Prices

October 17, 2023

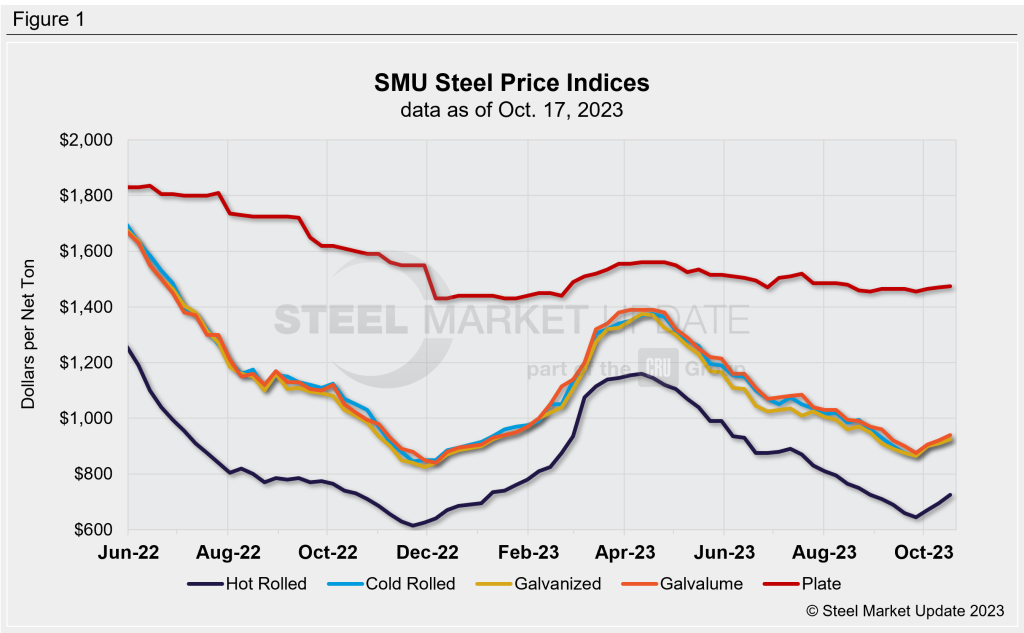

SMU Price Ranges: Sheet Prices Up Again, But Outlooks Diverge

Written by David Schollaert & Michael Cowden

Sheet prices notched a third consecutive week of gains on limited supply and stable demand outside of automotive operations impacted by the UAW strike.

But opinions diverged on the future direction of prices.

Some sources said they would continue to rise on long lead times and limited spot availability. Others said they would lose momentum as the impact of mill outages faded and as the effects of the UAW strike increased.

SMU’s average hot-rolled coil price in the meantime stands at $725 per ton ($36.25 per cwt), up $30 per ton from $695 per ton last week and up $80 per ton from a 2023 low of $645 per ton in late September.

Prices for cold rolled and coated products also increased. Cold rolled and galvanized base price are both at $925 per ton, up $15 per ton from a week ago and up $60 per ton from late September. Galvalume, at $940 per ton, was up $20 per ton week over week (WoW).

Plate prices, in contrast, were roughly flat at $1,475 per ton, up $5 per ton from last week.

Despite divergent outlooks, our sheet price momentum indicators remain pointed upward. We will keep them there unless there are clear signs of that upward momentum fading. Our plate price momentum indicator remains at neutral.

Hot-Rolled Coil

The SMU price range is $700–750 per net ton ($35.00–37.50 per cwt), with an average of $725 per ton ($36.25 per cwt) FOB mill, east of the Rockies. The bottom end of our range increased $40 per ton vs. one week ago, while the top end of the range edged up $20 per ton compared to the prior week. Our overall average is up $30 per ton WoW. Our price momentum indicator for HRC continues to point higher, meaning SMU expects prices will increase over the next 30 days.

Hot Rolled Lead Times: 3–7 weeks

Cold-Rolled Coil

The SMU price range is $900–950 per net ton ($45.00–47.50 per cwt), with an average of $925 per ton ($46.25 per cwt) FOB mill, east of the Rockies. The lower end of our range was up $20 per ton WoW, while the top end was $10 per ton higher compared to a week ago. Our overall average is up $15 per ton WoW. Our price momentum indicator for CRC continues to point higher, meaning SMU expects prices will increase over the next 30 days.

Cold Rolled Lead Times: 5–8 weeks

Galvanized Coil

The SMU price range is $900–950 per net ton ($45.00–47.50 per cwt), with an average of $925 per ton ($46.25 per cwt) FOB mill, east of the Rockies. The lower end of our range was up $20 per ton vs. last week, while the top end of our range was also up $10 per ton WoW. Thus, our overall average is up $15 per ton vs. the prior week. Our price momentum indicator on galvanized steel continues to point higher, meaning SMU expects prices will increase over the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $997–1,047 per ton with an average of $1,022 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 5-8 weeks

Galvalume Coil

The SMU price range is $920–960 per net ton ($46.00–48.00 per cwt), with an average of $940 per ton ($47.00 per cwt) FOB mill, east of the Rockies. The lower end of our range was up $20 per ton vs. last week, while the top end of the range was $20 per ton lower WoW. Our overall average was up $20 per ton compared to one week ago. Our price momentum indicator on Galvalume steel continues to point higher, meaning SMU expects prices will increase over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,214–1,254 per ton with an average of $1,234 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 5-10 weeks

Plate

The SMU price range is $1,450–1,500 per net ton ($72.50–75.00 per cwt), with an average of $1,475 per ton ($73.75 per cwt) FOB mill. The lower end of our range was $10 per ton higher WoW, while the top end of our range was unchanged compared to the week prior. Thus, our overall average is up $5 per ton vs. one week ago. Our price momentum indicator on steel plate remains neutral, meaning there is no clear indication where prices will head over the next 30 days.

Plate Lead Times: 4-7 weeks

SMU Note: Above is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@steelmarketupdate.com.

David Schollaert

Read more from David Schollaert