Analysis

February 27, 2024

January imports rally to a seven-month high

Written by David Schollaert

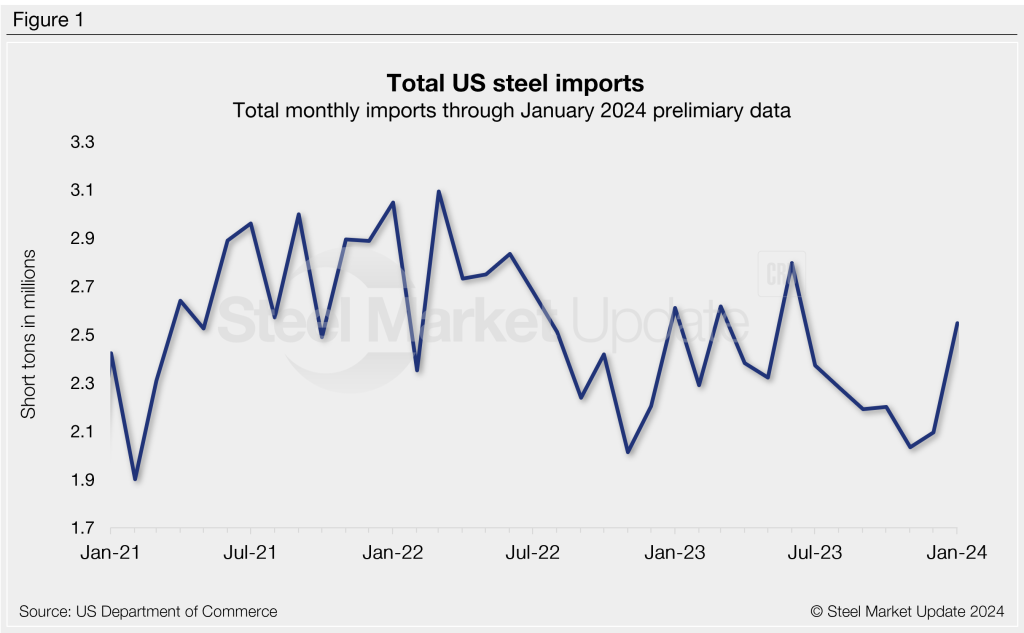

January’s import level was even higher than an earlier license count had suggested, making it the highest month for imports since June 2023.

