Analysis

September 26, 2023

August Imports Down Again, Even Lower YoY

Written by David Schollaert

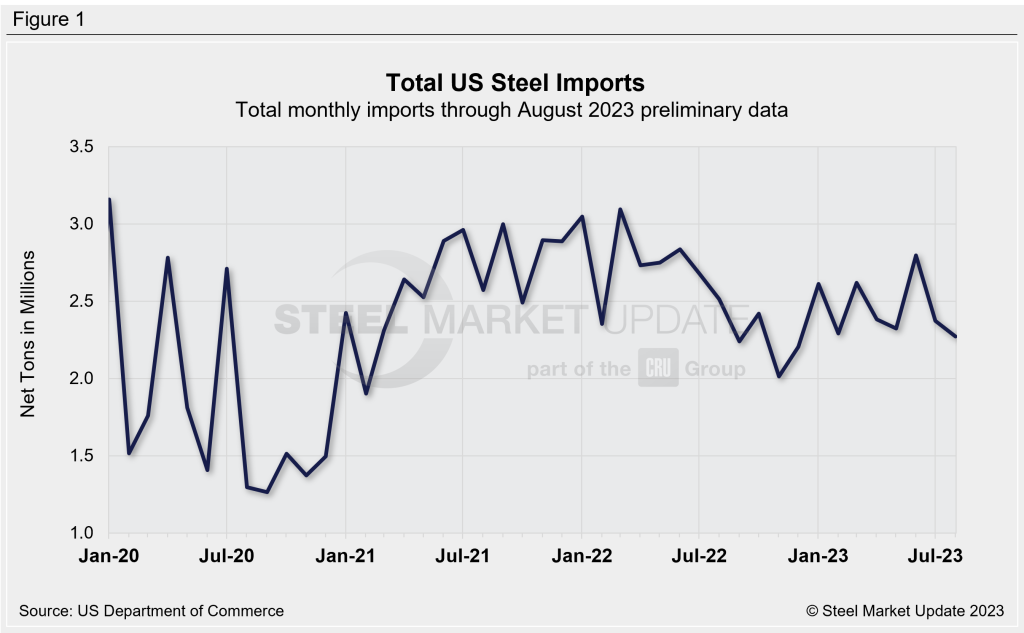

The drop in imports continued for the second straight month, in line with license applications and falling lower year on year (YoY).

