Analysis

October 15, 2023

Final Thoughts

Written by Michael Cowden

SMU’s latest survey data are out, and they reflect a consensus among steel buyers that sheet prices have bottomed out and might rebound.

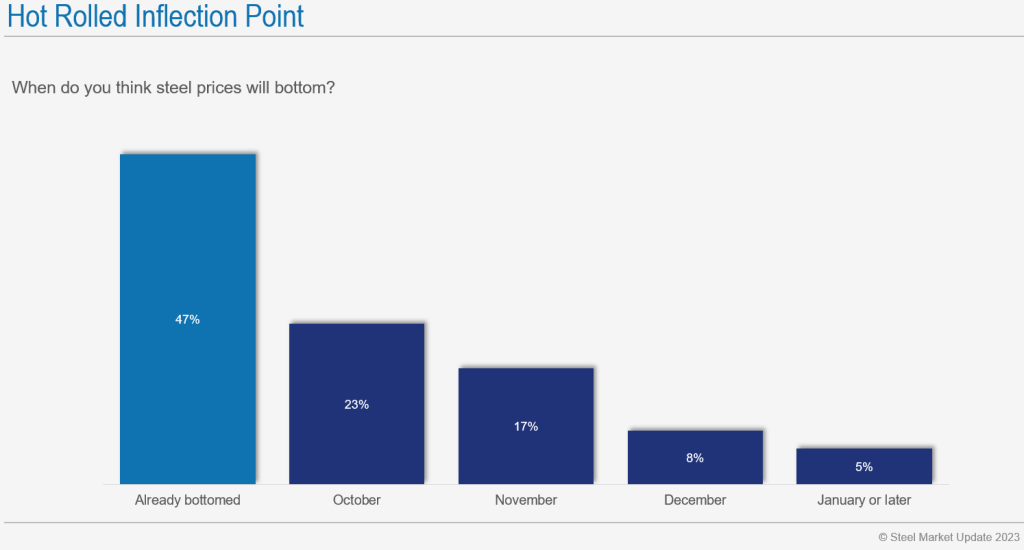

Lead times continue to extend. Fewer sheet and plate mills are willing to negotiate lower spot prices. And 70% of survey respondents think prices have already bottomed out or will later this month:

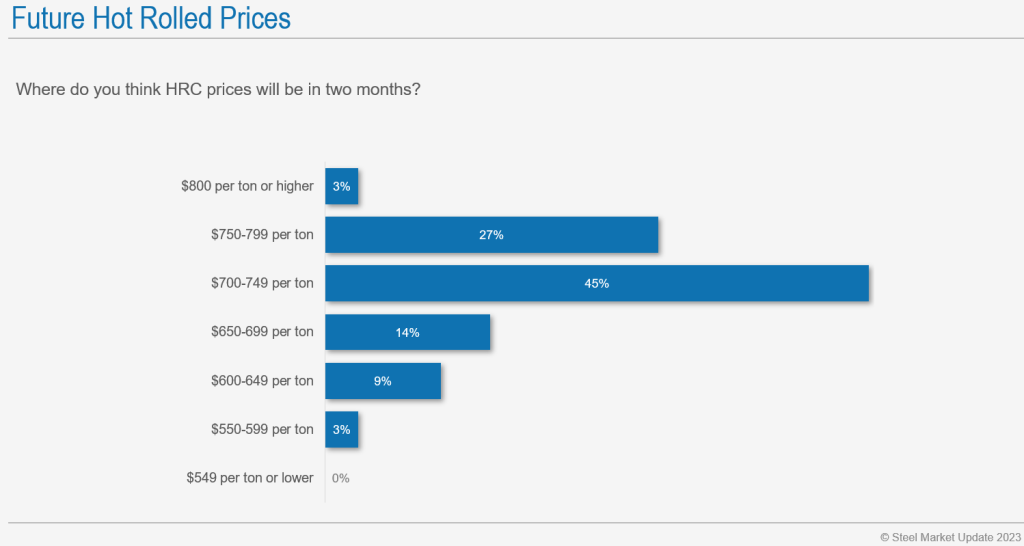

Also, 75% of respondents think that we’ll end the year with hot-rolled coil prices above $700 per ton:

That’s somewhat remarkable considering that there had been concerns – especially ahead of the UAW strike – that HRC could fall into the $500s per ton.