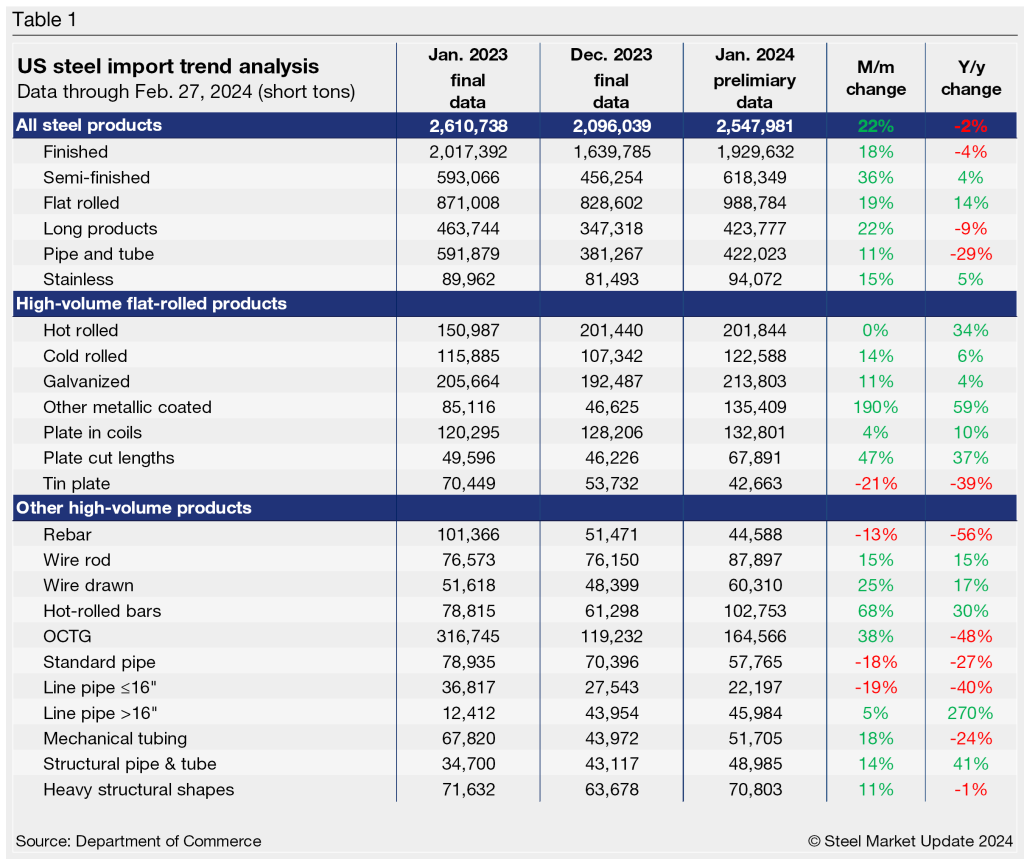

The US Commerce Department’s preliminary count shows 2,547,981 short tons (st) of steel products entered the country in the first month of 2024. This was a 22% increase from December’s final tally of 2,096,039 st but a 2.4% drop from January 2023.

Imports as a 3MMA

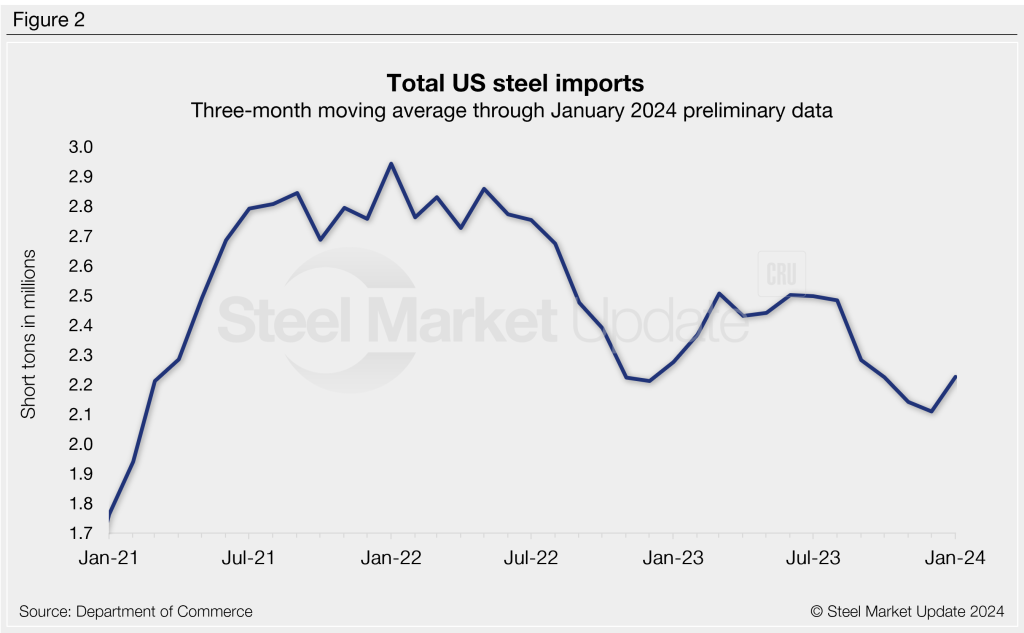

Looking at imports on a three-month moving average (3MMA) basis to smooth out the variability in monthly readings, we can see the strong rally after imports slowed in the latter part of 2023.

Semi-finished and finished steel

Imports of semi-finished steel rallied to 35% from December to 617,799 st in January. Slab shipments from Mexico improved 17% vs. December and reached a five-month high of 29,750 st last month. Slab shipments from Brazil improved to a four-month high of 278,264 st, a 71% boost from December’s total tally. Of note in the data is 3,353 st of slab imports from Germany in January compared to no marginal volume of slabs coming from that European country in the prior eight months.