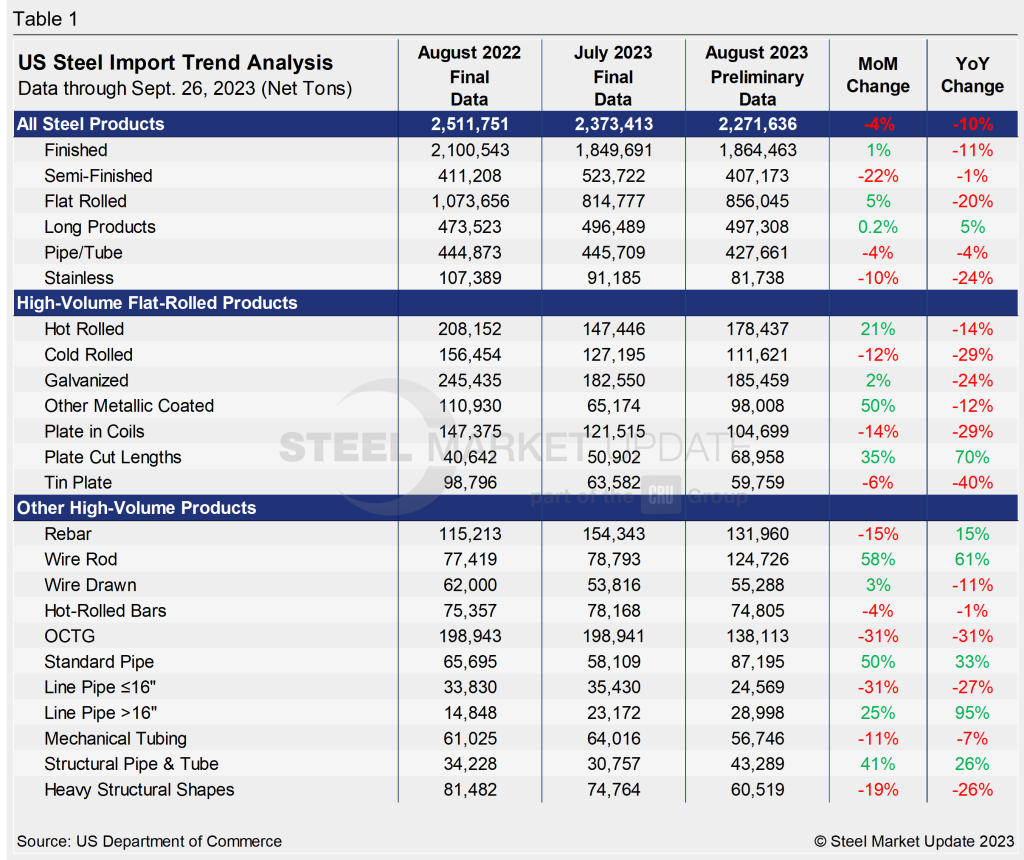

The US imported 2,511,751 net tons of steel products in August, according to a preliminary count by the US Department of Commerce. This was a 4% decline from July and down further from the 12-month high of 2,797,419 tons in June.

Compared to year-ago levels, August’s imports were down 10%.

