Plate

October 1, 2023

Plate Report: Mills Hold the Line Despite Slowing Demand

Written by David Schollaert

US plate prices have been relatively flat this year, especially when compared to sheet products.

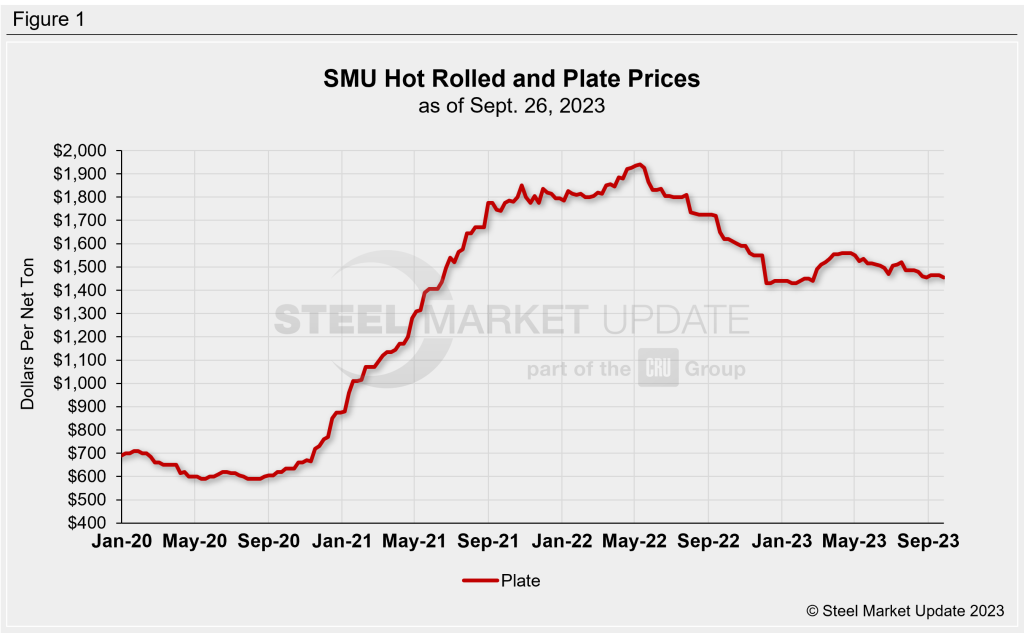

Case in point; SMU’s plate prices stands at $1,455 per ton ($72.75 per cwt) on average, down 7% from a $1,560 per ton peak in April. Our HRC price is at $645 per ton, down 44% from an April peak of $1,160 per ton.

In other words, domestic mills’ efforts to decouple domestic discrete plate from hot-rolled coil have been successful.

Nucor said last Thursday that it aimed to keep plate prices unchanged with the opening of its November order book.

Background

From January to April, US plate mills announced eight price increases, pushing prices from $1,430 per ton on average to a recent high of $1,560 per ton on April 11. And while tags have declined by $105 per ton since there was only one formal mill notice of lower plate prices – Nucor’s $40 per ton decrease on Aug. 31.

The latest plate market pricing is displayed below in Figure 1.

Nucor has been the unofficial top end of the range for the domestic plate of late, market participants said.

Market Reaction

The news caught many by surprise. Prices had been trending lower. And many expected Nucor to lower prices, as it did in late August when it cuts prices by $40 per ton.

But others questioned what an increase would have accomplished, especially with little spot demand.

Below is reaction from plate market participants in their own words:

“I was shocked. I was expecting a drop of $80-100 a ton.”

“Lowering prices for the sake of lowering prices would serve no positive benefit.”

“I didn’t think [a decrease] was justified at this time. Lowering prices will not create a market or increase demand.”

“I think Nucor had no choice but to keep prices unchanged publicly. Lowering them just erases profits that they are going to get regardless for those in the market who have to buy in Q4.”

What Comes Next?

With spot activity limited, mills might lean on contract business – which accounts for the bulk of domestic demand.

Another possible support for prices might be a trend of trading among service centers. That might not be a positive for prices in the short term. But it could have the longer term effect of tightening inventories ahead of restocking in Q1, some market participants said.

And while HRC sheet and plate prices might have decoupled in recent years, price trends in one product can still impact the other.

“Cliffs drawing a line in the sand on HRC I’m sure also played a role in (Nucor’s) decision to hold the line on discrete plate prices,” one source said.

