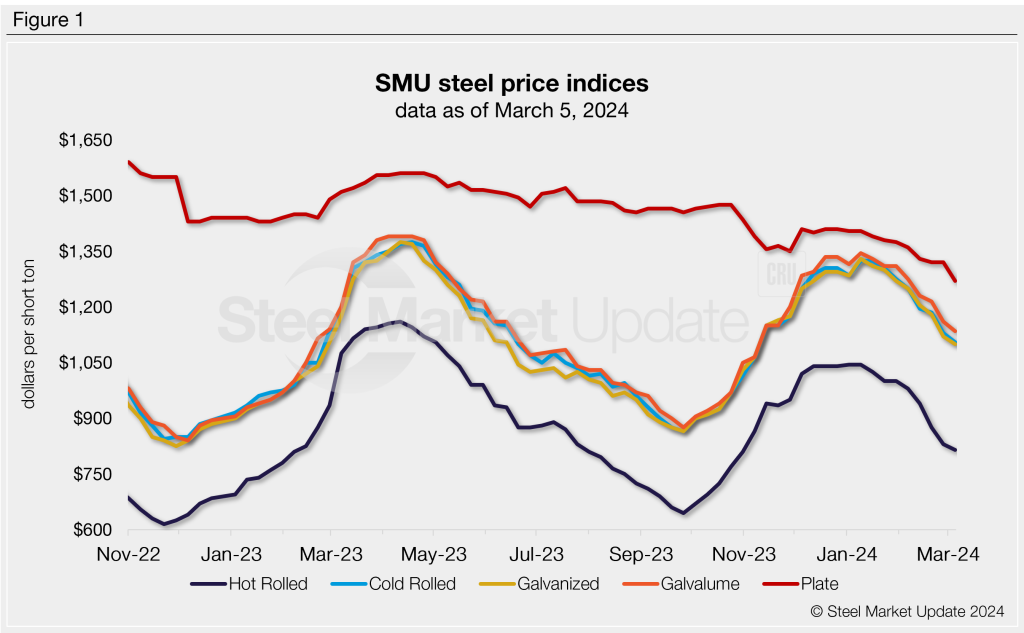

Sheet and plate prices this week continued the downward trend they’ve been on for most of 2024.

SMU’s hot-rolled (HR) coil price now stands at $815 per short ton (st) on average, down $15/st from last week and down $230/st from the beginning of the year.

Prices for cold-rolled (CR) and tandem products saw similar declines week over week (w/w). SMU’s CR price is at $1,105/st on average (-$25/st w/w). Our galvanized base price is at $1,100/st on average (-$20/st w/w). And our Galvalume price stands at $1,135/st on average (-$25/st w/w).

Some market sources predicted that a wave of spring maintenance outages at domestic mills would help to stabilize lead times and prices in the weeks ahead – especially should service center inventories, high at the beginning of the year, come down meaningfully.

“I still think we all rush back to restock at the same time. We just underestimated the amount of material people bought,” one service center executive said.

But others said that inventories remained elevated and that scrap prices could fall more than expected in March, following declines in January and February. That could give EAF mills in particular further leeway to reduce prices.

“It just seems to be getting weaker and weaker,” a second service center executive said. Multiple mills had expressed willingness to negotiate lower spot prices – including some that had called unsolicited. He said their attitude was, “If you’ve got real tons, let’s talk.”

Plate prices notched more substantial declines than sheet following Nucor’s publicly announced $90/st plate price cut.

SMU’s plate price now stands at $1,270/s on average, down $50/st from last week and down $135/st from the beginning of the year.

Hot-rolled coil

The SMU price range is $780–850/st, with an average of $815/st FOB mill, east of the Rockies. The bottom end of our range was flat vs. one week ago, while the top end of our range was down $30/st w/w. Our overall average is $15/st lower from last week. Our price momentum indicator for HRC remains lower, meaning SMU expects prices will move lower over the next 30 days.

Hot rolled lead times: 3–6 weeks

Cold-rolled coil

The SMU price range is $1,020–1,190/st, with an average of $1,105/st FOB mill, east of the Rockies. The lower end of our range was $20/st lower vs. the prior week, while the top end of our range was down $30/st. Our overall average is down $25/st from last week. Our price momentum indicator for CRC remains lower, meaning SMU expects prices will move lower over the next 30 days.

Cold rolled lead times: 5-9 weeks

Galvanized coil

The SMU price range is $1,030–1,170/st, with an average of $1,100/st FOB mill, east of the Rockies. The lower end of our range was down $30/st vs. the prior week, while the top end of our range was $10/st lower w/w. Our overall average is $20/st lower than the week prior. Our price momentum indicator for galvanized remains lower, meaning SMU expects prices will move lower over the next 30 days.

Galvanized .060” G90 benchmark: SMU price range is $1,127–1,267/st with an average of $1,197/st FOB mill, east of the Rockies.

Galvanized lead times: 5–10 weeks

Galvalume coil

The SMU price range is $1,100–1,170/st, with an average of $1,135/st FOB mill, east of the Rockies. The lower end of our range was $40/st lower, while the top end of our range was down $10/st from the prior week. Our overall average was down $25/st when compared to the previous week. Our price momentum indicator for Galvalume remains lower, meaning SMU expects prices will move lower over the next 30 days.

Galvalume .0142” AZ50, grade 80 benchmark: SMU price range is $1,394–1,464/st with an average of $1,429/st FOB mill, east of the Rockies.

Galvalume lead times: 6-9 weeks

Plate

The SMU price range is $1,240–1,300/st, with an average of $1,270/st FOB mill. The lower end of our range was down $20/st vs. the prior week, while the top end of our range was $80/st lower w/w. Our overall average is $50/st lower vs. one week ago. Our price momentum indicator for plate remains lower, meaning SMU expects prices will move lower over the next 30 days.

Plate lead times: 4-7 weeks

SMU note: Above is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is also available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@steelmarketupdate.com.

David Schollaert

Read more from David Schollaert