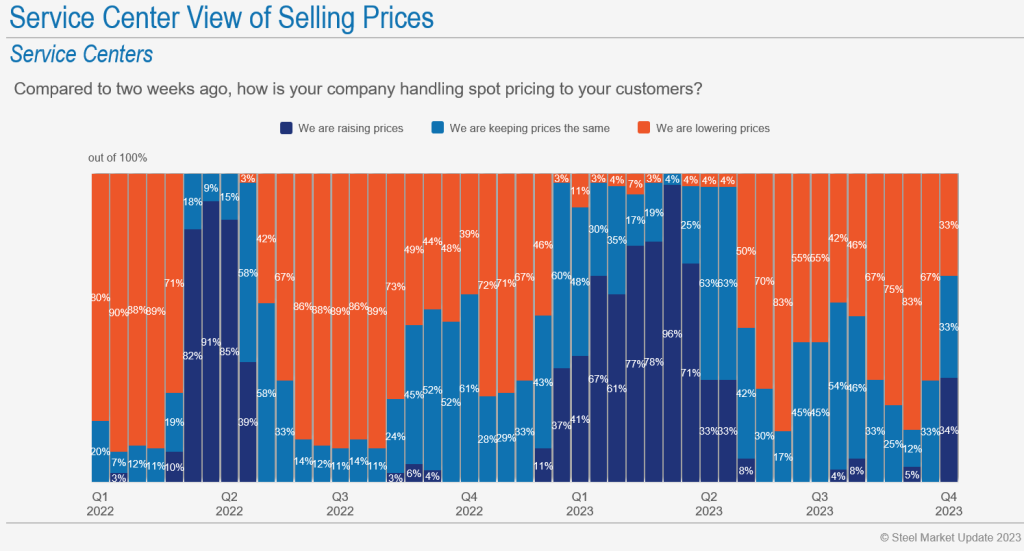

Notable, too, is that the sheet price increase led by Cleveland-Cliffs in late September appears to have gained more traction among service centers than a prior round of hikes announced in June/July:

Approximately one-third of service center respondents reported increasing prices to their customers in our latest survey. Compare that to only 8% following the increase led by U.S. Steel in mid-June.

We haven’t seen service centers following mills higher at this level since late Q4 of 2022, just ahead of a sheet price spike in Q1 of this year.

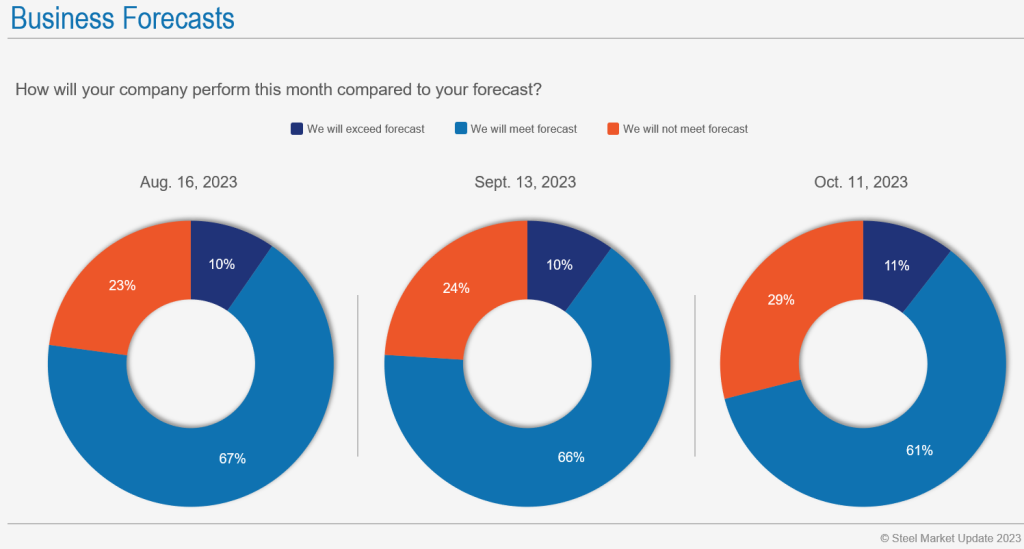

Meanwhile, more than 70% of respondents predicted that they would meet or exceed forecasts this month:

That trend has proven durable despite volatility in prices and current events.

Also interesting: Price expectations have firmed even as the consensus about the length of the UAW strike has shifted from 3-4 weeks to 7-8 weeks (or more).

Approximately 50% of survey respondents last week predicted that the UAW strike would last 7-8 weeks or longer. In September, shortly after the strike was announced, about 50% thought it would last only 3-4 weeks.

A month ago only 10% predicted that the strike would last more than seven weeks. How are prices rising even though most people underestimated the length of the UAW strike? Have idlings, maintenance outages, and strength in other markets offset lower demand from union-represented automotive companies?

I ask those questions partly because not all the data we collected in our survey supported the narrative that prices have bottomed out and rebounded.

