Analysis

October 1, 2023

Final Thoughts

Written by Michael Cowden

Will the sheet price hike announced by Cleveland-Cliffs (and quietly followed by at least some mills) stick?

Comments about the increase on SMU’s LinkedIn page (and on my LI page) indicated that some of you were skeptical of a big price hike succeeding in the middle of a UAW strike.

But our latest survey results paint a more bullish picture. They looked surprisingly similar to what we saw in November 2022, when a round of price increases initiated by Cliffs sparked a rally (aided by a surprise shutdown at AHMSA) that stretched deep into Q1.

Before we jump to any conclusions, let’s look at some of the assumptions that underpin the idea that prices are set to bottom and move higher.

UAW Strike Duration Speculation

We asked survey respondents how long the UAW strike would last. Nearly 75% said it would last four to six weeks. The strike started on Sept. 15, which implies that SMU survey respondents think it will end later this month.

Another 15% said it would last three weeks. That implies that strike would end sometime this week – which is all but impossible given the UAW and the “Big Three” automaker haven’t reached a tentative agreement.

Recall that a less acrimonious strike in 2019 also began on Sept. 15 and didn’t end until Oct. 25. In other words, it lasted roughly six weeks, a span that included time necessary for ratification votes.

Only 10% of survey respondents said they thought the strike would last more than seven weeks, or longer than it did in 2019. That suggests the market could be caught by surprise if the strike drags into November.

More Blast Furnace Idlings Predicted

So how can people be generally bullish on prices?

This might explain it: Approximately 70% of survey respondents think that more blast furnaces will be idled because of the UAW strike.

Recall that to date only one furnace – the ‘B’ blast furnace at U.S. Steel’s Granite City Works near St. Louis – has been idled.

Our readers think more are to come. It’s not an unreasonable position. U.S. Steel alone idled multiple furnaces last year when prices softened.

Mills Were Cutting Deals. Have They Stopped?

Nearly all respondents to our latest survey (90-100%) reported that mills were willing to negotiate lower prices for hot-rolled, cold-rolled, and galvanized sheet.

Here’s an important note: We collect responses to the mill negotiation question from Monday morning until Wednesday evening. That means our results probably didn’t yet reflect the impact of the Cliffs increase, which was announced Wednesday morning.

It’s also possible that the responses we got reflected pre-increase discounting. Most of you know that play. Mills lower prices in hopes of bringing in big orders. The goal: to stretch out lead times ahead a price hike announcement.

Will Lead Times Stretch?

