Market Data

February 15, 2024

SMU survey: More sheet buyers find mills willing to talk price

Written by Ethan Bernard

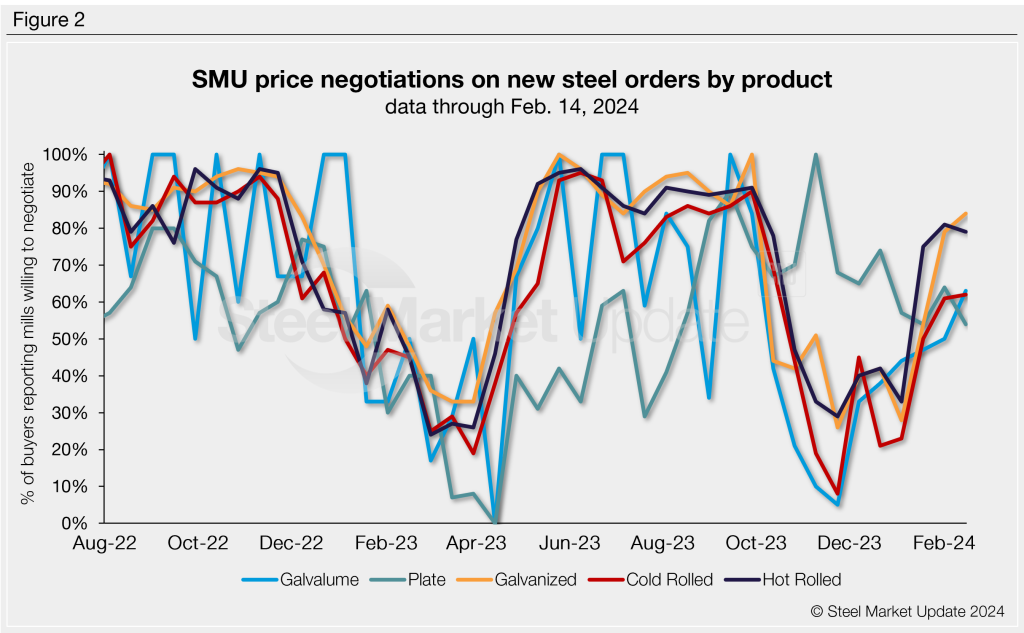

The percentage of sheet buyers finding mills willing to negotiate spot pricing rose or remained relatively flat on the products SMU surveys, while plate slumped, according to our most recent survey data.

The mill negotiation rate for plate fell 10 percentage points to 54% this week vs. two weeks earlier. Meanwhile, the only sheet product to notch a slight decline was hot rolled, slipping two percentage points to 79% from the previous market check.

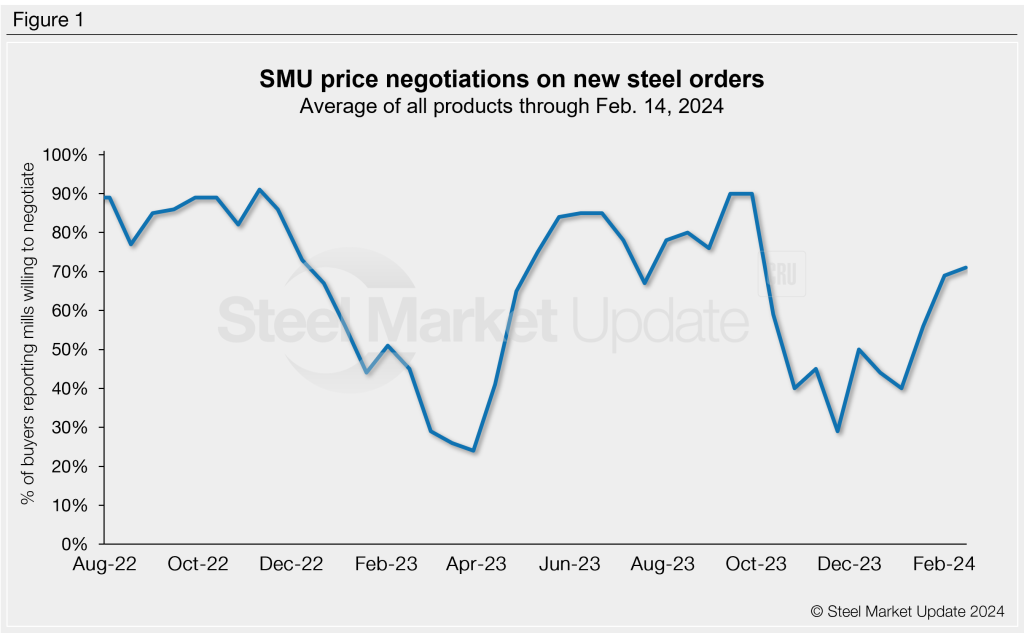

Every two weeks, SMU asks steel buyers whether domestic mills are willing to negotiate lower spot pricing on new orders. This week, 71% of participants surveyed by SMU reported mills were willing to negotiate prices on new orders, up from 69% at the last market check (Figure 1). It seems the bump up from 56% a month ago is sticking as the general trend of declining steel prices has continued.

Figure 2 below shows negotiation rates by product. The rate for cold rolled increased one percentage point to 62%; galvanized was up five percentage points to 84%; and Galvalume was up 13 percentage points to 63%.

Here’s what some survey respondents had to say:

“Not (willing to negotiate) on spot (for plate). No.”

“Spot might start opening up (on Galvalume) in a few months.”

“HR galvanized seems to be a better bargain than CR galvanized.”

“Seems like more tons (of hot rolled) will get you a better price.”

“Very limited (on negotiating price for hot rolled).“

Note: SMU surveys active steel buyers every other week to gauge their steel suppliers’ willingness to negotiate pricing. The results reflect current steel demand and changing spot pricing trends. SMU provides our members with a number of ways to interact with current and historical data. To see an interactive history of our steel mill negotiations data, visit our website.