Analysis

February 6, 2024

Final thoughts

Written by Michael Cowden

Our hot-rolled (HR) coil price fell below $1,000 per short ton (st) on average for the first time since November.

It was another steady drip lower, down $20/st to $980/st. In other words, the kind of on-and-off declines we’ve been seeing since the start of the year.

To be clear, there are still plenty of people paying more than $1,000/st for spot tons, and our range reflects that. But we’re also hearing from some of you who have bought in the mid/upper $900s per ton. And we’re not talking thousands of tons (a barge load, for example). We’re talking a few hundred tons (a few rail cars, for example).

We’ve heard some chatter of prices in the $800s per ton. We haven’t been able to substantiate those, not on the domestic side anyway. But we are hearing import numbers in that range. Let’s say ~$800/st for April/May delivery to the Gulf Coast. Add freight upriver into the Midwest, and I can see where some of the chatter about HR in the $800s might be coming from.

It might make sense for buyers in coastal areas – Long Beach, Houston, the Philly area – to buy material at those prices. But I don’t know that I see many inland buyers loading up, especially if HR prices continue to drift lower.

Dimming the lights, or lights out?

With HR prices slipping below $1,000/st, some of you have told me that you think a blast furnace might be idled to “protect” HR at a grand. My kneejerk reaction is that’s a bit of wishcasting. But stranger things have happened. And I wouldn’t be surprised if talk of EAFs dialing back capacity is true.

The bigger EAF steelmakers have a lot of downstream operations to feed know – whether that’s metal roofing, utility poles, garage doors, or tubular products. In the past, they might have cranked up sheet production so that increased volume could help offset price decline. I don’t know that such logic still applies.

Let’s pick some round numbers. Say HR goes from $1,050/st to $650/st (I’m not saying it will, just giving an example) as domestic mills increase volumes. Not only are HR prices now lower, you might also have consumers of your downstream products asking for significant discounts to match the declines they’ve seen in HR price.

So let’s say EAF producers are like a dimmer and integrated producers are an on/off light switch. I can see the logic of EAFs dimming the lights now. But I have a hard time seeing – assuming mills are still very profitable at current levels – an integrated producer shutting off the lights.

Soft or hard landing on world HR prices

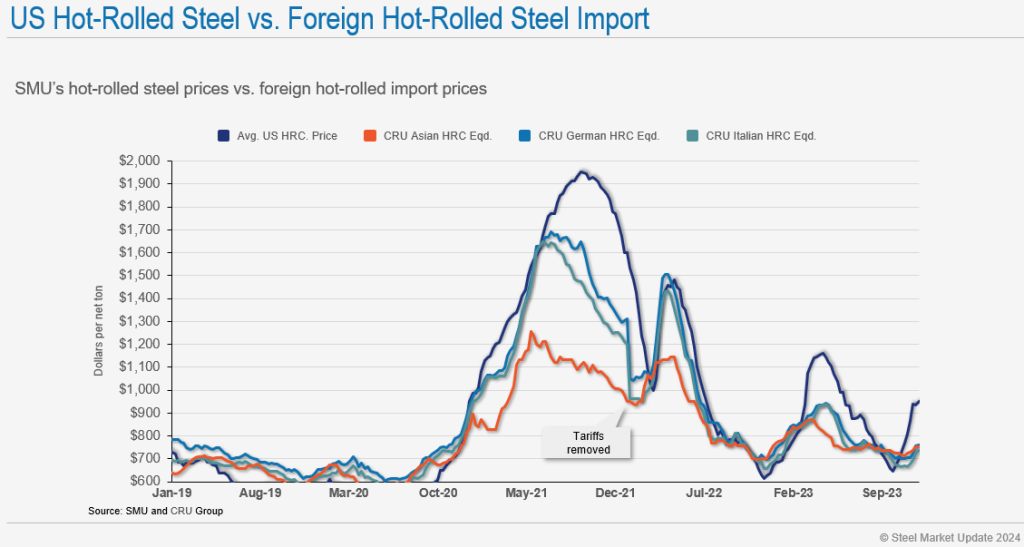

As you can in the chart below, US HR prices have since the pandemic sort of bounced on top HR prices abroad like a ball:

We typically dive briefly below world prices as we did in August 2020, late November 2022, and late September 2023. Then we shoot higher again. If post-pandemic norms hold, we’re in the returning-to-earth phase of the cycle.

We talk a lot about whether the Fed will pilot a soft landing or a hard landing when it comes to raising interest rates to lower inflation – all without causing a recession. It’s a good analogy.

I don’t know whether US HR prices will see a soft landing or a bumpy one as they approach world prices. But it’s probably safe to say this: It’s a good buying opportunity once US prices land near world prices – because domestic prices rarely stay on the ground for long.

Wildcard watch: the UAW and non-union automakers

The SMU team asked speakers at the Tampa Steel Conference last week what wildcards they were keeping their eyes out for.

Here is one that didn’t come up then but that I’d keep an eye on: the United Auto Workers (UAW) union. New contracts were negotiated with the “Detroit Three” automakers last fall. And the union has since made good on its promise to organize non-union automakers based on the historic gains it achieved with Ford, General Motors, and Stellantis.

The UAW is working to organize workers at Mercedes in Vance, Ala.; Hyundai in Montgomery, Ala.; and Volkswagen in Chattanooga, Tenn. And the union said on Tuesday that “a clear majority” of the 4,000 workers at VW’s assembly plant in Chattanooga wanted to form a union there.

I’m not going to handicap the odds of them forming a union, let alone of a strike. But it’s fair to say that labor activism isn’t going away anytime soon. (Another example in case you’re not convinced: the International Association of Machinists and Aerospace Workers seeks a 40% pay raise from Boeing.)

SMU Community Chat

Around 600 people have registered for the Community Chat with Wolfe Research Managing Director Timna Tanners.

Tanners is an astute student of the steel industry and doesn’t pull her punches. So don’t miss out! Be sure to register here and tune in on Wednesday at 11 am ET.