CRU

January 11, 2024

CRU: Ore-based metallics prices rose slightly outside of the EU

Written by Brett Reed

Pig iron prices rose month over month (MoM) in all major regions aside from Europe on improved buying. Demand in the US remains robust while market participants report that availability of Brazilian material increased after tightening a month prior. Meanwhile, Ukrainian export capacity increased due to greater access to temporary sea corridors.

In the CIS, pig iron prices increased $10 per metric ton (t) MoM to $395/t FOB Black Sea. Ukrainian pig iron exports also increased as Ukrainian exporters now have better access to temporary sea corridors. However, freight rates were elevated due to military activity in the Red Sea. Heavy congestion was being reported at land borders between Ukraine and the European Union, driving exporters to utilize maritime shipments due to the increased export capacity.

After declining in November, Russian exports of merchant pig iron increased in December as higher scrap prices made Russian pig iron more lucrative for buyers. Market participants report that demand for Russian material increased in early December, though deteriorated in the latter half due to the holidays.

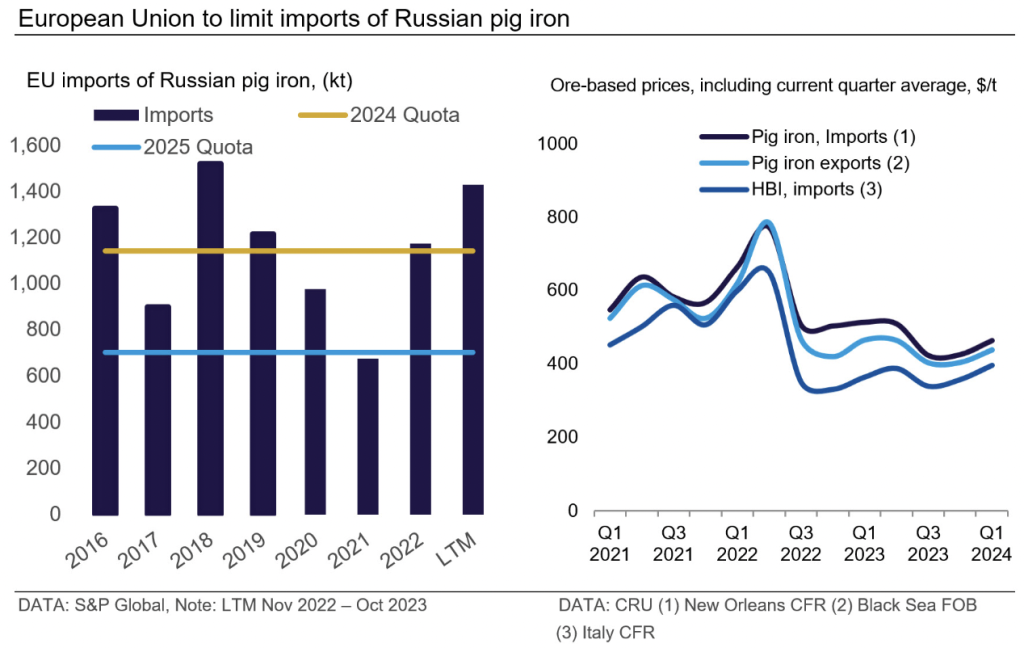

In Europe, pig iron prices were unchanged MoM at $425/t CFR Italy due to a slow start to 2024 following Christmas and New Year holidays. Moreover, in December the European Union had imposed the 12th package of sanctions against Russia, which includes restrictions on Russian pig iron imports into the EU to 1.14 million t in 2024, 700,000 t in 2025, and prohibited in 2026.

Meanwhile, Brazilian pig iron prices increased $15/t MoM to $480/t and $450/t FOB for the North and South, respectively. Despite the rise in prices, increased cost of charcoal due to heavy rainfall in the southeast region of Brazil is putting pressure on producer margins.

In the US, pig iron prices increased $20/t MoM to $500/t CFR NOLA, in line with the historical average premium to scrap prices. Buyers report that availability of both Brazilian and Ukrainian material has loosened this month despite continued strong demand, though buyers are unwilling to increase order volumes for Ukrainian material due to continued risks.

This article was first published by CRU. Learn more about CRU’s services at www.crugroup.com/analysis.