Market Data

November 9, 2023

SMU Survey: Mills Less Willing to Talk Price on Sheet, More Willing on Plate

Written by Ethan Bernard

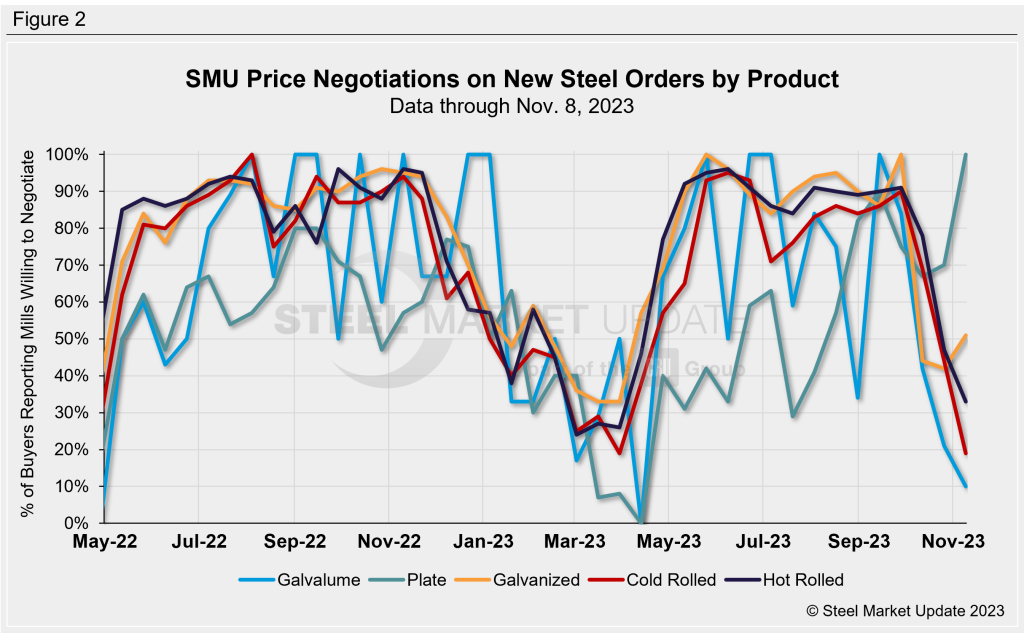

The percentage of steel buyers saying mills were willing to negotiate spot pricing fell for hot rolled this week, while plate’s negotiation rate shot up, according to SMU’s most recent survey data.

The negotiation rate for steel plate rose 30 percentage points from two weeks ago to 100% of surveyed buyers saying mills were open to discussing lower spot prices. However, hot rolled’s rate declined 14 percentage points to 33%, and cold rolled’s fell 25 percentage points to 19% in the same comparison.

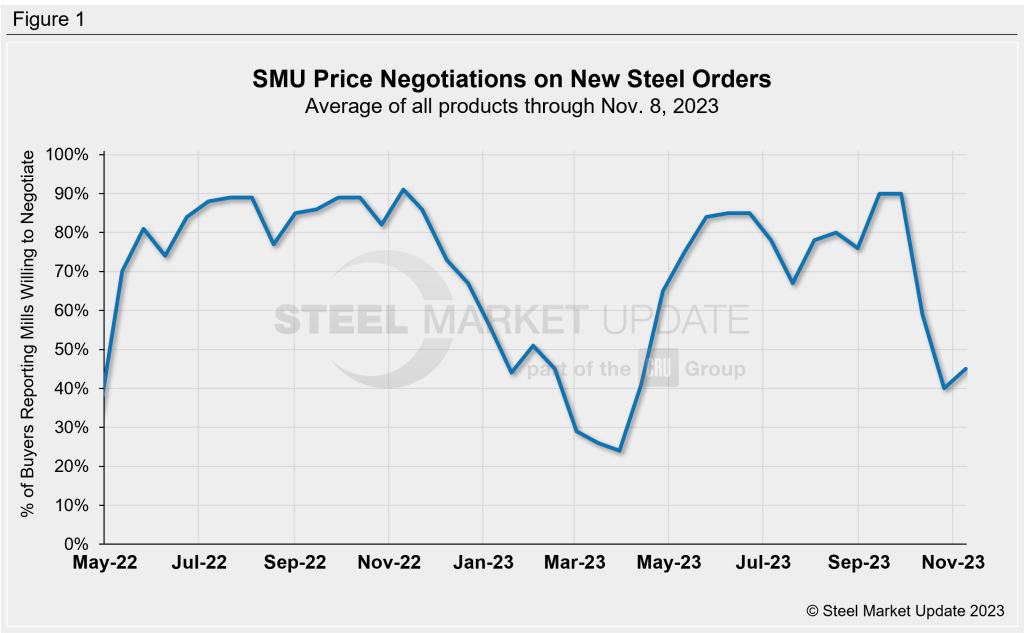

Every two weeks, SMU asks steel buyers whether domestic mills are willing to negotiate lower spot pricing on new orders. This week, 45% of participants surveyed by SMU reported mills were willing to negotiate price on new orders, rising from 40% from two weeks earlier (Fig. 1). Although up five percentage points from the previous check, this rate stood at 90% as recently as the end of September.

Fig. 2 below shows negotiation rates by product. Galvanized’s rate increased nine percentage points to 51% of buyers saying mills were willing to talk price. Meanwhile, Galvalume’s fell 11 percentage points to 10% in the same comparison. We have averaged Galvalume with the previous market check because of fewer market participants and to reduce volatility.

Here’s what some survey respondents had to say:

“Waiting for spot to open for (galvanized for) January.”

“I think there is a little room (for galvanized) depending on the size of the buy.”

“Not seeing buyers wanting to buy (hot rolled) at this number, but also not seeing mills come off prices.”

“All mills ‘no quote’ on Galvalume.”

“Minor mills are more willing to negotiate (on plate). I expect the majors to make quiet deals based on their December bookings.”

“If you call Nucor lowering their plate prices down -$7 ‘negotiating,’ I’d say yes. They are looking for tons.”

Note: SMU surveys active steel buyers every other week to gauge the willingness of their steel suppliers to negotiate pricing. The results reflect current steel demand and changing spot pricing trends. SMU provides our members with a number of ways to interact with current and historical data. To see an interactive history of our Steel Mill Negotiations data, visit our website here.