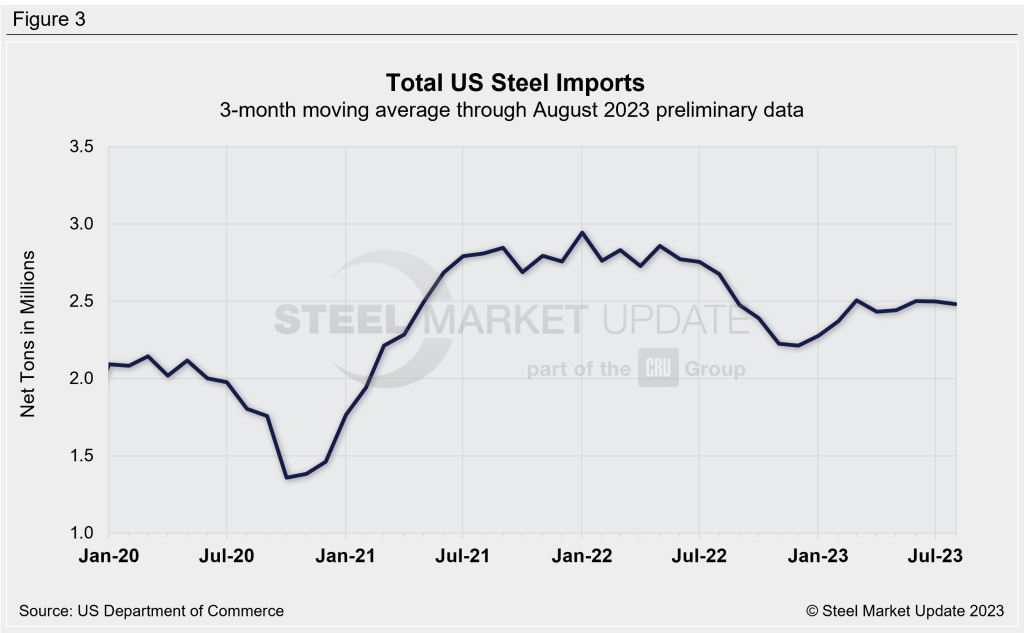

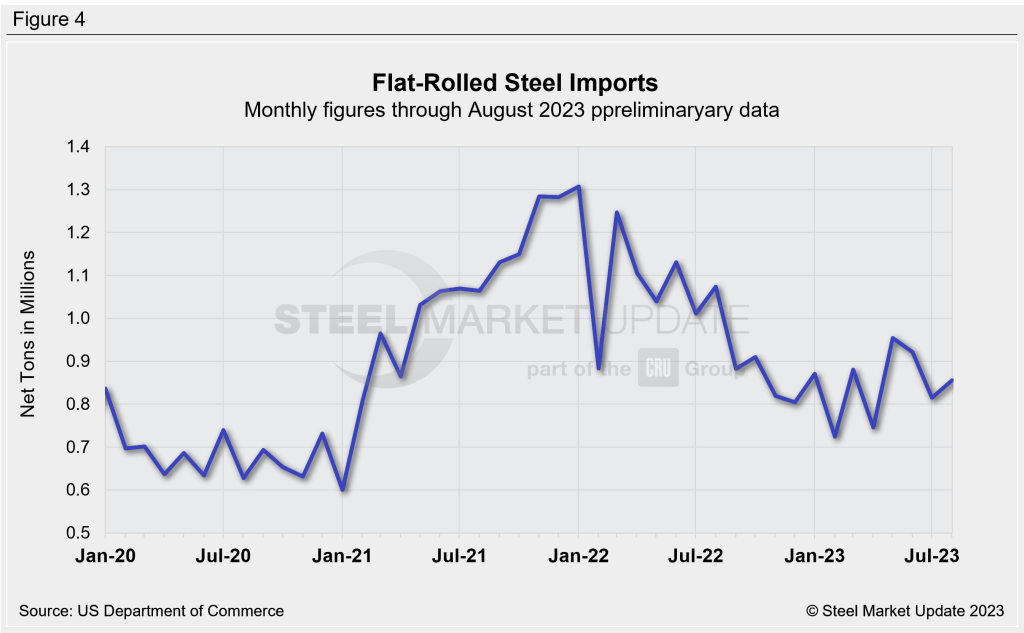

Looking at imports on a three-month moving average basis to smooth out the month-to-month fluctuations, we can see that imports have been somewhat steady since March but have been trending down over the past couple of months and are still well below the elevated levels seen mid-2021 through mid-2022.

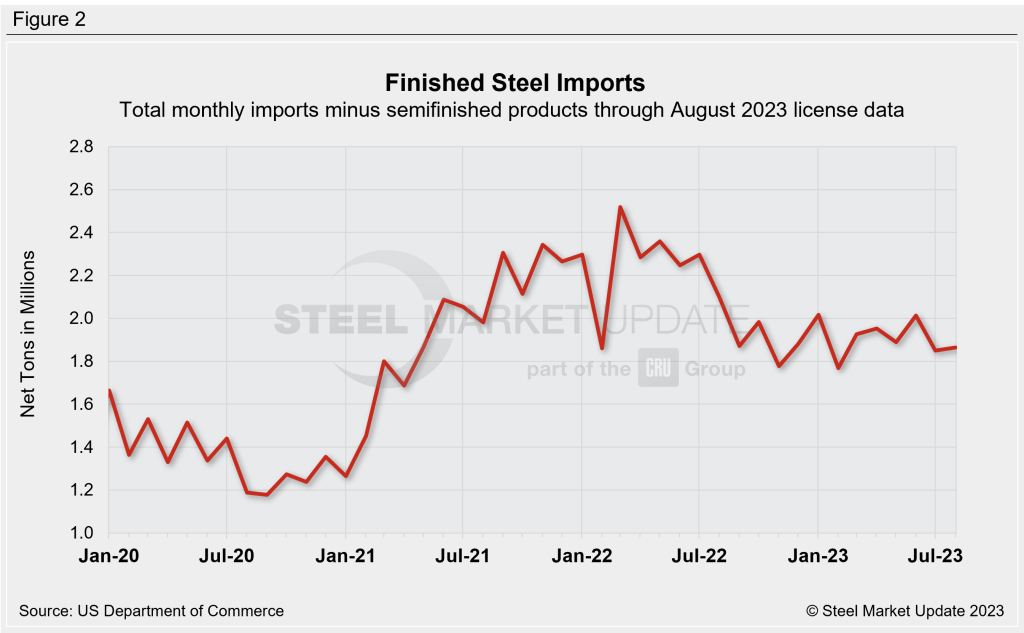

While imports of semifinished steel dropped by more than 20% from July to 407,173 tons in August, they were just 1% below year-ago levels.

