Analysis

February 9, 2024

January import licenses at six-month high

Written by Laura Miller

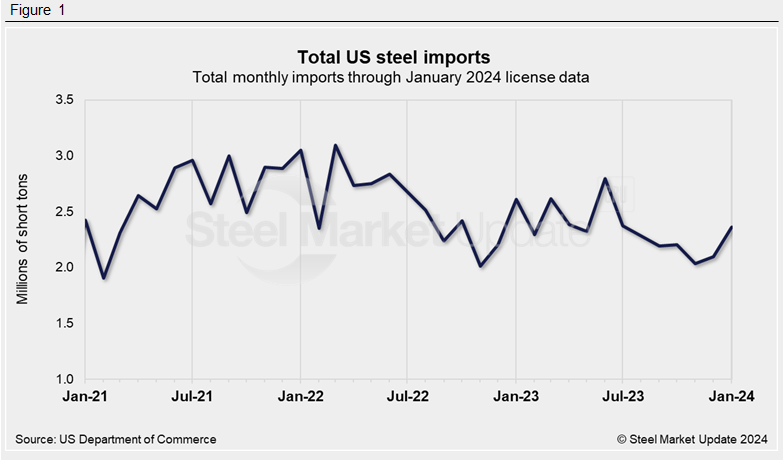

Based on initial license data for January, steel imports appear to have risen to a six-month high, and flat-rolled steel imports to a seven-month high.

Licenses to import steel totaled 2,359,250 short tons (st) in January, according to a count by the US Department of Commerce as of Feb. 5.

While those January licenses are 13% higher than December imports of 2,096,040 st, they’re down 10% from a year ago.

Recall that license counts can differ from Commerce’s preliminary and final figures, as license applications must be obtained before importation occurs.

Over the last year, November and December were the slowest months for steel arriving into the US, while June was the busiest.

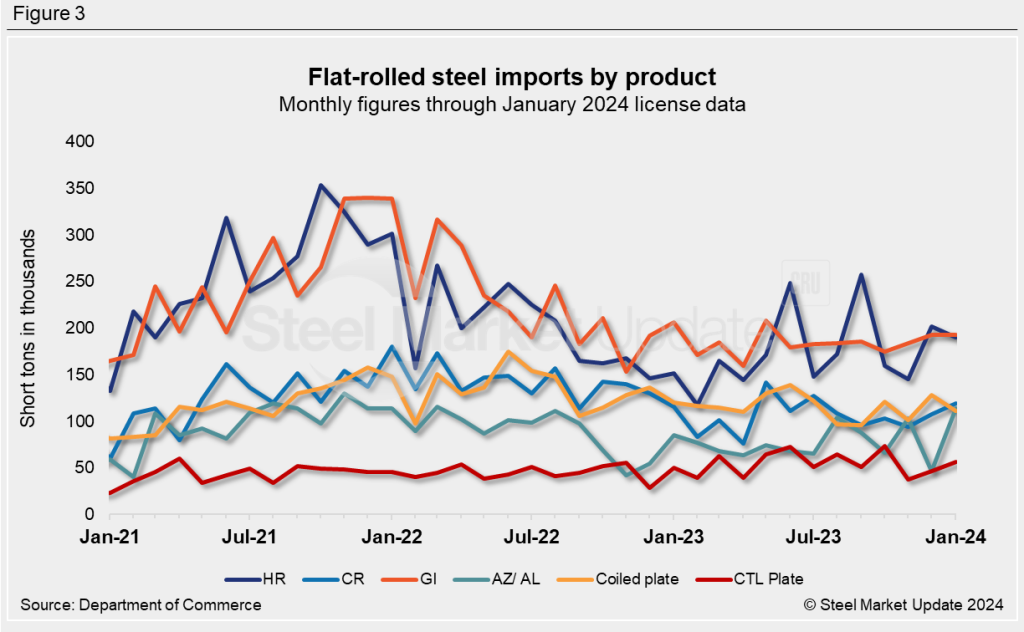

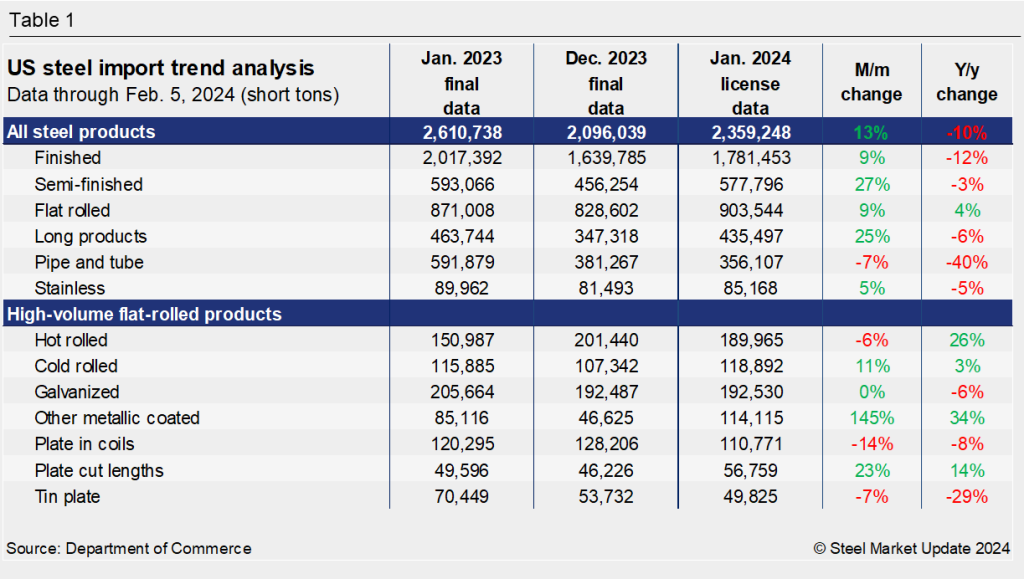

Flat-rolled steel imports of 903,544 st in January were at their highest point in seven months.

Licenses to import other metallic coated sheet (AZ/AL) spiked in January to a 22-month high of 114,115 st. The top suppliers of the product, based on January licenses, were Vietnam, Mexico, Taiwan, and South Korea.

CR sheet imports were the highest they’ve been in six months with 118,892 st of licenses in January, with the top suppliers being Canada, Sweden, and Australia.

Other lower-volume categories with notable increases in January licenses include tin-free steel and hot- and cold-rolled strip.