Prices

October 19, 2023

HRC Futures: A Swing in the Market

Written by Bradley Clark

Well, what a difference a month makes…

Against the backdrop of a prolonged United Auto Workers (UAW) strike, a low inventory environment, and planned and unplanned outages at mills, prices have moved higher. With a second round of price hikes announced today — Nucor, Cliffs, and U.S. Steel — we have seen the forward curve push up around $30 per net ton for any given month.

The surprising lack of available material and extension of lead times pushing into and past December has certainly spooked sellers of futures. A scramble to cover short positions and concern from consumers who were unable to purchase physical have led traders to jump in to buy up the paper market.

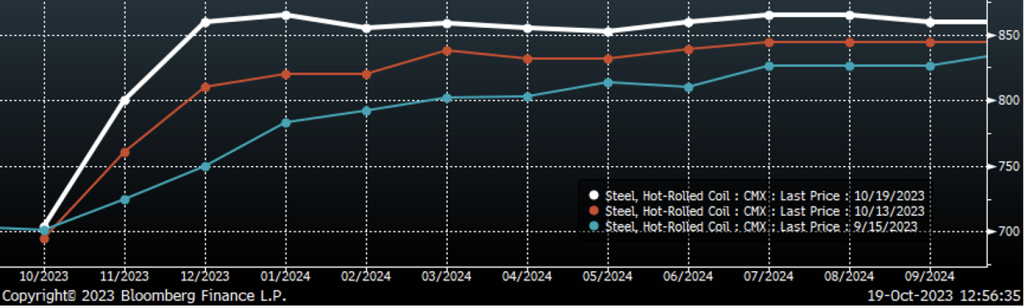

The chart below shows the forward curve with today’s (Oct. 19) settlements in white, last week’s (Oct. 13) settles in orange, and settles from one month ago (Sept. 15) in blue. The curve has recently been in a strong contango, where later dated forward prices traded at a premium to nearby prices. However, this has started to flatten out. Of late, we have seen December as the month du jour trading up ~$110 over the last five weeks, now trading $5 above Q2’24 after this same spread was trading $25 below, just last week.

With November (white, below) trading at $800, December (blue) at $860 and Cal24 periods around $865, the market is pricing in the full achievement of today’s price hike announcements and then some, going into the end of year and into the next. Volatility looks to increase as well, solid option volumes (puts in red, calls in purple) have been trading over the past month, highlighting the market’s growing demand for more sophisticated derivatives instruments to manage their risk. This is a very healthy sign for the HRC market as a whole.

As we head into the weekend, the nervous market of late seems to be accepting higher prices for longer. While we expect the market to be choppy as volatility is giving traders short-term opportunities, the longer trend seems to be firming to the upside. The use of prudent and appropriate risk management solutions continues to be underscored by the rapid change in pricing and sentiment in both the underlying and futures market.

About Flack Global Metals

In 2010, Flack Global Metals (FGM) was founded with the mission to reinvent how metal is bought and sold. Over 13 years later, the company has evolved into a hybrid organization combining an innovative domestic flat-rolled metals distributor and supply chain manager, a hedging and risk management group supported by the most sophisticated ferrous trading desk in the industry known as Flack Metal Bank (FMB), and an investment platform focused on steel-consuming OEMs called Flack Manufacturing Investments (FMI). Together, these entities deliver certainty and provide optionality to control commodity price risk in the volatile steel industry.

Disclaimer: The content of this article is for informational purposes only. The views in this article do not represent financial services or advice. Any opinion expressed by Flack Global Metals or Flack Metal Bank should not be treated as a specific inducement to make a particular investment or follow a particular strategy, but only as an expression of his opinion. Views and forecasts expressed are as of date indicated, are subject to change without notice, may not come to be and do not represent a recommendation or offer of any particular security, strategy or investment. Strategies mentioned may not be suitable for you. You must make an independent decision regarding investments or strategies mentioned in this article. It is recommended you consider your own particular circumstances and seek the advice from a financial professional before taking action in financial markets.