HRC-Plate Spread

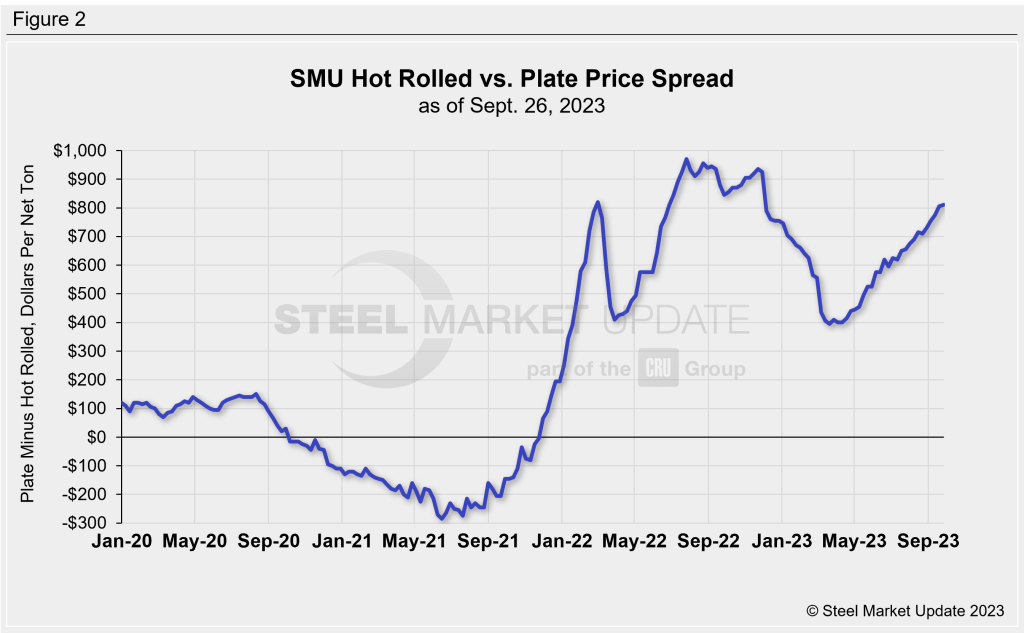

It’s been nearly two years now since plate prices decoupled from HRC (Figure 2). We saw the spread between plate and HRC reach as high as $970 per ton in the summer of 2022. It currently sits at $810 per ton.

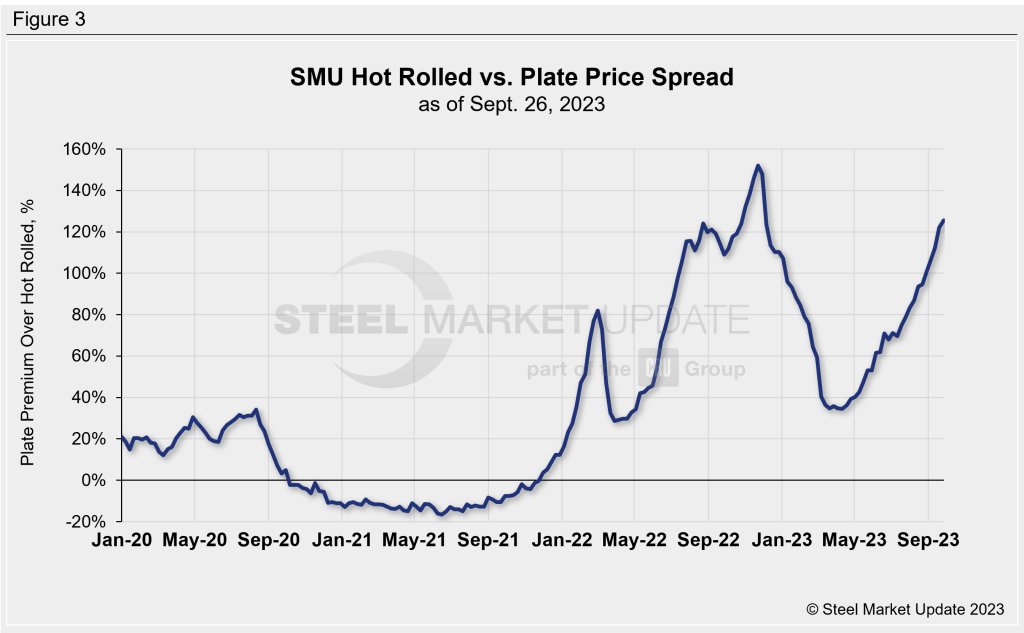

As a percentage basis, plate’s premium over HRC has ballooned to 126% (Figure 3), a 10-month and not far from the all-time high of 152% in November 2022.

“I am not sure if plate prices will reach the historic premium over sheet prices in 2024. But it’s funny to think that not that long ago we saw price inversion for several months,” said a source.

The Takeaway

With plate demand spotty, mills are focused on controlling order books, market participants said. This probably reflects a desire to keep prices steady and to maintain a big premium over HRC.

Also, imports remain attractive. Offshore product is running between $1,280-1,360 per ton at depots. And plate for early Q1 delivery from South Korea and Thailand is sub-$1,200 per ton, according to several sources.

It will be important to watch discrete plate lead times. They have slipped below the five-week mark for the first time since mid-January. They stand on average at 4.86 weeks as of Sept. 28, down from roughly 5.50 weeks just a few weeks ago.