Finished steel imports, meanwhile, were up 1% MoM but 11% lower YoY at 1,864,463 tons in August.

Flat-rolled steel imports moved up MoM after declining consecutively in June and July. August flat-rolled imports came in at 856,045 tons. This was a 5% MoM increase yet a 20% YoY fall.

While overall flat-rolled imports were up MoM, plate in coils, cold-rolled sheet, and tin plate registered decreases of 14%, 12%, and 6%, respectively. Other metallic-coated imports shot up 50%, followed by cut plate.

Imports of hot-rolled rebounded MoM, surging by 21% from July to 178,437 tons in August.

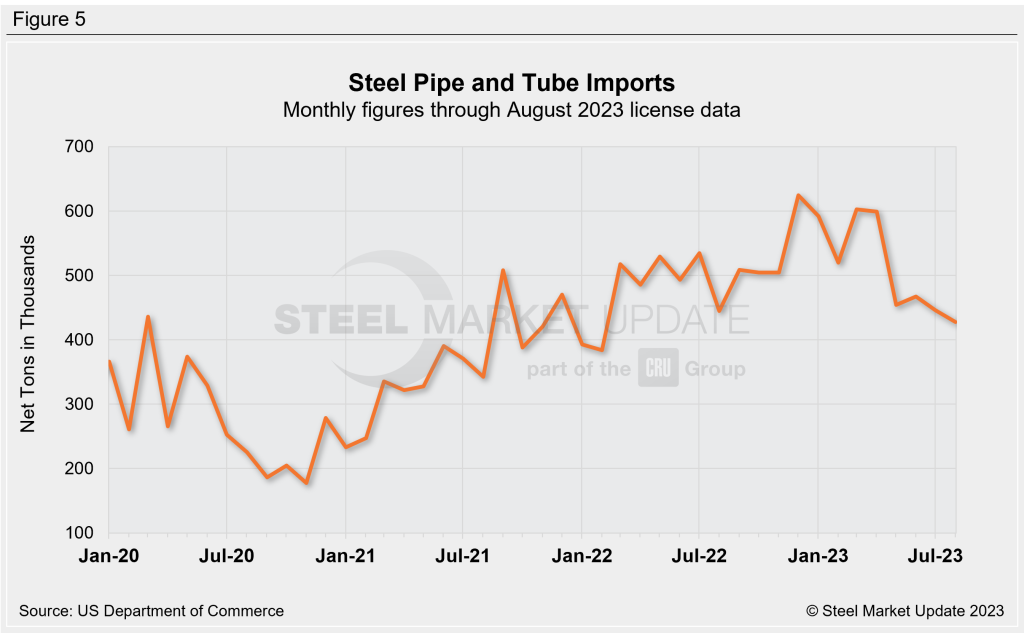

Pipe and tube imports surged by 50% in August to 87,195 tons after falling to a 17-month low from the month prior.

OCTG imports were down markedly again in August, a trend seen repeatedly since May. It is a reversal from seeing elevated totals for the prior six months.

Imports of wire rod and structural pipe and tube were at 124,726 tons and 43,289 tons, respectively in August. Structural pipe and tube recovered strongly after posting a near two-year low the month prior.

Mechanical tubing imports, meanwhile, slipped in August to 56,746 tons after reaching an almost two-year high in July.

The table below provides further detail into imports by product, highlighting high-volume steel products.