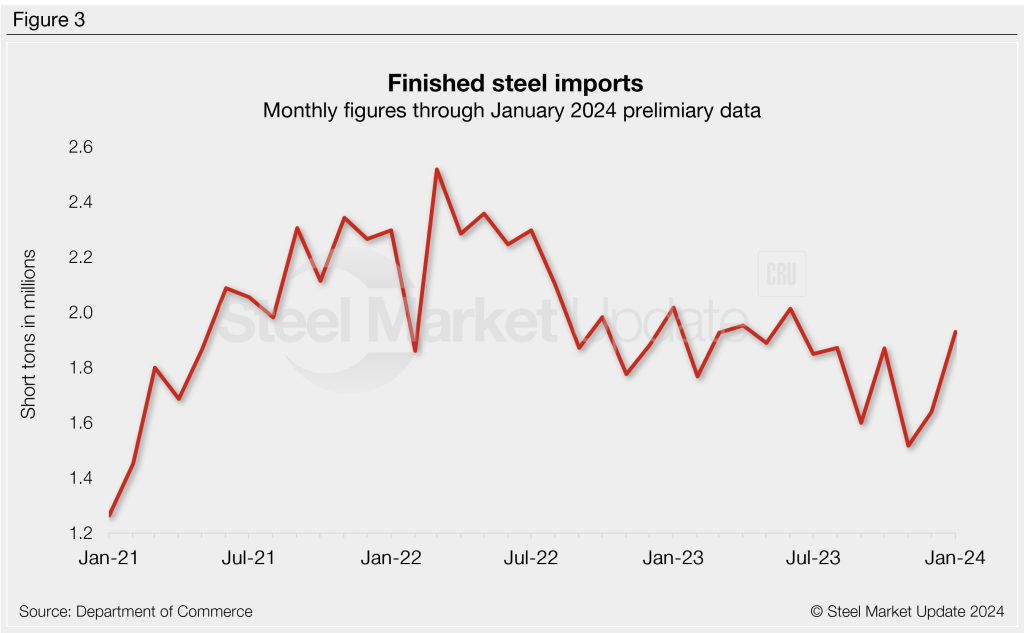

Meanwhile, finished steel imports, at 1,929,632 st in January, increased by nearly 18% month on month (m/m) from December’s tally of 1,639,785 st.

The American Iron and Steel Institute (AISI) estimated the finished steel import market share to be 22% in January 2024.