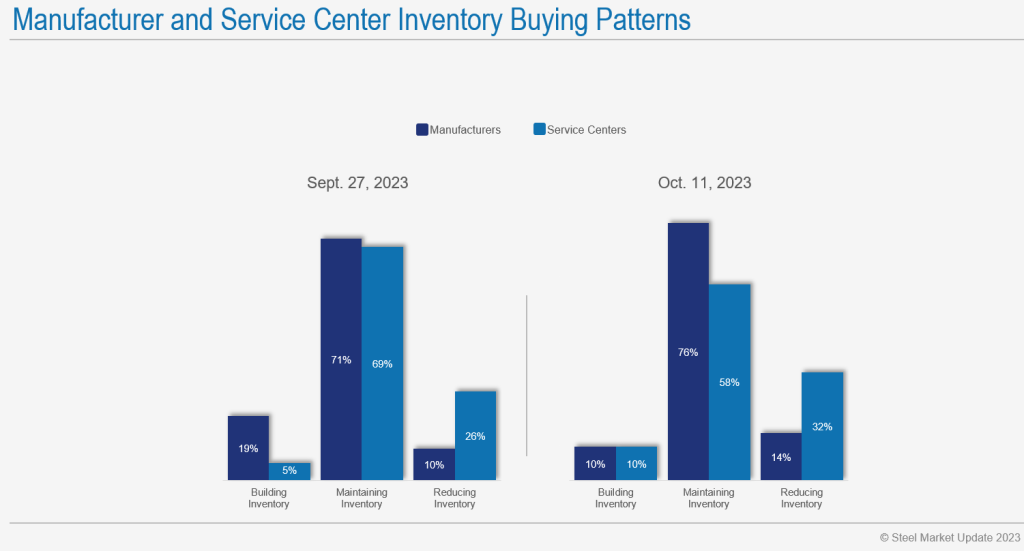

A significant number of service centers, for example, continue to reduce inventories. Why is that?

Is it a reflection of typical, seasonal factors? Not wanting excess inventory in jurisdictions – Harris County, Texas, for example – that charge year-end inventory taxes? Recall that lead times for many flat-rolled steel products are into late November or December. And customers in such locations typically don’t want excess steel at year-end.

Is it because inventory carrying costs are higher because of higher interest rates? Or are some service centers concerned that the rebound in sheet prices that we’ve seen over the last few weeks isn’t sustainable?

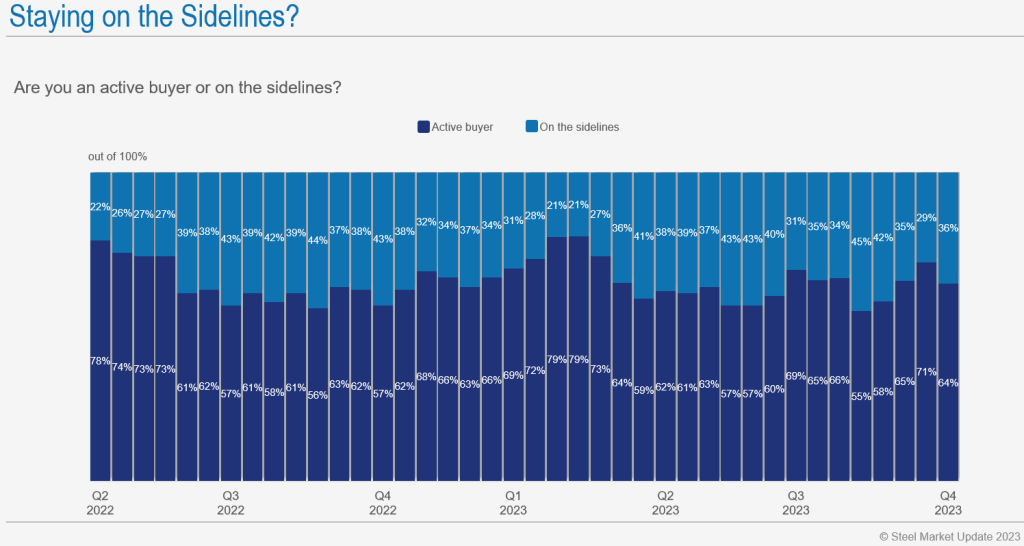

Also, we’ve seen a modest increase in the number of respondents who report that they’re on the sidelines:

That may be just noise. I’m not reading too much into it unless we see the same trend continuing in future surveys.

But I can see why it has the potential to become a trend. Some big buyers bought large volumes at a significant discount to prevailing spot prices in September. Those deals mean some probably don’t need to return to the spot market (except to fill in holes) for the balance of the year.

And, as some of you continue to point out, these are uncertain times in the US and abroad.

At home, the UAW has said it will change tactics. It will no longer wait to announce strikes on Fridays. It will instead announce them at any time and with little notice.

Also, will there be a deal for U.S. Steel this year? What might a deal look like? And would it result in more consolidation or less consolidation at the mill level?

Finally, there is the possibility of an expanding conflict in the Middle East. What might the ramifications of that be, if any, for steel markets in the US?

Let me know your thoughts.

SMU Events

Our Steel 101 workshop on Oct. 24-25 near Charleston, S.C. – featuring a tour of Nucor Steel Berkeley – has sold out. Our next in-person Steel 101 will be in the spring. Stay tuned for the location and dates.

In the meantime, more companies continue to register for the Tampa Steel Conference, which we do together with Port Tampa Bay. Some of you told me last year that high hotel costs were an impediment. So register here before the hotel rates go up!