Prices

February 15, 2024

HRC futures: Understanding and addressing HRC basis risk

Written by Logan Davis

What to do about basis?

It’s no secret that HRC futures have been particularly volatile over the past several years. The most recent instance was the outsized break in the March futures contract early this week. For companies procuring raw material in anticipation of higher prices or even to get ahead on future purchase orders from customers, understanding the relative price of that raw material versus the hot-rolled coil futures curve is important.

This relationship (physical vs. futures) is what is referred to as “basis” or simply the difference between the two. Having a historical understanding of the basis can help inform risk-management decisions around raw material transactions and can also help support or challenge a company’s bias or directional view on the market over time.

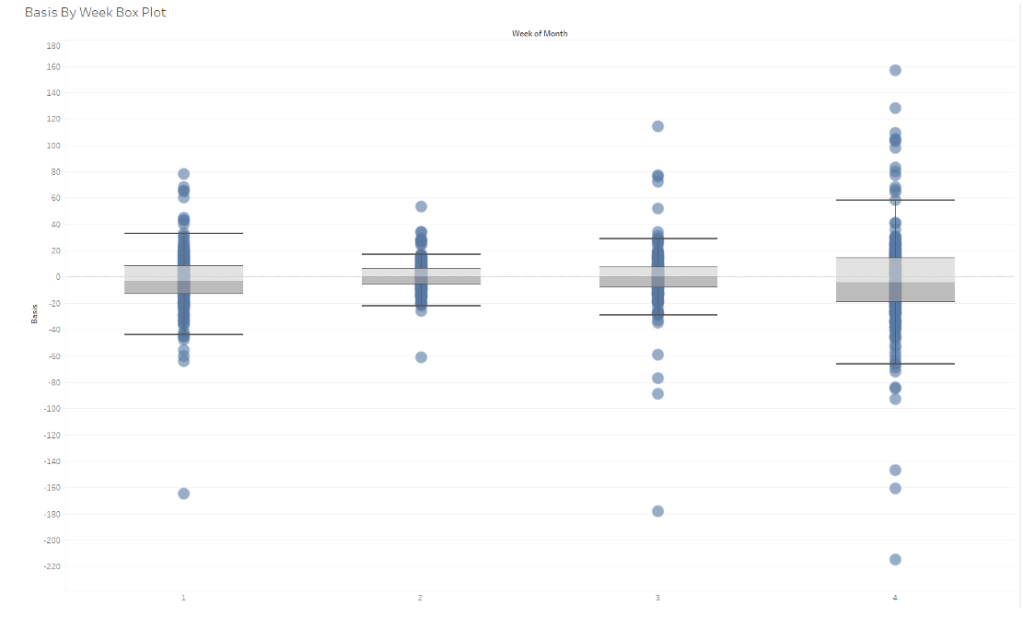

Under the hood, this volatility doesn’t just have implications in the futures market. Physical pricing is affected by the combination of futures volatility, the futures contract settlement structure, and processes inherent in them. Transactions occurring during different weeks when the CRU HRC index prints have had varying outcomes relative to the futures contract for that same month since 2009. See below:

As stated in the contract specifications in the CME rulebook, “The Floating Price for each contract month is equal to the average price calculated for all available price assessments published for that given month by the U.S. Midwest Domestic Hot-Rolled Coil Steel (CRU) Index”.

While the CRU index and HRC futures have a significantly high correlation (99%), discrepancies between physical and futures exist, as they do across all of the commodity markets we serve.

While pricing discrepancies may be something our readers are keenly aware of, understanding basis better can help operators manage it more effectively. When managing the risk of an adverse change in physical prices, two primary risks are exposed to this change: the futures component or benchmark price and the basis differential that relates that futures value or benchmark to a local physical market.

By definition, PHYSICAL = FUTURES + BASIS; therefore, BASIS = PHYSICAL – FUTURES. While futures are used as a hedge against an adverse move in physical prices, the basis differential remains a floating variable to the final determined price. Basis itself can be subject to adverse fluctuations from the time the futures hedge is initiated to the time the hedge is removed and the physical price is agreed upon.

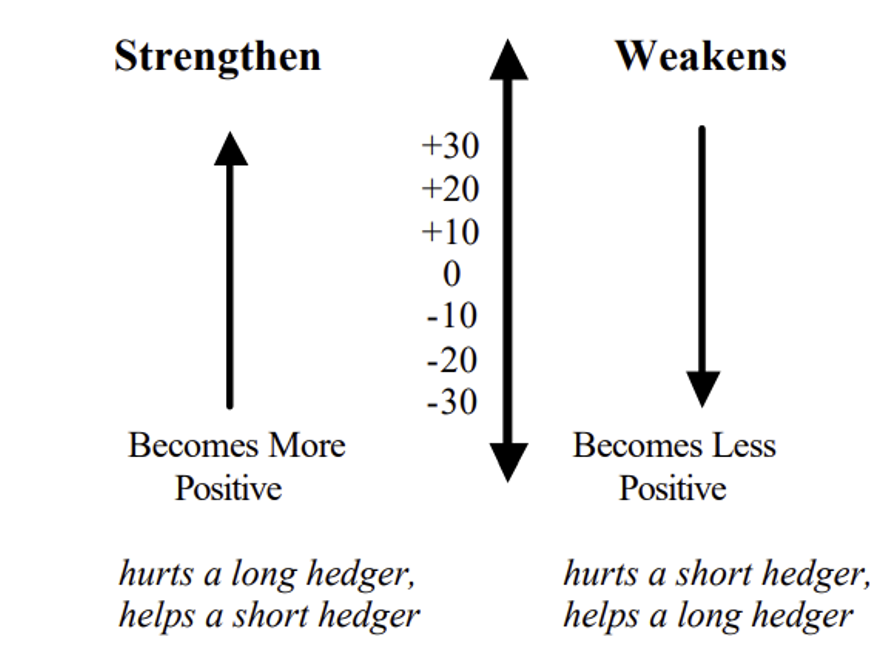

As a long hedger (someone who needs to buy the commodity in the physical market), one is exposed to a stronger basis. As a short hedger (someone who needs to sell the commodity in the physical market), one is exposed to a weaker basis. The graph below illustrates the movement of basis and its impact on the long and short hedger:

