Prices

February 8, 2024

HRC futures: Momentum picking up on HR spot price declines

Written by Jack Marshall

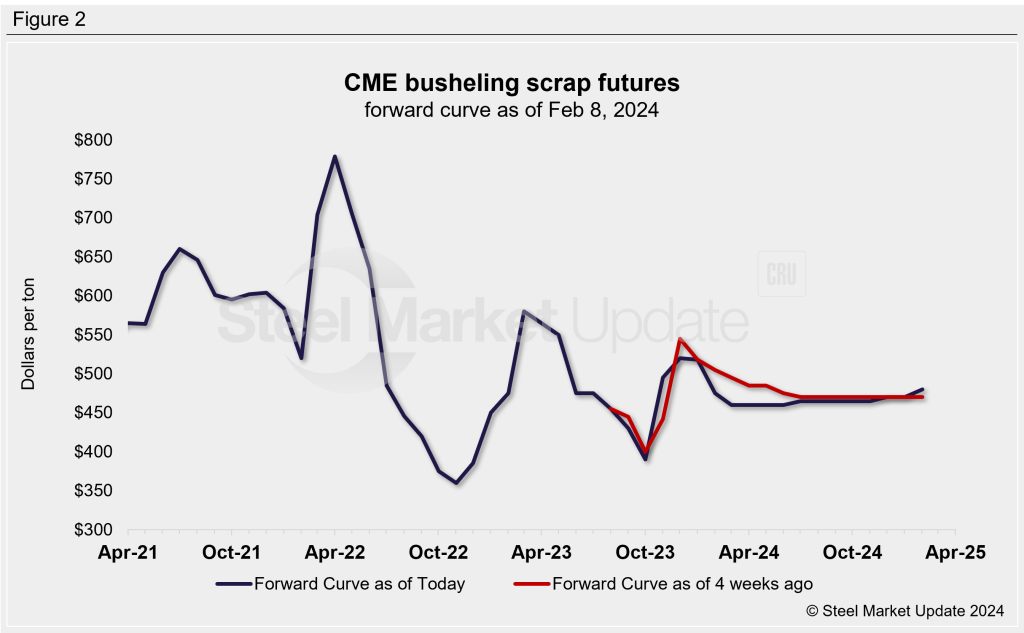

After holding steady for most of January, the hot rolled (HR) index has started to gain some downward momentum. In the last 30 days, it has declined $89 per short ton (st) and is sitting just above $1,000/st.

A steep backwardation in the nearby end of the HR futures curve points to an expectation of an acceleration of the price declines. On Thursday, Feb’24 future settled at $945/st vs. an Apr’24 settle at $811/st, a healthy $134 discount.

One month ago that discount, based on Jan. 10 settles, was just $96/st.

Also worth noting, the latest Apr’24 HR settlement is still just over a $100/st over the Aug-Sep’23 index low of $702/st. Technical support will provide some resistance, but real demand and actual inventory need will determine the trend.

The pickup in momentum could be a sign transaction volumes are increasing as price discounting by mills of HR helps move inventory. Steep interest rates, which are unlikely to soften before the next quarter, appear to have suppressed physical volumes as service centers manage higher financing costs and less leverage. Imports likely also will help accelerate discounts. The April-to-December 2024 futures price curve is sitting in the mid-$830/st range as an average.

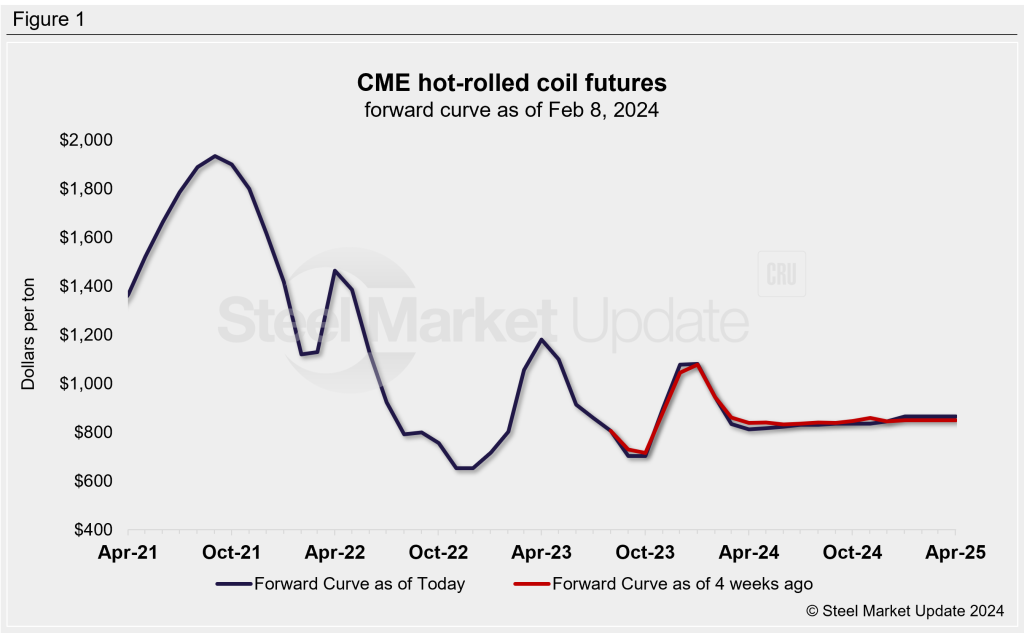

Prime busheling (BUS) scrap, which had surprised in January with settle at $518.10—only off slightly from December—appears poised to decline between $35 and $45 per gross ton (gt) for February. The balance of 2024 months for BUS fall between $455 and $475/gt based on Thursday’s settlement, with March-May trading at $460 for some volumes. The Feb-through-June’24 curve has dropped about an average of $20/gt, with the latter half giving up less than $10/gt.