Prices

January 11, 2024

HRC futures: Ferrous indexes do not reflect future price expectations

Written by Jack Marshall

After a holiday period that saw HR futures volumes somewhat muted in December, the first week of January brought with it increased interest reflected in higher volumes.

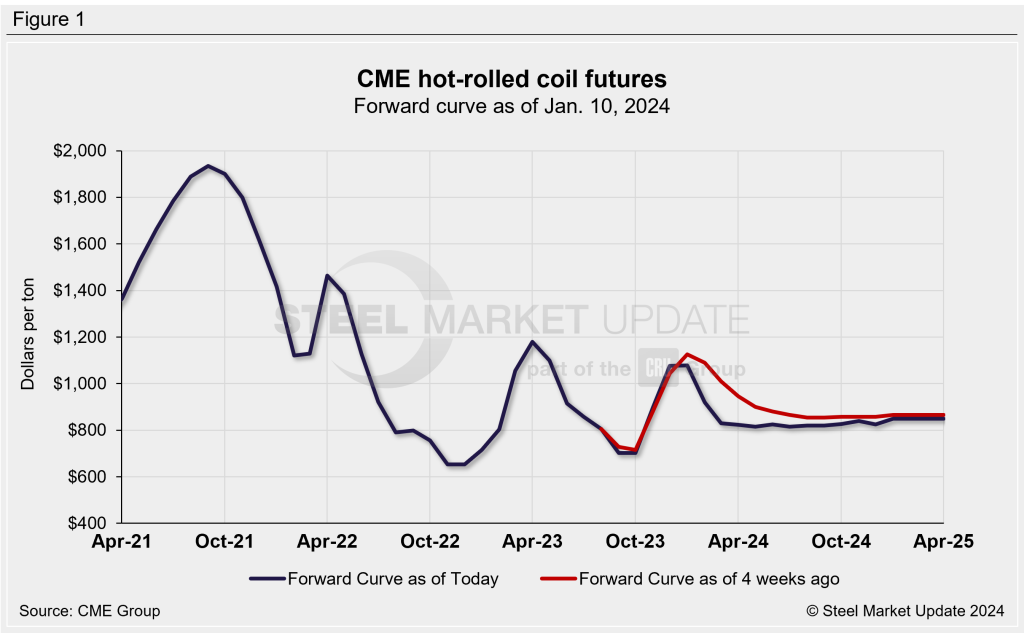

The increased futures interest also brought additional volatility in futures along the curve. While the HR index the last four weeks has been fairly pegged at just shy of $1,100 per short ton (st), the futures curve experienced strong selling pressure in the nearer futures dates. For example, the settlements from Dec. 11, 2023, to Jan. 10, 2024, saw HR Feb’24 and HR Mar’24 futures decline by $156/st and $176/st.

The sharp selloff in the last week points to a lack of confidence in the HR market holding its gains of the last month or so. Some futures buying has come in for the nearer dates following the large price decline, but given the velocity of the down move, it has been suggested that the market experienced some CTA liquidation. A lot of ferrous hedgers have been quietly observing from the sidelines as they formulate their strategies for the 1H’24.

How much of a bounce we see in futures depends on volume of imports headed our way given the $250 differential from the indexes, and how much of the demand for HR was pushed forward into December. A clearer sign of lower interest rates should help boost demand expectations.

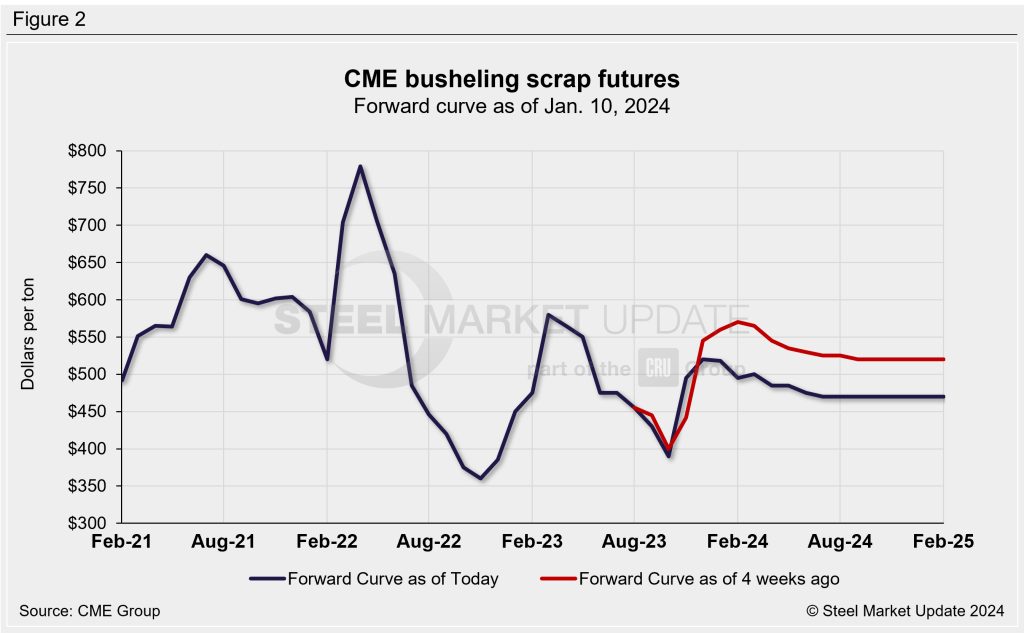

CME BUS settled at $518.10 for January. Leading up to the settlement, the market expectations were at first up $20 and later at down $40 to $50 per gross ton (gt). The market got a surprise as the index barely moved from December’s strong settlement.

Interestingly, the BUS futures curve has recently been sold off just under $50/gt basis average settlement price for Cal’24 from Dec. 11, 2023, to Jan. 10, 2024. So the future sentiment points to weaker BUS prices. February is a short month, and some winter weather could keep BUS prices steady..

The metal margin HR minus BUS settled at $454/ton on Dec. 11 and settled at $389/ton on Jan. 10. This is another sign that HR price advances have decelerated rather quickly, even as the indexes remain little changed.

Disclaimer: The content of this article is for informational purposes only. The views in this article do not represent financial services or advice. Any opinion expressed by Jack Marshall should not be treated as a specific inducement to make a particular investment or follow a particular strategy, but only as an expression of his opinion. Views and forecasts expressed are as of date indicated, are subject to change without notice, may not come to be and do not represent a recommendation or offer of any particular security, strategy or investment. Strategies mentioned may not be suitable for you. You must make an independent decision regarding investments or strategies mentioned in this article. It is recommended you consider your own particular circumstances and seek the advice from a financial professional before taking action in financial markets.