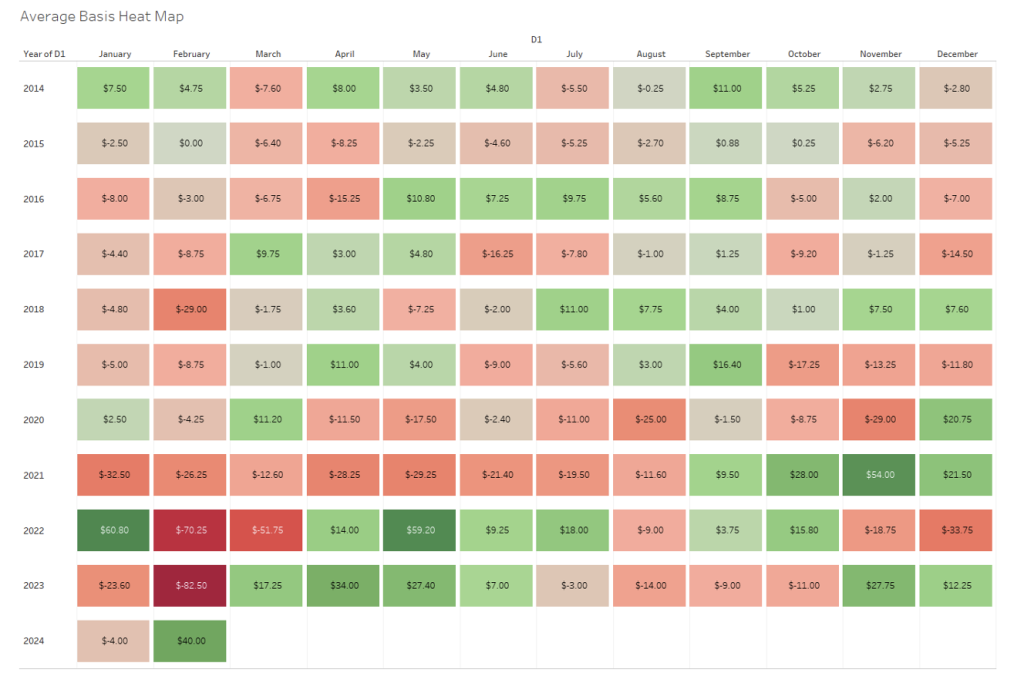

While basis variation is significant, fortunately it is the smaller portion of overall price variation. Futures variation accounts for approximately 80% of the overall variation in physical prices. Despite this, unfavorable movements in basis can limit the effectiveness of a futures or options hedge in protecting price. Below you will see the average basis history by month since 2014:

For many markets, basis can be set independently of price well ahead of time, thus removing this variable cash price risk from the equation. However, because of uncertainties associated with basis movement, particularly in years of extreme price volatility, the costs associated with establishing basis can be high, and the forward basis value offered in the physical market can appear unattractive relative to historical levels.

Just as futures prices display seasonal tendencies, so does basis. HRC exhibits its own seasonality, and companies may be able to use this information to inform their purchasing. HRC basis tends to be the weakest in January-March and strongest in September-October. See the average basis ranking for each month below:

If a standalone basis contract is not offered in the physical market, a company could recreate it. They can accomplish this by establishing a physical purchase with their supplier and use the exchange to offset the price component they’ve agreed to when purchasing the physical. The exchange position would come as a sold futures contract or put option. This would establish a basis-only exposure. Remember, PHYSICAL= FUTURES + BASIS, so the long physical and short futures offset each other to leave BASIS as the company’s position.

As an example, the raw material purchase price is $900, and the forward futures price is $950. The company could establish a short position in the relevant futures contract and create a long basis position of $-50.

As an alternative to forward-pricing basis, futures spreads can be used to manage the risk of a strengthening basis. The reasoning behind this is that basis and spreads do exhibit a relationship in which they tend to move together. For example, in situations where the physical market is very strong, basis tends to be increasing. This typically is reflected in the spot futures contract gaining relative to deferred contracts.

In the opposite case, where the physical market is very weak, basis tends to be decreasing. This usually corresponds with spot futures declining relative to deferred contracts. It is important to note that while the example given is typical, the premium or discount physical has to the futures price is an independent risk. Basis can move higher even if the futures price is declining or move lower if the futures price is rising.

Futures spreads are non-directional. An important point to note is that using a futures spread to mitigate basis risk is separate and distinct from using futures or options to hedge price risk. As an example, if a company purchases HRC futures as a hedge against higher physical prices in a forward period, and in addition, the company uses a spread to manage the basis risk for that same timeframe, these are two separate positions hedging two separate risks. In fact, these basis hedge positions are typically segregated in a separate account to prevent unintentional offsets of price hedges.

By better understanding the discrepancy between the CRU index and spot HRC futures, or basis, companies can identify and address risks to their core business function through their operations or through the exchange. As for managing basis, much like markets, we can only use this data to inform our expectations. Anomalies can and do happen. That said, HRC futures spreads tend to show a relationship to physical basis and can be considered, among other tools, to mitigate risk to adverse physical price movements.

There is a risk of loss in futures trading. Past performance is not indicative of future results. © 2024 Commodity & Ingredient Hedging, LLC. All rights reserved.