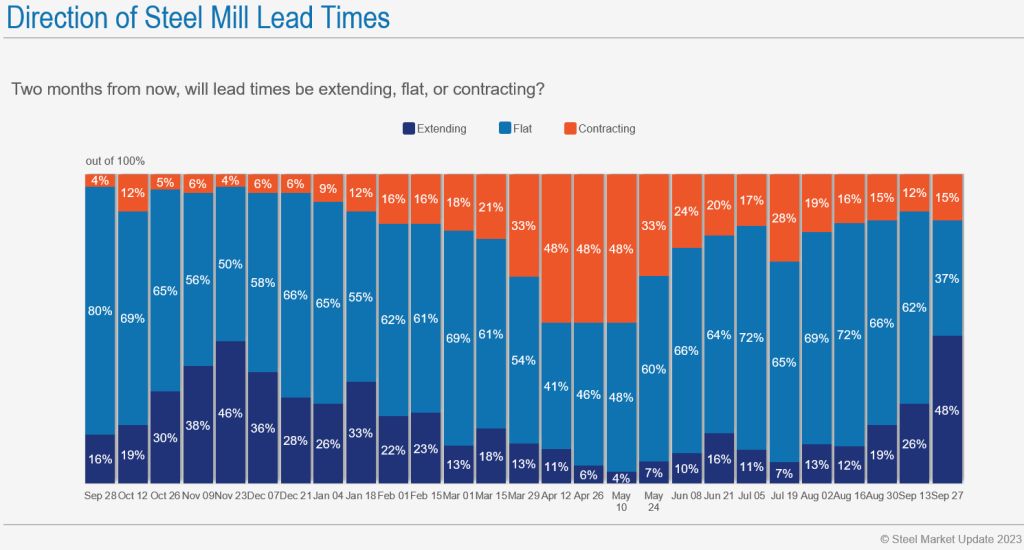

The evidence is mixed, as we reported on Thursday. But we have seen a steady increase in the number of people predicting that lead times will extend in the future.

Nearly half of survey respondent predicted that lead times would be extending two months from now, up from 12% from our mid-August survey.

Why does that matter? We saw something similar in November of last year, just ahead of the late Q4’22/Q1’23 price rally. Does that mean we’re about to enter another bull market for steel?

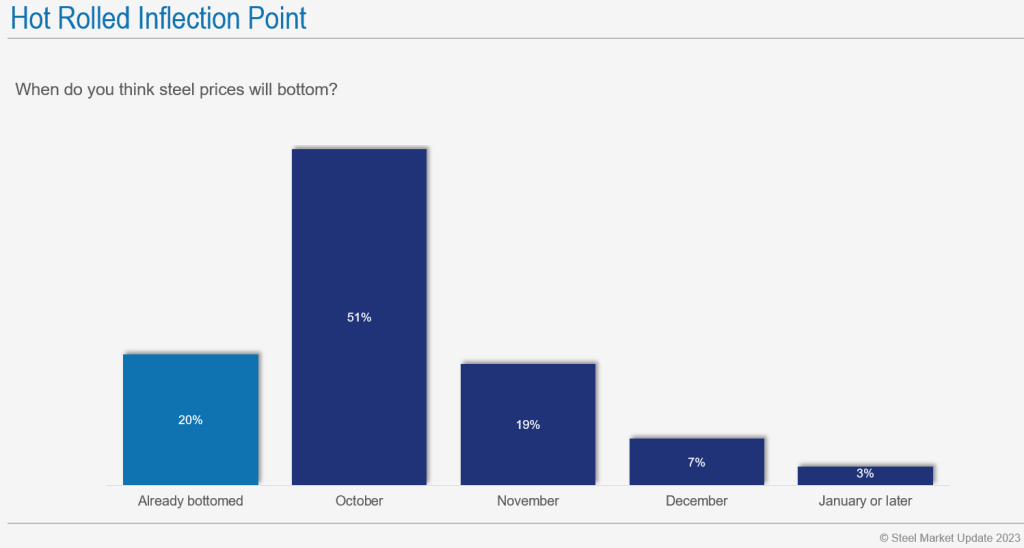

Respondents See October Price Bottom

Some of you tell me that we are. You say you’re already looking past the UAW strike.

Our survey results reflect that sentiment: 71% of respondents think HRC prices have bottomed or will bottom later this month.

