Analysis

December 21, 2023

Global steel output up in November: Worldsteel

Written by Michael Cowden

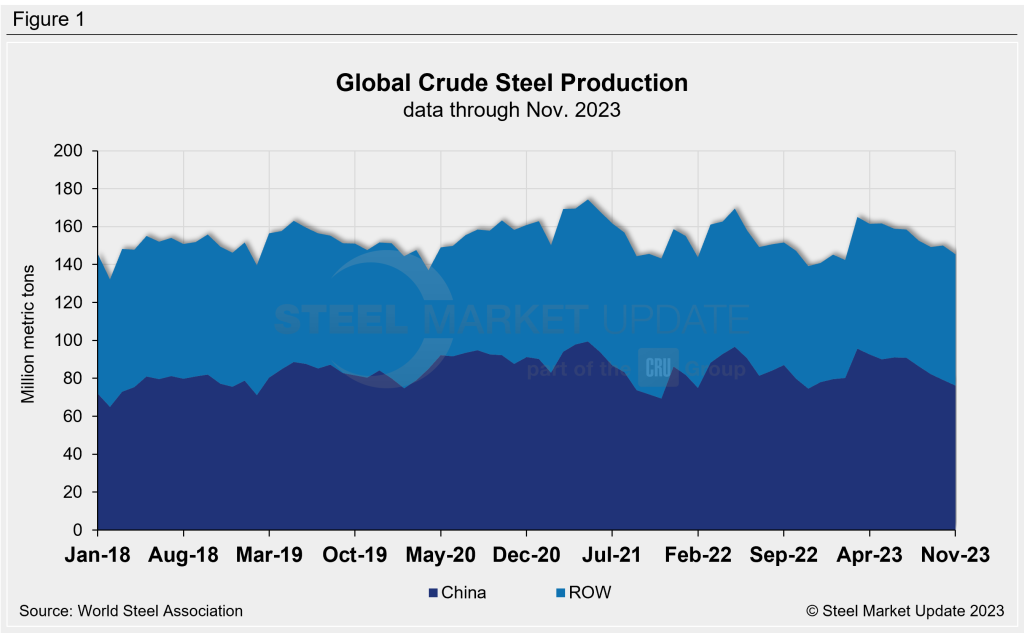

Global steel production rose in November compared to a year earlier, with output in China roughly flat and significant gains elsewhere, according to the latest figures from the World Steel Association (worldsteel).

Nov. ’23 vs. Nov. ’22

All told, world steel production stood at 145.5 million metric tons in November 2023, up 3.3% from November 2022.

China – by far the world’s largest steel producer – made 76.1 million tons of steel in November 2023, up 0.4% from November of last year. The United States produced 6.6 million tons last month, up 6.1% year over year (YoY). And EU mills made 10.6 million tons in November 2023, up 3.2% YoY.

Some of the biggest percentage gains in November were recorded by Turkey (3 million tons, up 25.4% YoY), Russia (6.4 million tons, up 12.5% YoY), South Korea (5.5 million tons, up 11.9% YoY), and India (11.7 million tons, up 11.4% YoY).

Partially offsetting those gains were declines in Germany, Europe’s largest steelmaking nation (2.7 million tons, down 2.4% YoY), and Japan (7.1 million tons, down 0.9%).

Jan.-Nov. ’23 vs. Jan.-Nov. ’22

Through 11 months of 2023, global steel output stood at nearly 1.72 billion tons, up 0.5% from the same period in 2022.

China accounts for the vast bulk of that tonnage (952.1 million tons, up 1.5% YoY), followed by India (128.2 million tons, up 12.1% YoY), and Japan (80 million tons, down 2.8% YoY).

The US was the world’s fourth-largest steel producing nation through the 11 months of 2023 (73.9 million tons, down 0.5% YoY).

Notable fact

China made more steel in November 2023 than the US made in 11 months this year.