Analysis

October 3, 2023

Final Thoughts

Written by Michael Cowden

Did the price increase announced by Cleveland-Cliffs last week stick? Yes, at least partially.

Our hot-rolled coil price is up $25 per ton ($1.25 per cwt) week over week (WoW). So, whatever happens going forward, Cleveland-Cliffs has at least temporarily “stopped the bleeding” in sheet prices.

Keep in mind that sheet tags had been falling since mid-July, when a price hike initiated by U.S. Steel a month earlier fizzled. Reversing that trend, and bearish market sentiment, was no small feat.

So will this increase meet the same fate as U.S. Steel’s? Will it lose momentum a month from now? Or are its prospects better?

That depends on who you ask.

$700+ HRC – Here to Stay?

Some market participants think it’s only a matter of time before the low end of our price range – now in the mid-$600s per ton – rises to $700 per ton or more. They don’t think the year-end deals will happen. Because they effectively happened in September.

They might also point to an uptick in inquiries and to customers ordering to the high side of their “min-max” contracts to avoid stepping into what is suddenly a pricier spot market.

It’s also worth noting here that price hikes appear to have been supported by unplanned outages of varying seriousness at domestic mills, according to recent market chatter.

Those unplanned outages, even if they were short-lived, come on top of widespread and in some cases extended planned maintenance outages. They also follow the temporary idling of steelmaking at U.S. Steel’s Granite City Works near St. Louis.

I’ve in addition heard that import offers are in the $620-640 per-ton range for offshore HRC – think South Korea and Brazil (so quotas but no S232 tariff), and in the high $600s per ton from Canada and Mexico. If that’s the case, why would US mills go back into the $500s per ton for hot band?

Does that mean Cliffs will get the $750 per ton it is targeting for HRC? We’ll see. Will domestic mills be able to hold the line, at least for a while, at $700 per ton? I think that’s highly possible.

Destocking Over (Maybe)

I suggest that because I’ve heard from some of you anecdotally that you’re no longer in destocking mode. It might be early to call this a restocking cycle. But there seems to be at least a mini-restock following the destocking we saw ahead of the UAW strike.

And evidence of at least limited restocking isn’t just anecdotal. Seventy-one percent of respondents to our latest steel market survey said they were active buyers. Only 29% said they were on the sidelines. That’s the highest activity level we’ve recorded since the first quarter.

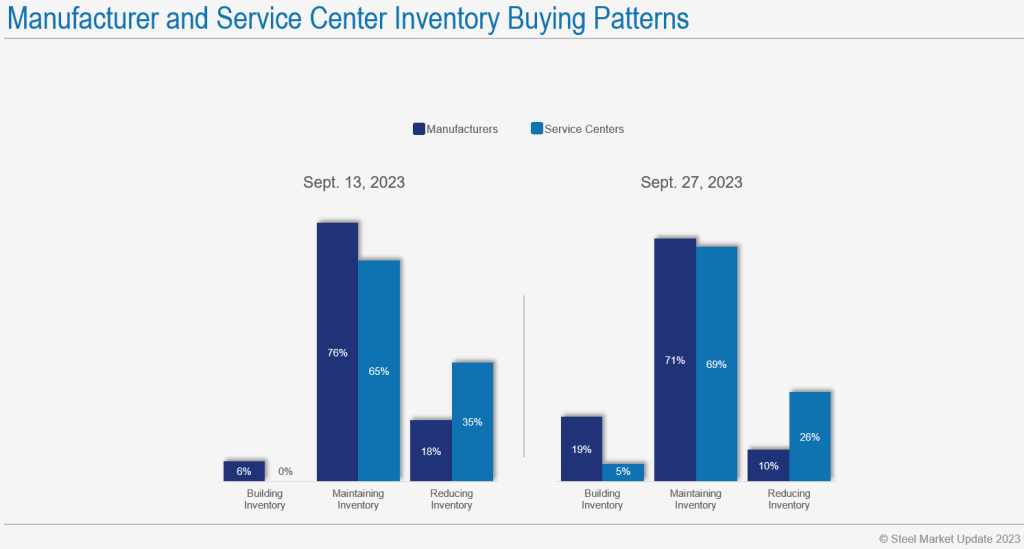

You can also see that trend in our question about buying patterns. True, most people are maintaining or even reducing inventories. But we’ve recently seen a small but perhaps notable increase in the number of companies replenishing stocks:

So why am I holding off on endorsing the idea of a sheet price rally?

For starters, some of the gains we’ve seen are prefaced on limited capacity – and perhaps on the expectation that more capacity might be taken down. That’s hard to square with any notion of increasing demand.

We’ve also heard that EAF mills have been quietly ratcheting back capacity because of the strike – thus limiting spot availability. If the strike ends, wouldn’t they increase production again?

Also, it’s not just the UAW strike that’s expanding. So, too, are the number of plants that the the “Detroit Three” automakers – GM, Ford, and Stellantis – are idling in response to the strike and the various supply chain bottlenecks caused by it.

Could we see a snapback in demand once the strike is resolved? Yes. But I’m still not sold on the consensus view among our survey respondents that this strike will be over in 4-6 weeks.

Save the Date: Tampa Steel – Jan. 28-30, 2024

Don’t forget to register for the Tampa Steel Conference, which SMU hosts along with Port Tampa Bay.

It’s Jan. 28-30, 2024, at the JW Marriott Tampa Water Street. Don’t wait until the high season for tourism kicks in and hotel rooms become scarce and expensive. Register here!