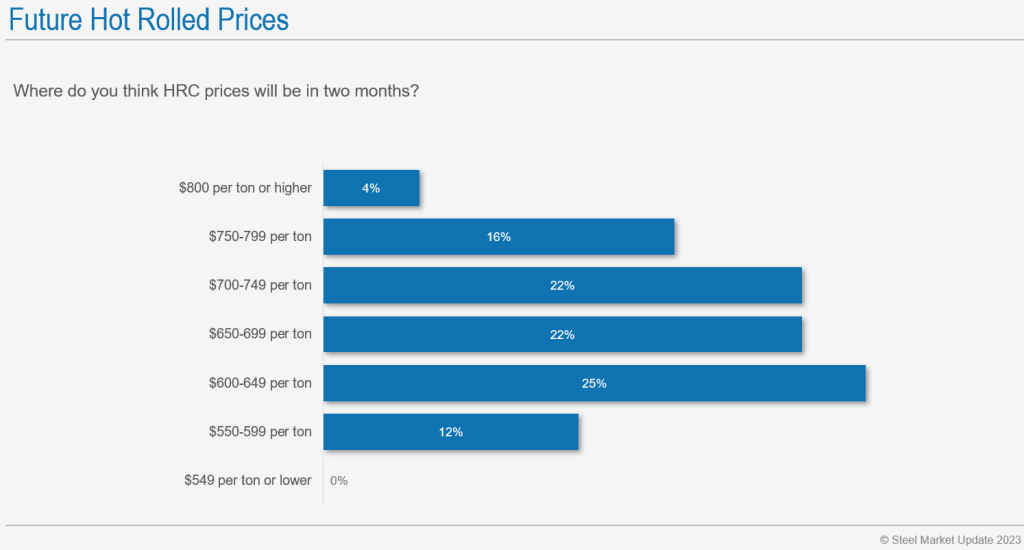

Meanwhile, nearly 42% of respondents think hot-rolled coil prices will be over $700 per ton in December – in other words, that the Cliffs increase will at least partially succeed.

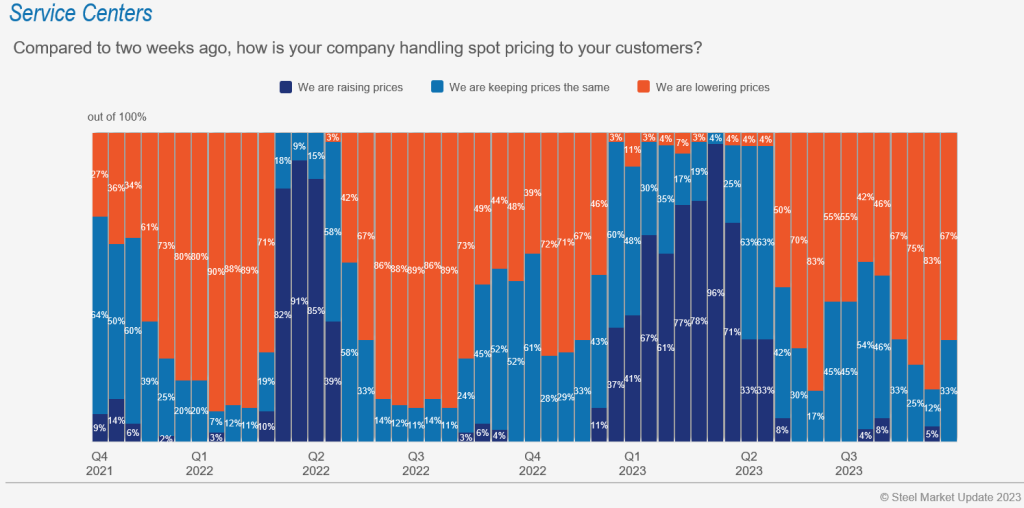

Another thing that’s notable: We’ve seen a decrease in the number of service center respondents who say that they’re lowering prices.

About two-thirds of service center respondents tell us they are still lowering prices. That’s a change from our last survey, when 83% reported that they were lowering prices.

SMU founder John Packard sometimes called that territory, when 70-80% of service centers were lowering prices, the “point of capitulation.” That’s when service centers want prices to go up again and so are willing to support mill price hikes.

Packard found over time that mill prices hikes typically came shortly after one of those points was reached. We definitely saw that again last week with Cliff’s price increase.

My two cents: I think the renewed bullishness we’re seeing makes sense – if the UAW strike doesn’t drag out and if more capacity is idled. My concern: Those are some big ifs 🙂

Participate in Our Survey!

Do you agree with the results above? Do you disagree? Either way, make your voice is heard!

Contact us at info@steelmarketupdate.com if you want to participate in our surveys. It only takes a few minutes.

Also, many thanks to those who already participate. You make it possible for SMU to keep its finger on the pulse of the market.