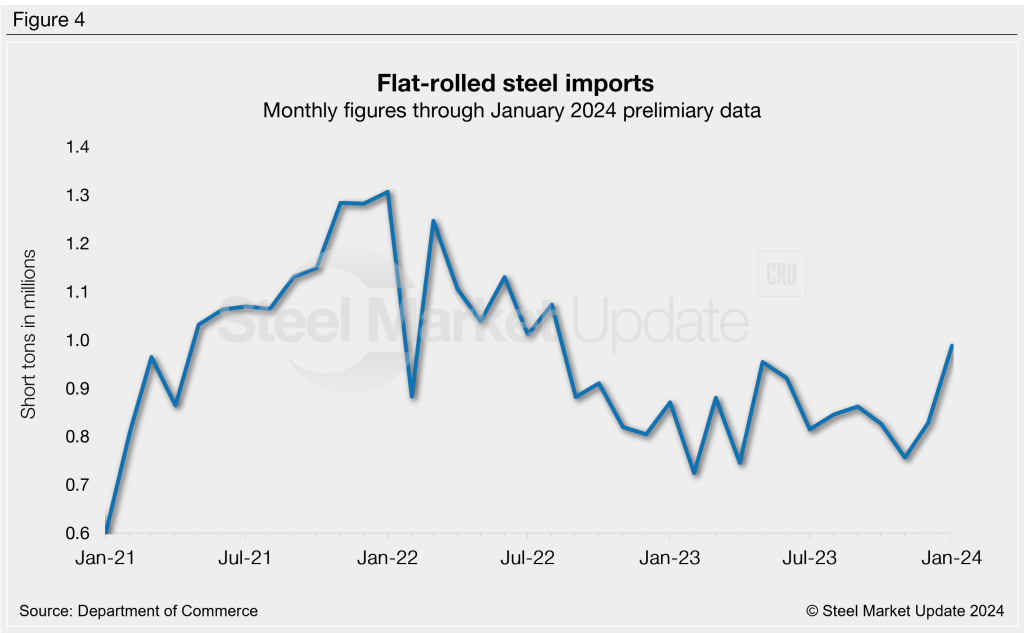

Flat-rolled steel

After falling to a seven-month low in November, flat-rolled steel imports have bounced back consecutively. January’s total – a 17-month high – came in at 988,784 st, a 19% boost m/m and a 13.5% gain from January 2023.

Hot-rolled sheet imports were at a four-month high in January at 201,844 st, inching up 0.2% vs. December. While shipments from Canada and South Korea were relatively similar m/m, noticeably higher shipments from Mexico and Japan were logged in January. Canada’s hot rolled shipments to the US were at a seven-month high of 105,800 st.

Significant suppliers of cold-rolled sheet in January included Canada, Australia, South Korea, Brazil, Mexico, and the Netherlands. Shipments from Mexico, more than doubled at 7,651 st after a recent low of just 3,001 st the month prior.

January imports of galvanized sheet and strip were at a 17-month high of 213,804 st. The countries supplying the most galvanized in December were Canada, Mexico, South Korea, Brazil, and South Africa.

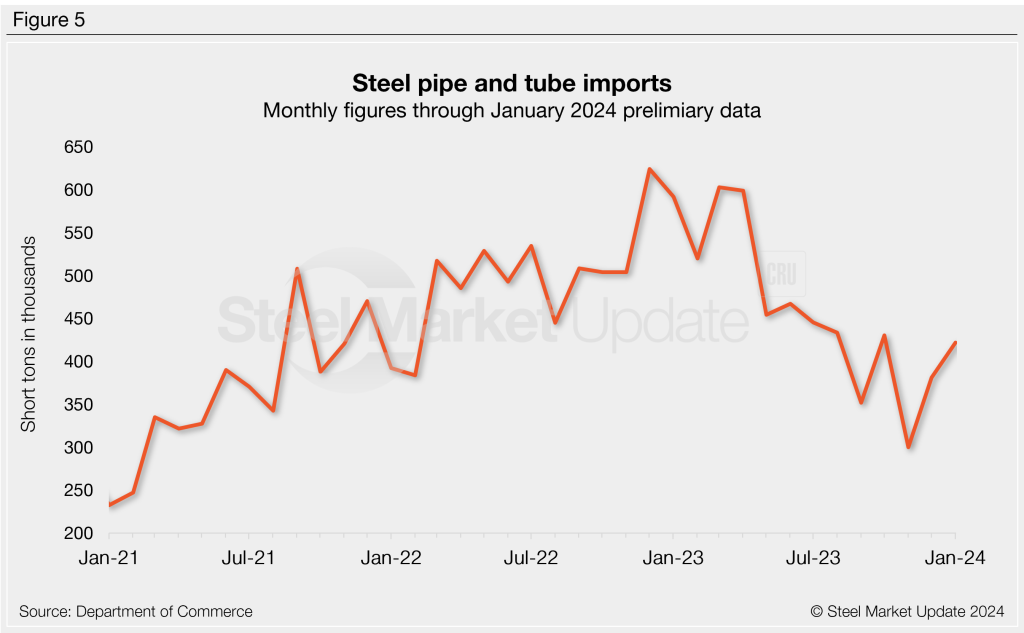

Pipe & tube

December’s preliminary count of pipe and tube imports, at 423,777 st, was nearly 19% higher than the license count of 356,107 st.

After hitting a three-year low of 78,163 st in November, OCTG imports jumped consecutively, tallying 164,566 st in the first month of the year. Shipments from South Korea, Austria, and Brazil were considerably higher.

Imports by product

The chart below provides further detail into imports by product, highlighting high-volume steel products.